This is the hard part about being an investor.

You told yourself you would go shopping for stocks when things got really cheap.

Now they are.

The bigger question is whether you’ll pull the trigger — or take the easy way out, as millions of other investors do, and wait until things look more certain.

I have news for you: The world never looks certain.

There’s always risk. That’s why you invest in stocks instead of, say, bank certificates of deposit.

Today, one industry leader is down nearly 30% in three weeks.

The question is: Will you buy it when it’s on sale now — or wait until it’s much higher to finally pull the trigger?

The Biggest Name in Credit Cards Is on Sale

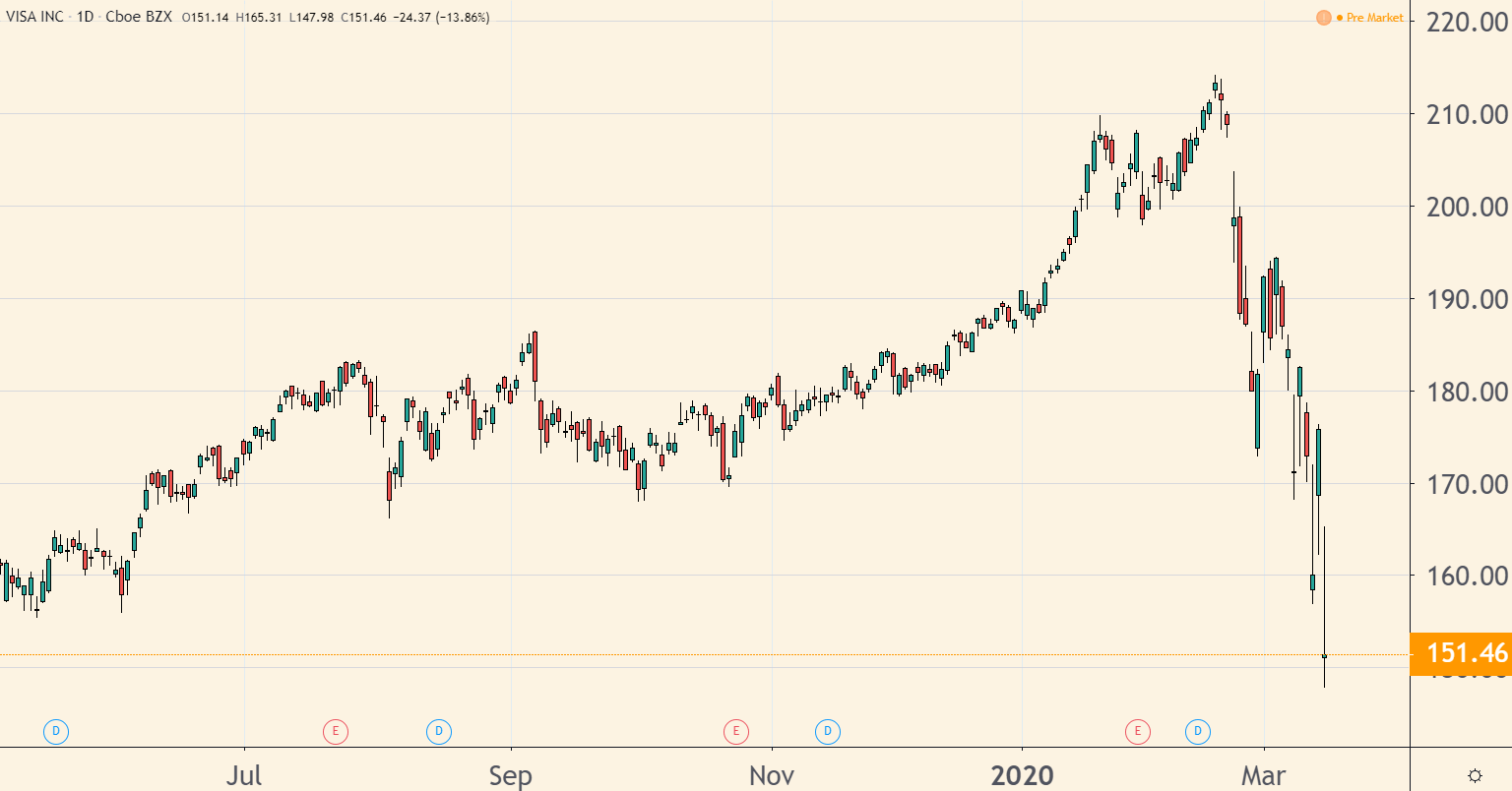

Shares of Visa Inc. (NYSE: V) have plummeted these past few weeks.

V Plunged 30% in 3 Weeks

(Source: TradingView.com)

Think about it: The biggest name in credit cards is on sale now.

Yes, Visa’s revenue may be taking a hit because of the temporary economic impact of the coronavirus.

The company recently said its revenue growth might drop 2% to 3% below earlier forecasts.

Then again, what were Americans doing at stores over the past few weeks — and even now via e-commerce, as many people shelter in place at home?

They buy even more stuff on credit.

Visa also has plenty of room to trim its internal costs as necessary to make up for a revenue shortfall. So, it may well turn out that there’s no impact at all on its first-quarter profits.

The Stock Hasn’t Been This Cheap Since the Financial Crisis

Let’s suppose the unlikely event happens — economists’ nightmares come true — and the nation enters a recession.

After a decline of nearly 30%, Visa shares have already discounted those recession worries.

At the stock’s current price, it has a price-to-earnings ratio of 24.

You’d have to go back to the first years after the financial crisis, when consumer confidence was utterly destroyed and the economic outlook far worse, to find the stock as cheap as it is now.

Let’s also not forget what’s happening in the background of the economy.

The Federal Reserve just cut rates to zero.

Investors took that as a sign of extreme worry. But it also means that millions of Americans just got a significant break on their debt payments — which means less impact to credit card spending.

The Fed’s actions will also drive many people to remortgage their homes, leaving more money in their pockets each month.

Many of them will spend it on upgrades, furniture and other discretionary expenses, likely using their Visa-branded credit or debit cards to pay for the transactions.

Visa’s 10x Growth Opportunity

Lastly, Visa is still finding new ways to leverage its network and highly trusted brand.

For instance, the company just rolled out Visa Direct. In a recent talk with Wall Street analysts, Visa called the new system its next “10x growth opportunity.”

Instead of being merely a facilitator of credit transactions, the new business makes Visa a financial intermediary.

With Visa Direct, a gig worker doesn’t need to wait for an employer’s payment. Visa pays the worker and pockets the employer’s payment when it comes in.

The point is, coronavirus or not — there’s lots of growth and opportunity ahead for the stock, not recession.

Best of Good Buys,

Editor, Total Wealth Insider

P.S. I’m sending readers of my Total Wealth Insider service a special “Correction 2020” issue on Thursday. I’m recommending three stocks, all “unloved and unwanted” now, that I see handing us gains of 40% or more over the next 18 months. I believe this market is the buying opportunity of our lifetimes. You don’t want to miss it! Click here to sign up for this special edition today.