Car companies today make only about half of the components found in their cars.

This figure used to be closer to 90% in the 1970s.

That might sound high until you consider that Ford used to source steel from its own steel mills.

It even owned and operated its own iron mines.

Since the ‘70s automakers moved to a more global supply chain.

It made things cheaper and more efficient.

For example, Ford divested from its steel mills in the ‘80s.

It now gets most of its steel from a multinational steel giant.

Over the last couple of years, these supply chains turned into the biggest limitation.

New cars are now more expensive and take a long time to produce.

It’s neither cheap nor efficient.

But with the rise of electric vehicles (EVs), we’re seeing a return to the old model.

Automakers Are Racing to Meet EV Demand

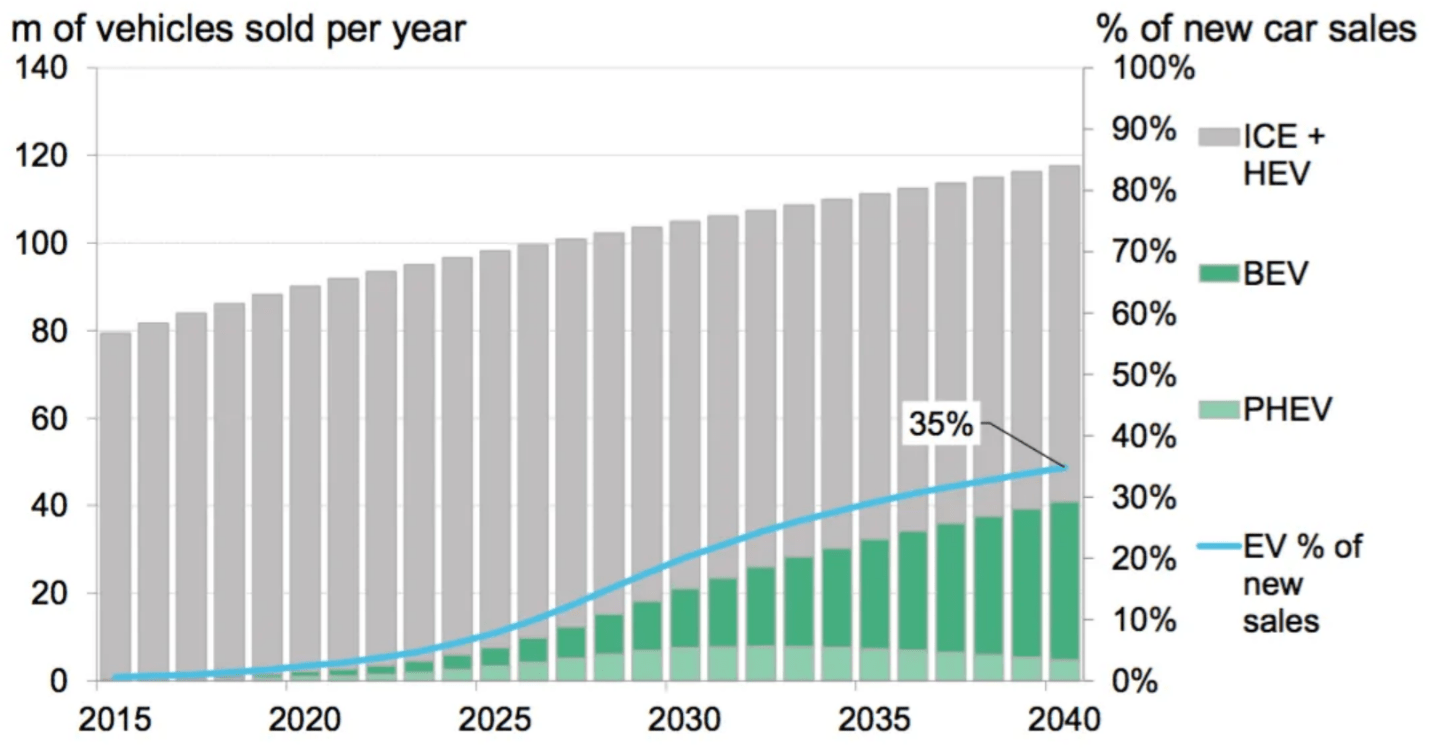

EV adoption is growing at a rapid pace.

Bloomberg estimates 35% of global new car sales will be electric by 2040.

(Source: Bloomberg.)

Automakers are satisfying this demand with new EV models.

Nearly all automakers today have at least one EV in development.

The big three American automakers even set a target of 50% new EV sales by 2030.

But aiming this high brings challenges.

Controlling the Supply Chain Is Essential to the EV Future

The lack of control over supply chains affected production capacity and costs.

Automakers aren’t looking to repeat this mistake with their EV projects.

Instead, they want to control key components such as motors and batteries.

But this goes beyond building supply chain resilience.

Motors and batteries are the new powertrains.

Outsourcing this would be like a company not developing its own engines.

And the variations in powertrains are what sets automakers apart from each other.

Most EV makers are moving to this supply chain model if they haven’t already.

- Tesla was the first to insource battery production by building a Gigafactory with Panasonic.

- Volkswagen plans to build a cathode-materials factory with Belgian materials company Umicore.

- Ford is building three new battery production plants in a joint venture with energy company SK Innovation.

This brings the opportunity to profit from the EV boom in two ways.

You can invest in both the automaker and the suppliers it partners with.

Check out Ian King’s Strategic Fortunes service to learn about such an opportunity.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

Stride Inc. (NYSE: LRN) is a technology-based education company that provides proprietary and third-party software systems and educational services for students. The stock is up 30% after it reported better-than-expected Q2 earnings thanks to sustained strong demand for online learning.

Sierra Oncology Inc. (Nasdaq: SRRA) researches and develops therapies for the treatment of patients with hematology and oncology needs. The stock is up 19% in response to positive late-stage trial results for its blood cancer drug candidate, Momelotinib.

DraftKings Inc. (Nasdaq: DKNG), the digital sports entertainment and gaming company, is up 17% this morning. The move came after Morgan Stanley upgraded the stock from a neutral to a buy rating, stating that it was too big an opportunity to ignore.

Genius Sports Ltd. (NYSE: GENI) develops and sells technology-led products and services to the sports, sports betting and sports media industries. It is up 15% on the news that Betway will add two new Genius Sports services to its sports betting platform.

GameStop Corp. (NYSE: GME) provides games and entertainment products through its e-commerce properties and various stores. The stock is up 14% as part of a rebound in some meme stocks after they tumbled the last two days.

Luminar Technologies Inc. (Nasdaq: LAZR) operates as a vehicle sensor and software company for passenger cars and commercial trucks. It is up 14% as it recovers from its drop earlier in the week.

Clean Energy Fuels Corp. (Nasdaq: CLNE) provides natural gas as an alternative fuel for vehicle fleets and related fueling solutions. The stock rose 13% after the company released details on its five-year strategic and financial plan, including the development of its renewable natural gas business.

Adagio Therapeutics Inc. (Nasdaq: ADGI) discovers and develops antibody-based solutions for infectious diseases. It is up 13% along with other vaccine stocks today as COVID-19 deaths hit their highest level in nearly a year.

Corning Inc. (NYSE: GLW) is a leading developer and manufacturer of the glass used in screens and display technologies globally. The stock is up 13% after it beat both revenue and earnings estimates for Q4.

Novavax Inc. (Nasdaq: NVAX) focuses on the discovery and development of vaccines to prevent serious infectious diseases. It is another vaccine stock that is up 12% today as COVID-19 deaths top 2,100 a day.