The Cannabis Act went into effect on October 17, 2018, across Canada. This legalized recreational pot for all adults. Provinces were left to handle the logistics of how and where pot could be sold.

But stocks plummeted in the days that followed.

The Horizons Marijuana Life Sciences ETF fell by 30% in less than two weeks, while dispensaries sold-out of product to strong market demand.

The juxtaposition between a successful launch and falling stocks was bizarre. But it marked an important turning point for the industry.

Cannabis stocks shifted from pure speculation into real business.

Results are in with earnings reports from the fourth quarter of 2018. And they point to a widening gap between the best and worst of the major producers.

The Future of Marijuana Producers

The top 5 largest marijuana producers in Canada by market cap are:

- Canopy Growth Corp.

- Aurora Cannabis.

- Cronos Group.

- Tilray

- Aphria

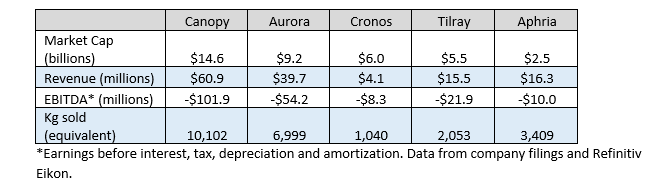

The chart below breaks down the market cap, revenue, earnings and kilograms of pot sold last quarter.

Based on the kilograms sold to market cap ratio, Aphria and Aurora are the cheapest of the top producers.

Among the other three, there is a common trend.

Canopy, Tilray and Cronos have partnerships with major brands. In August, Canopy partnered with Constellation Brands, the maker of Corona and Svedka vodka.

Cronos made a $1.8 billion deal with Altria Group, the major cigarette maker. And Tilray signed the first major pharmaceutical deal with Novartis.

These partnerships helped to elevate the companies. Signing a deal with a Fortune 500 company is a vote of confidence in the management and operations behind these companies.

But not all of them were able to cash in during the first quarter of recreational sales.

Cronos group lagged behind other producers. It is in the midst of building out its production facilities. That means it is forfeiting market share due to weak production volume.

Tilray also struggled to supply large volumes of product. During its earning’s call, management suggested that they were going to shift focus to the international market — namely Europe.

Tilray’s management sees marijuana becoming commoditized in Canada. That means the price of marijuana will be determined much like corn, copper or oil. Based on supply and demand.

Get Exposure to the Cannabis Market With the MJ ETF

The markets flooded with marijuana products would drive the price of dried flower down. But producers of value-added products will flourish.

That’s because branded drinks, vapes and similar products aren’t tied to the underlying price of the commodity it uses.

For comparison, most Starbucks coffees sell for more than $5 a cup. Yet the cost of the coffee used amounts to only a few cents.

The cannabis companies of tomorrow will need to make this transition or face being left behind. Consider owning the ETFMG Alternative Harvest ETF (NYSE: MJ) to get exposure to the overall marijuana market.

In Real Wealth Strategist, readers have received our latest trade alert on the must-own marijuana producer to tap into the next wave of growth in the marijuana sector. This company isn’t in the top 5 right now. But we expect it to be within the next year!

Good investing,

Anthony Planas

Internal Analyst, Banyan Hill Publishing

P.S. If you’re interested in learning more on how to identify cannabis companies to invest in, click here. And don’t forget to checkout my new YouTube channel, where I’ll be discussing additional information in various topics. Just click here and hit the subscribe button to be notified when I post a new video.