A lot of traders and investors look at the Volatility Index, or VIX, to gauge the short-term future of the stock market. This is also known as the Fear Index, and it measures the projected volatility level of the S&P 500.

The way that it does this is by measuring S&P 500 options premiums.

For most traders, options are a way to hedge a position. So, when the premiums are higher, it means people are willing to pay more to hedge. This demand indicates a fearful market outlook.

The VIX typically moves in the opposite direction of the market. This is because when the market is falling, or even when there is a consensus belief that it will fall, people buy options to hedge.

So, it would make sense to be more worried when the VIX is high. But when the VIX is low, people become afraid that there’s a market crash right around the corner, like we’re “due” for one.

As a side note, trying to time a market crash is going to be a losing strategy far more often than a winning one. Since 1878, there have only been 19 bear markets (when the market falls 20% or more). Personally, I’d rather not try to time something that happens only once every seven years on average.

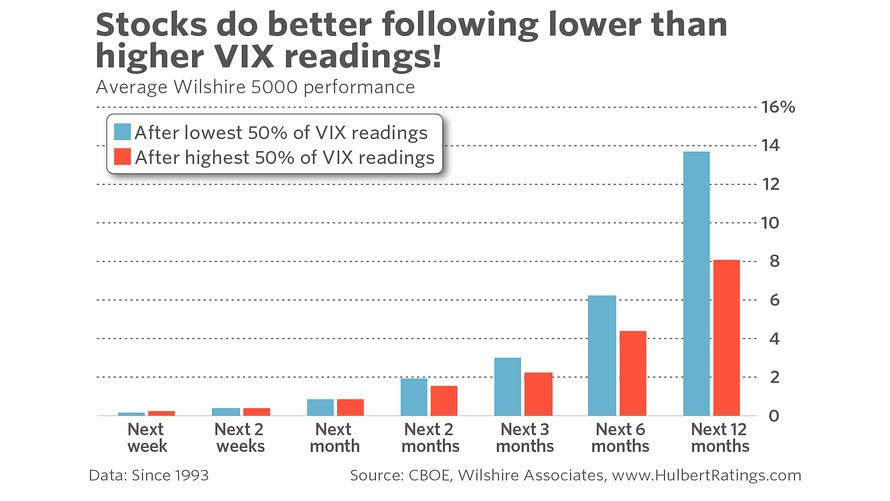

As the chart above shows, it’s more profitable to put your money into the market than wait on the sidelines for a crash that may not happen for years. Remember that the VIX just measures the amount of hedging going on. If there is no action being taken to hedge, why worry about a market crash?

If you look at a chart of the S&P 500, you’ll see that the market clearly moves up over time. The point is, it’s more profitable to wait until the VIX is high to begin to worry.

And then, when it falls back down, that’s the time to invest.

Regards,

Ian Dyer

Internal Analyst, Banyan Hill Publishing