This week is going to determine what sort of corrections we’ll be seeing. It will be one of two things.

The first is a quick, V-shaped move, where the market will quickly rally back and make new highs.

The second is a prolonged correction, which would mean we see at least one more downturn to test the lows that we saw back on February 5.

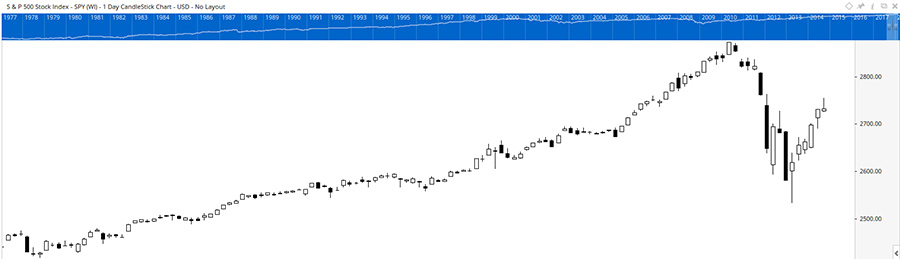

I’ve taken a look at five corrections that have happened similar to this one since the financial crisis of 2008. These are quick “crashes” that have taken the market by surprise.

2010: The Flash Crash

The first was the May 6, 2010, “flash crash,” which happened when a lot of exchange-traded funds (ETFs) suddenly crashed, bringing the market down about 10% in a single day.

It rebounded some that day, but still set off a slide in the market that lasted for months.

The initial crash was about 12.6%. The market rebounded by 10% after that, but then fell another 13.8%, resulting in an overall correction of 17.1%. It took 182 days for the market to regain the price where it sat before the flash crash.

2011: The Debt Downgrade

The second was in August 2011, when the U.S. government’s debt was downgraded for the first time in history.

Investors became worried that the same thing might happen elsewhere in the world. The market fell for two and a half weeks without interruption, a little over 18% overall.

And then, it bounced back almost 12%. But, over about a month’s time, it fell another 12.7%, resulting in an overall correction of 20.2%. Interestingly enough, the market again took exactly 182 days to regain its original price before the correction.

2012: Trouble in Europe

Then, in May/June 2012, worries over the debt in Europe (mainly Greece, Spain and Italy) sent the market into a tailspin.

Over the course of about a month, the market fell 10.5%. But unlike other situations listed here, the market rebounded and never looked back.

Although the downturn was a bit more drawn out than others, the market was back at original prices within 74 days of the start of the correction.

2015: China Stumbles

The sharp drop of August 2015 was next, brought on by fears of a slowing global economy, particularly in China.

The market fell over 11% in just four days, one of the quickest drops in history. But then it rebounded 8% over the next few weeks. And just when people thought the market was safe, it fell 11% back to the original lows.

After it hit the original low point, the market bounced back for good and was at the precrash levels 69 days after it all began.

2016: Global Worries

Lastly, the correction of January 2016 was based on an uncertain outlook for global markets, as fears of slowing economies all over the world still haunted investors.

This correction included the worst first-week stock market performance in history. From peak to trough, the original drop was about 13%.

And even though the market rebounded 7% in less than two weeks, it fell back down to the exact same point afterward, another “double dip” market drop. 84 days after it began, the market was back up to its original levels.

2018: The Latest Correction

So what makes this drop different? Will it be the first or second type?

In all the situations listed above except the 2010 flash crash, the reason was clearly worries over the global economy.

However, in this recent correction, everyone is in agreement that the world, especially the U.S., is in great shape.

Although a double dip should not be ruled out, I believe that we will see a return to all-time highs sooner rather than later.

Regards,

Ian Dyer

Internal Analyst, Banyan Hill Publishing