The headline on the Bloomberg website caught my eye:

“SUVs Get Parked in the Sea, Revealing Scope of U.S. Auto Market Glut.”

Living on the coast, I’m no stranger to SUVs in the surf. But that wasn’t exactly what this author meant.

Instead, he described the Jupiter Spirit, a ship carrying 2,000 Nissan Armada SUVs, stuck at anchor outside the Los Angeles harbor.

There wasn’t enough room in the car lots to unload the vehicles — because new cars aren’t selling right now.

And it’s not just in the U.S. The global auto industry got crushed in the first few months of this year.

Some investors are looking at these stocks for big gains, but it’s too soon.

Here’s why…

Sinking Auto Sales in 5 Nations

Auto sales numbers are a disaster:

-

- China’s car sales fell to just 224,000 in February 2020. That’s the fewest cars sold in a month since 2005.

- U.S. new car sales plunged by 42% compared with the same period last year (year over year). That’s the largest recorded decline in more than 30 years.

- In April, just 4,321 cars sold in Great Britain, a 97% decrease year over year. That’s the slowest month since just after World War II.

- Last month, France’s auto sales plummeted 89% from April 2019

- In South Africa, new car sales sank to 574 in April, a 98% fall from the 36,787 sold a year ago.

In the U.S., that’s worse than we saw in the Great Recession. Compared with the same period in 2008, car sales decreased by 38% in January 2009.

This is a global issue. That means the big carmakers can’t count on sales from one region to offset declines in another. It’s a huge problem that’s not over yet.

Avoid These Bull Traps

Last year, car sales began to shift. Rental agencies and non-retail fleet buyers made up over one-third of auto giant Ford’s (NYSE: F) sales in the first quarter of 2019. That was great until it wasn’t…

Today, those car rental companies are in trouble. The global travel bans crushed demand for rental cars.

The same forces that drove oil prices to plunge 82% from January to April 2020 hit car rental companies.

The mandatory shelter-in-place orders around the world were a massive blow to rental agencies. As the tide of demand went out, we saw that some of those companies were swimming naked.

Rental car company Hertz (NYSE: HTZ) is on the brink of bankruptcy.

It has until May 22 to work out a rescue plan. This is the second-largest car rental company in the U.S. It had about 567,600 vehicles in its fleet.

Some of those will have to go, to service the $18.6 billion in debt on the books. That means Ford can’t look to Hertz and its peers to buy cars this year.

And Ford’s forecast looks dismal.

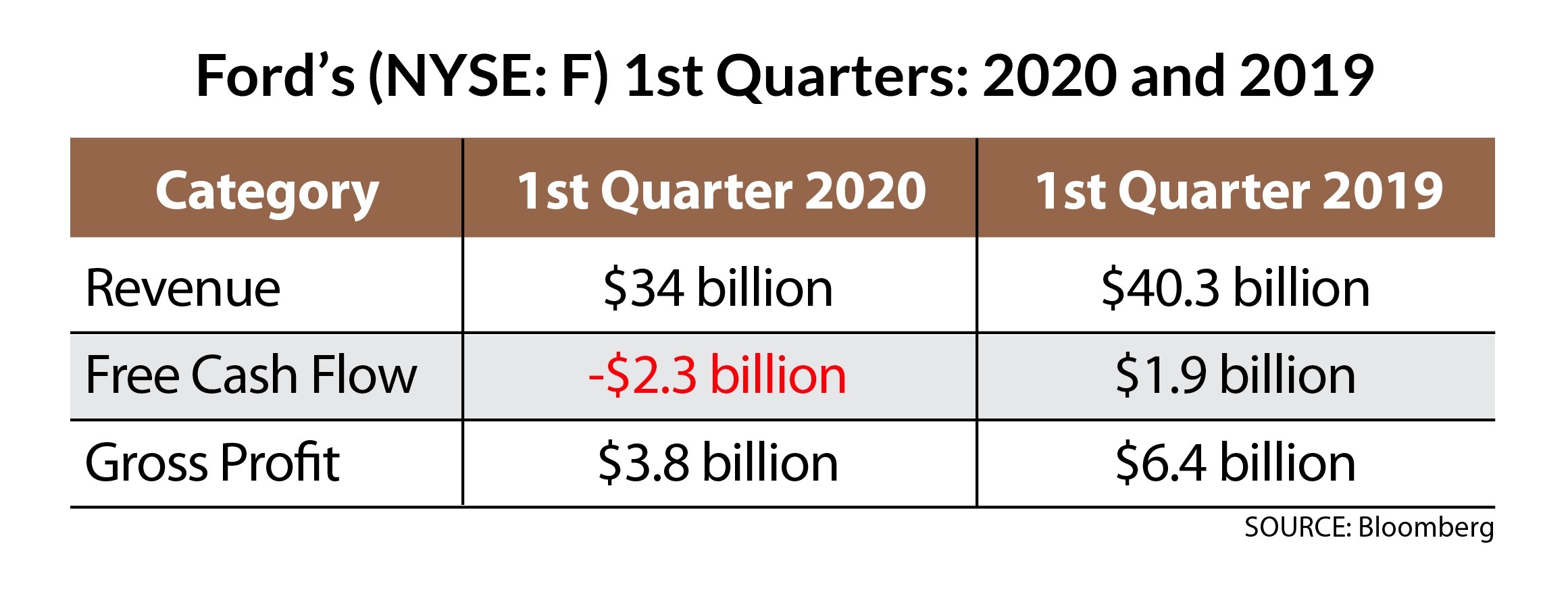

Its first-quarter numbers weren’t great:

The forecast for the second quarter of 2020 looks much worse than the first. Bloomberg analysts project Ford’s revenue to fall to just $14.8 billion. That’s far below the company’s lows in the 2008 crisis.

While the share price is down 60% from its 2019 high, it will get worse before it gets better.

And Ford isn’t alone. The entire auto industry is in deep trouble.

These stocks are “bull traps” waiting to grab unwary investors and send their cash to money heaven as the stock price collapses into a second bottom in May.

Don’t fall for the trap.

For now, avoid the big automakers like Ford and car rental companies such as Hertz. There’s more pain to come before we can make big gains.

Good investing,

Editor, Real Wealth Strategist

P.S. Instead of putting money to waste in Ford, there are much better stocks out there right now. While Ford investors hope for recovery, I’m showing my readers a simple three-step process to double their money. Click here to find out more about those three steps.