Some of you are buy-and-hold investors.

It’s as simple as that.

No matter what Wall Street or any newsletter — Banyan Hill’s or otherwise — tell you about how to make outsized gains, you prefer to buy and do nothing more.

And if that’s the way you do things, I’m not going to change your mind. If you’ve been doing it for a while and you’ve had success with it, more power to you.

But if you’re going to buy and hold something, wouldn’t you prefer it to be something that beats the market?

Without Cash, You’re Just Talking

Last week I told you about cash. I believe it is the single most important concept in investing.

In the past, I sold a lot of assets on behalf of creditors big and small … from the big banks to mom-and-pops. The deals I worked on involved assets worth thousands of dollars up to hundreds of millions of dollars.

During the sale process, a buyer can become smitten with the goods we were pushing. Smitten enough to make an offer, at least.

The buyer provides a “letter of intent,” which lays out the terms of his or her deal. To which my next question — without fail — was: “You have the money to do this, right?”

Your realtor likely did the same when you asked her to make an offer on a house for you.

Cash is king. Without it, you’re just talking.

When it comes to investing, one item that is related to cash is dividends.

Makes sense, right? The buyers in my deals couldn’t buy without cash. And the companies we invest in can’t pay dividends without cash.

There are companies out there that prove this every quarter (or monthly, in some cases). They reward their faithful investors with dividend payments.

Dividend Payers Beat the Market

You should care about this because stocks that pay dividends are one of ways you can beat the market.

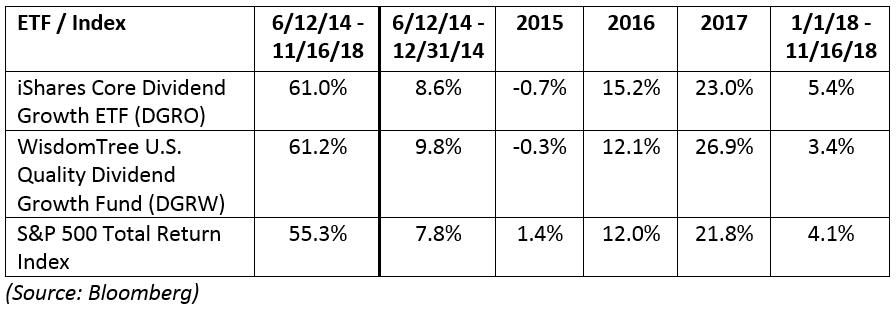

For example, take a look at these returns:

The iShares and WisdomTree exchange-traded funds began trading in June 2014. And both have beaten the market since then.

These funds focus on companies with a history of dividend growth.

You see, it ends up that companies that grow their payouts to investors tend to see their prices rise, too.

For example, pharma stalwart Johnson & Johnson (NYSE: JNJ) is the largest holding of DGRO and the second-largest in DGRW.

Over the past five years, its dividend payout has increased each year. It paid $2.59 per share in 2013. That is up to $3.48 over the past year.

Its share price has increased, too. It grew about 60%, from $92.35 at the end of 2013 to about $148 today.

This is why we want to own companies that pay dividends. They reward us … and they can beat the market.

With a market struggling to find its way, this may be of interest to you.

Good investing,

Brian Christopher

Editor, Insider Profit Trader