On December 7, the “death cross” happened to the S&P 500 Index. This is when the average price over the past 50 days moves below the average price over the past 200 days.

Since the more recent average is moving below the longer-term average, this is seen as a slowing in momentum.

After all, it happened in October 2000 and December 2007, right before some of the biggest market crashes in recent history.

However, the death cross hasn’t been bearish over the long run.

While it does happen in weak markets, it doesn’t necessarily mean things are going to get worse.

Historically, it’s happened after the worst parts of the crashes are done. And by that time, the markets are starting to turn around.

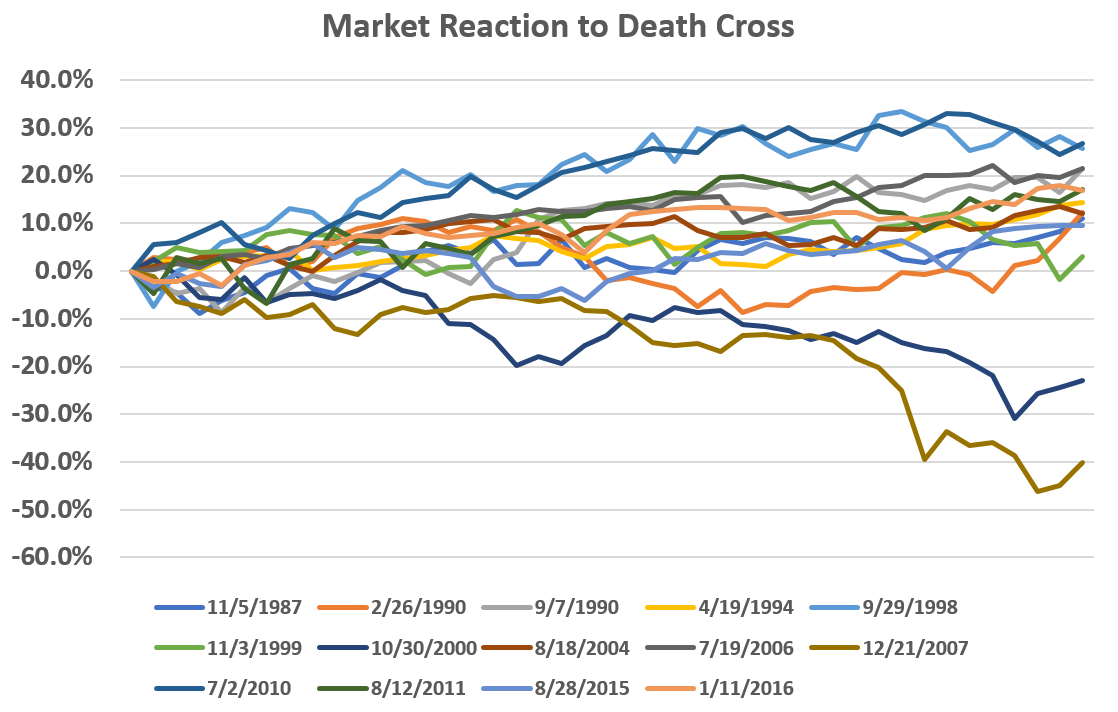

The chart below shows what’s happened after all 14 death crosses in the past 31 years. As you can see, it’s not all that bad.

The return over the next six months has been positive 10 times out of 14. And the return over the next year has been positive 12 times out of 14.

So, although this event has preceded a couple bad crashes, it hasn’t caused them.

And while this cross is referred to as a sign of death in the markets, it’s actually the opposite. That’s because by the time the market has lost this much momentum, most of the sellers have already sold out of panic.

This is exactly what we’ve been seeing since early October. And although the markets have been choppy, if history repeats itself, the death cross will actually lead them higher.

Regards,

Ian Dyer

Editor, Rapid Profit Trader