Crypto investors are staring into a sea of red this week as total market cap has fallen below $350 billion, a level not seen since (way back in) December 2017.

While you can never pinpoint the exact reason for any sell-off, some of the malaise comes after incendiary comments from lawmakers at Wednesday’s House subcommittee hearings on initial coin offerings.

Things got really heated when Rep. Brad Sherman, D-Calif., went so far as to call cryptocurrencies “a crock” and “popular with guys who sit around in their pajamas and tell their wives they’re going to be millionaires.” Comments that certainly provoked both crypto and pajama enthusiasts everywhere.

But not all members of the committee shared the same sentiment. Rep. Tom Emmer, R-Minn., a member of the Congressional Blockchain Caucus (yes — there really is one), provided a clear-thinking defense of the technology.

He posited that Congress should not attempt to regulate a subject it does not fully understand, adding “access to capital is something Democrats and Republicans should celebrate.”

A New Way to Invest

Emmer was referring to initial coin offerings, or ICOs, a new type of financing mechanism that can be described as a hybrid of venture capital and initial public stock offerings. In this unregulated offering, developers of crypto projects crowdfund new digital “tokens” using the blockchain.

Investors exchange cash or cryptocurrency for the new coins, which then can be used within these new networks for purposes such as trading storage space, renting computational power or anonymously searching the internet.

Digital Gold Rush

Last year was a digital gold rush for ICOs, as crypto offerings raised over $3.8 billion, doubling the amount of venture capital raised by traditional internet companies.

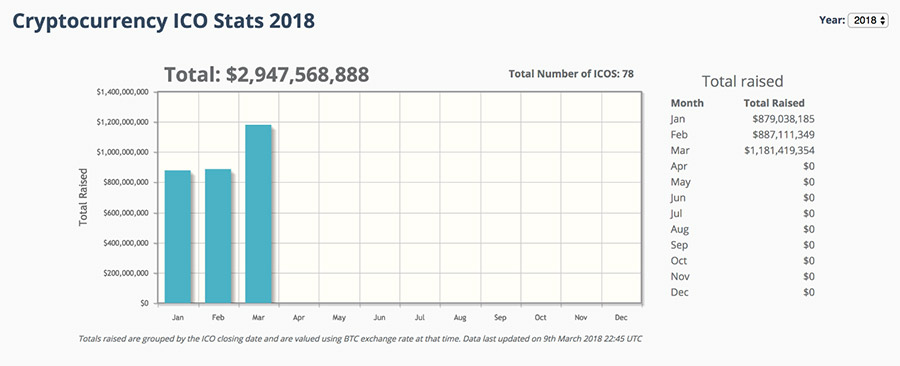

And even though the crypto markets have been struggling in 2018, the total amount raised by ICOs so far this year is closing in on $3 billion, with $850 million attributed to a record-breaking ICO for cloud-based messaging service Telegram.

This frenzy for investing in new ideas begs the question: Why are venture capitalists, hedge funds and high-net-worth investors the only ones able to get in on the ground floor of investments in new technology?

Meanwhile, the general public is left to fight over the crumbs after most of the gains have been realized on the private markets.

In an article earlier this year, I put forth the idea that much of the demand for these new crypto assets arrives from investors who totally missed out on massive gains in household names like Uber and Facebook.

While most of the gains accrued to venture capitalists and high-net-worth investors from getting in early, the general public was stuck holding the bag when these companies finally IPO’d.

Such was the case with much-heralded Snap Inc. (NYSE: SNAP) and Blue Apron Holdings Inc. (NYSE: APRN), respectively down 40% and 75% from their first day of trading.

Getting in Early Has Risks Too

Crypto is a uniquely attractive asset class in that investors, for the first time, are able to invest in early-stage projects. With big opportunity comes big risk, and the crypto asset class is more volatile than any market in recent history.

We’ve never witnessed a public market for early-stage ideas, where one strategic move can send the value 500% higher or 75% lower in a short amount of time. Typically, in venture investments, you had to wait for another funding round to find out if your initial investment gained or lost.

Lately, crypto investors have been realizing that getting in on the ground floor doesn’t necessarily mean the project will grow into a skyscraper. The overwhelming majority of startups fail, and that’s why it’s especially important to position size accordingly, and diversify your risk in early-stage investing.

But if you find just a few 1,000% or 10,000% projects, the rewards certainly outweigh the risks.

Regards,

Ian King

Editor, Crypto Profit Trader

Editor’s Note: If you’re someone who hates losing money, you’ll love that Ted Bauman’s Infinite Nest Egg system finds safe investments when things get volatile. After all, your investments should be stress-free, so you can live your life doing what you want to do instead of constantly having to worry about money! To find out the surprisingly simple way this system protects your portfolio from stock market crashes, click here now.