The great 1983 Eddie Murphy/Dan Aykroyd film Trading Places features two duffers pulling off a massive commodity futures scam. It was orange juice futures. They made a fortune by betting on the orange crop in Florida.

Thanks to Hurricane Irma, you can do the same thing today.

After Brazil, Florida is the world’s second-largest orange juice producer.

The orange juice industry is in a massive decline. Sales fell 14% — about a $98 million fall from 2012 to 2016. Some food exchange-traded funds that once held orange juice futures no longer use them as an investment.

It doesn’t help that we now know that orange juice is bad for you. It has the nutritional value of soda.

Business Insider called orange juice the “biggest con of your life.” That’s important, as the U.S. is the world’s largest consumer of orange juice by many times. We consumed over 630,000 metric tons of orange juice last year.

Irma’s Impact

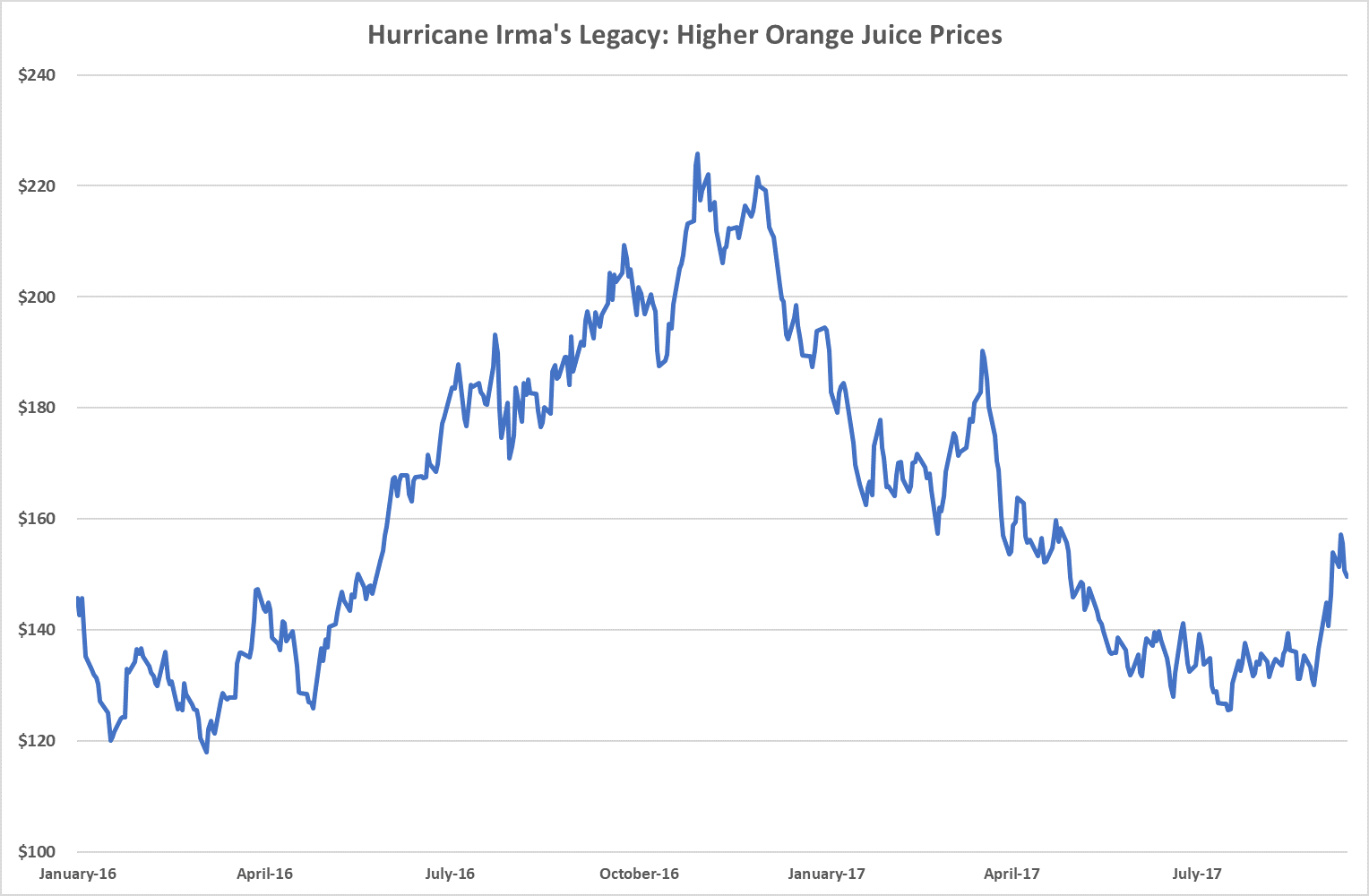

Frozen orange juice futures tanked over the past year. After peaking in October 2016 at $225, the JPMorgan Orange Juice Price Index fell 44% to a low of $125 in July 2017. You can see what I mean in the chart below:

The price of frozen orange juice jumped 21% in two weeks as Hurricane Irma grew and took aim at Florida.

The Florida orange crop looked particularly strong this year. Shannon Shepp, the executive director of the Florida Department of Citrus, wrote:

Before Hurricane Irma, there was a good chance we would have more than 75 million boxes of oranges on the trees this season. We now have much less.

To put that in perspective, last year’s crop, the worst since 2005, was about 77.9 million boxes. That crop sold for $800 million. In Florida, 90% of the oranges become juice.

This year, the crop looks like the lowest in 50 years. As you can imagine, that pushed the price of orange juice futures up, as we see in the chart above.

Sadly, unless you trade commodities, regular investors struggle to get in on this position. One way is the Elements Agriculture Total Return ETN (NYSE: RJA). It holds 1.8% of its assets in orange juice futures.

That’s about the best way I found to trade what could be a nice winner in orange juice. That’s typical with these trends. Sometimes, it’s hard to find a way to profit from them, even when you find a great opportunity.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist