While on a stroll with my dogs last Saturday morning, my weekly edition of Barron’s arrived like a flying saucer out of the delivery person’s driver’s side window.

As I fetched the weekly publication (a task I have yet to teach the pups), I expected another banal cover story about the rising costs of health care, the best exchange-traded funds to buy or the inverted yield curve.

However, this week’s topic quickly caught my eye.

In bold, oversized, Georgia font was a phrase that bulls never want to see gracing the cover of financial publications…

In the past, newspaper covers have been a contrarian signal, hence, my skepticism over Barron’s prognostication.

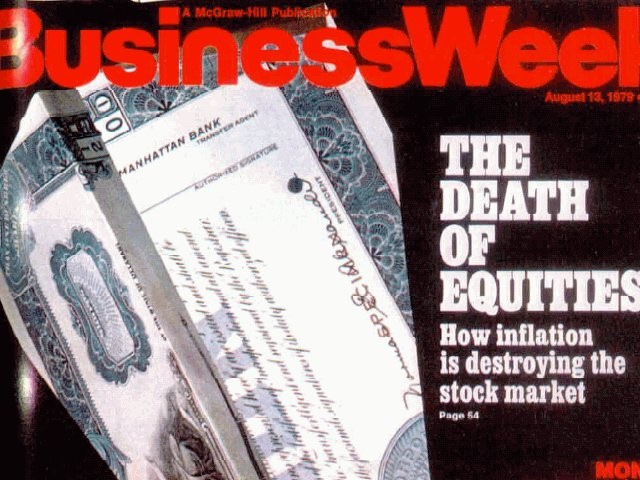

The most famous, or infamous, example is the August 1979 Business Week cover, “The Death of Equities,” which unfortunately appeared on newsstands shortly before a multidecade stock market rally:

Contrarians never want to see their views in bold headlines on the cover of Barron’s. It’s an anecdotal sign that the investing public has caught up to the trend, and there’s no one left to buy (or sell).

It’s also the financial equivalent of walking under a ladder or having a black cat cross your path.

There is no data to suggest a causation between bad luck and ladders. But you probably wouldn’t walk under one anyways.

Some Positives to Hang Your Bullish Hat On

Readers of my weekly Sovereign Investor Daily column will recall that I’ve been bullish on the market since shortly before the December lows.

My position contradicted the prevailing narrative that the bull market peaked in the fall and was headed for a bear market in 2019.

December’s sharp 13% sell-off saw many investors throw in the towel. They feared the bull was dead, killed by the double-edged sword of the Federal Reserve’s rate hikes and the Chinese trade war just shy of its 10-year anniversary in March.

However, if you looked past the falling stock prices, there were some positives to hang your bullish hat on. Most importantly, members of the Fed indicated a more relaxed position on the pace of interest rates.

This was good news for the market.

I’ve argued that the Fed will be on hold for 2019 because Jerome Powell is now a “yes-man.” And also that the yield curve inversion means we might actually see rate cuts in 2019.

In the last few months, stock market investors woke up to this new information and changed their collective minds. The market rallied, primarily for reasons I’ve explained in previous missives — an easy Fed and even easier global central banks.

I said it at the time, and I will say it again: We had a bear market.

It might not have lasted very long, but that was a bear market.

Perhaps in this day and age when information moves at the speed of light and the news cycle seems to roll over on a daily basis, high-speed bear markets are the new normal.

The S&P 500 Index ticked down nearly 20% on Christmas Eve, the operant definition of a bear market. Since then, the market has made back almost all of its losses, and is now closing in on its October 2018 highs.

The percent of stocks in the S&P 500 within 3% of their 52-week highs has reached 26.7%. Even the yield curve, which recently inverted and ominously warned of an economic recession, is no longer inverted.

A Game of Musical Chairs

When Barron’s showed up at my doorstep last weekend claiming the bull market would continue ad infinitum, it delivered a bout of morning indigestion as well.

After all, investing in the stock market sometimes feels like a game of musical chairs.

You want to keep moving and accumulating wealth until the music stops. But the longer the music keeps playing, the risks of a sudden stop are heightened.

At least that’s how it felt when the music stopped in December. And it appeared like the only chairs available had 4-inch nails sticking out of them.

There was nowhere to hide as everyone headed for the exits at the same time.

However, simply because a bull market is running longer than average doesn’t imply it has a defined end.

Market strategists often incorrectly frame economic expansions and bull markets as sports analogies. They imply there’s some set of arbitrary rules by which the market must abide.

“The economy is in the fourth quarter of its expansion.”

“The market is currently in the eighth inning.”

Barron’s makes the point that “bull markets do not die of old age.”

Since the end of World War II, the average bull run has lasted five years and four months.

The longest one ran from the 1987 crash through the dot-com peak in 2000, lasting more than 12 years.

The shortest, from 1966 to 1968, lasted a little more than two years.

This one might feel prolonged. But we are still a few years away from record territory.

The Survey of Consumer Finances

Markets rally by convincing fence-sitters to change their minds. The more investors that are sitting on the fence, the higher probability that the market will continue higher.

Perhaps the best indicator of how high the market can rally can be found by looking at the percent of investors who own stocks.

If less of the general public holds stocks, it implies there will be more buyers around who feel like they can’t miss the next bull run. This serves as a catalyst to drive the market higher.

Every two years the Fed publishes its Survey of Consumer Finances. The last one was released in 2017, and we will get a fresh look at the new survey sometime this year.

In 2017’s survey, in almost every age group, the share of families owning equities either directly or indirectly — through funds and retirement accounts — declined from 2007 to 2016.

That conclusion is astounding: Even as the market moved higher throughout the 2010s, ownership of stocks declined.

Of course, there could be other factors at play.

Perhaps the average investor doesn’t have the disposable income to invest in stocks.

Or perhaps they opted to buy a house or cryptocurrency with the money.

Or maybe they simply prefer cash.

Final Thoughts

I can’t say when this bull market will end. Perhaps a warning sign will be a massive increase in stock ownership by the general public.

That would surely give me pause.

But as long as the Fed continues to be accommodative, there is no reason to worry about bullish newspaper covers.

Kind regards,

Ian King

Editor, Crypto Profit Trader