October’s wild ride for the stock market may be just what the market needed to rally higher.

During the month, fear spiked for investors, causing them to be the most concerned about the stock market since the 2016 election.

When others are fearful, it pays to be greedy.

It worked out great in 2016, and earlier this year during the stock market correction.

This time is likely no different. That’s because extreme levels like this end up being contrarian opportunities.

Extremes are short-lived, and ultimately make way for new rallies.

Today, a commonly followed indicator of investor sentiment is at an extreme level: the put-call ratio.

The ratio looks at how many investors are buying puts versus calls.

This is a telling indicator because we know that put options are used as bearish bets on the stock market, and call options are a bullish bet.

If investors are buying puts more, the ratio rises.

Since put options are a bearish bet on the stock market, when the ratio rises it tells us investors are worried about the stock market.

And it’s at a point right now that it hasn’t hit since worries over the 2016 election.

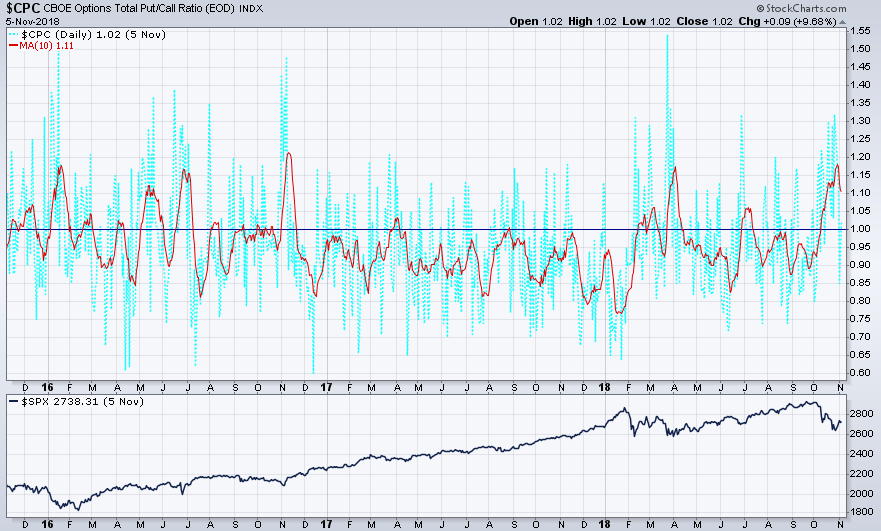

These extreme levels have coincided with previous bottoms in the market and helped set up significant rallies. Take a look:

At the top of the chart is the CBOE put/call ratio in light blue. I left that line in a light color because it is so sporadic.

Instead, I want to focus on the red line.

It’s a 10-day average of the ratio. It gives us a smoothed trend to clearly see where the put/call ratio is heading.

Whenever it is above 1, it means investors are worried about the market. Below 1, and investors are in a buying frenzy.

On the bottom is the S&P 500 Index so that you can see how the short-term bottoms were formed when the ratio hit this extreme level.

As long as the trend continues, the stock market is in a position to rally well past the end of the year.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert