Last Thursday was a critical turning point for two of the stock market’s biggest mega trends — but few investors seemed to notice…

It was a “blink and you’ll miss it” moment, where the market capitalization for biotech giant (and Ozempic manufacturer) Novo Nordisk (NYSE: NVO) finally surpassed that of Tesla (Nasdaq: TSLA).

The two mega-cap stocks met at a crossroads, with the Danish pharmaceutical company surging 70% in the last year alone. Meanwhile, 2024 has been a tough year for Elon Musk’s automobile company, with shares down 30% since January, making it the absolute worst-performing stock in the S&P 500 index year-to-date.

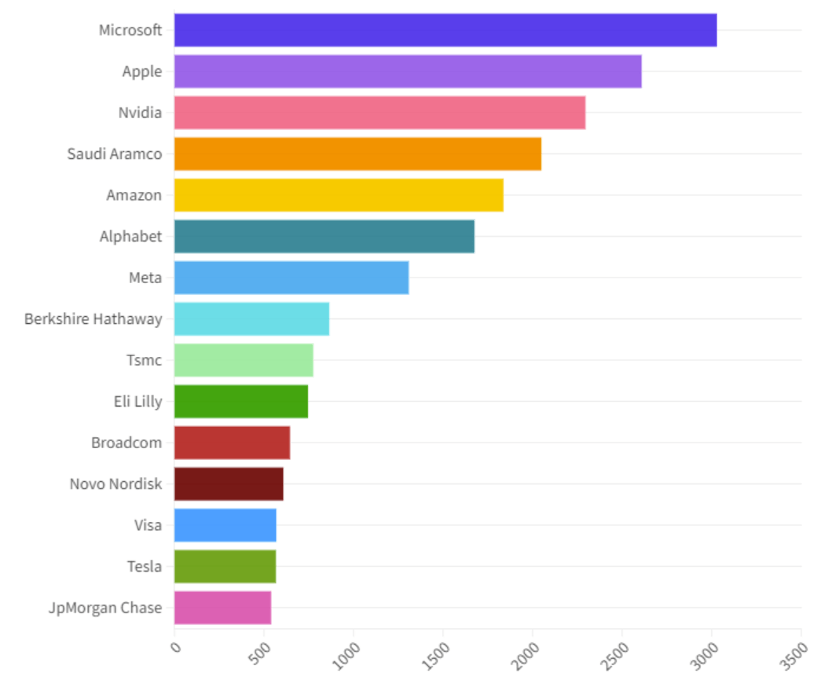

As you can see in the table below, Visa (NYSE: V) also surpassed Tesla in total market cap:

Tesla Barely Makes the Top 15 Stocks by Market Cap

It’s easy to blame Tesla’s misfortune on its goofball CEO Elon Musk, and his eccentric personality.

But the numbers don’t lie…

Tesla’s falling short of its own production goals for new vehicles. And it’s losing ground in important new markets like China to domestic producers. At the same time, Ford is slashing production of its Lightning F-150s. Hertz sold off its own fleet of EVs.

Early adopters were eager to get their hands on an all-electric Tesla Model 3, but electric vehicle (EV) sales have since leveled off at around 9% of the new car market for now. Even if this isn’t an outright “EV Winter,” there’s certainly a cooling effect going on.

Meanwhile, Novo Nordisk is surging higher — propelled by the runaway success of its new diabetes/weight loss medication, Ozempic.

That’s an indicator of a whole new mega trend on the rise for 2024…

New Biotech Breakthroughs Will Dominate the Early 2020s

Many, many years ago — before I started my financial career — I actually dreamed of becoming a doctor.

I studied. I volunteered. And after I finished my bachelor’s degree in Biology, I was accepted to medical school, which I attended for one year before realizing it wasn’t meant to be.

But I never lost the sense of fascination, the passion I have for medical technology.

After all, we’ve witnessed nothing short of a miracle when it comes to the evolution of medical technology. When you were a kid, they used a glass thermometer under your tongue to check your temperature. Now they just shoot your forehead with a laser, like something out of Star Trek.

And the biggest advancements have been made in the field of biotechnology…

We’ve seen a radical evolution in the types of medication and available diagnostics for treating different diseases.

This really came to a head back in 2020, when the race to find a cure for COVID-19 triggered a tidal wave of new interest in biotech stocks. New investment flooded in, and the industry grew by $284 billion.

Though eventually prices got ahead of themselves, many of these new investors didn’t stick around for long. As post-COVID “reopening” trades came to dominate, biotech and genomics stocks got left behind.

This brief spike in COVID-era interest was especially damaging for the hyper-growth stocks that dominate the biotech space. Most of these stocks were already expensive by traditional value metrics.

In a typical biotech investment, expected earnings and revenue are years in the future, and often depend on a successful drug trial or FDA approval (more on how to value these stocks in just a moment).

But despite the sector’s post-COVID setbacks, we know the 2020s will be the decade where market-leading stocks come from biotech and DNA technology.

It’s already beginning to happen…

Business Wire just recently reported:

“Thousands of clinical trials underway suggest a booming industry is imminent.”

The big money sees it, and is already starting to pile in…

JPMorgan just launched a team to invest in companies that have new biotechnologies.

Blackstone Group has quietly invested $137 billion into biotech.

Goldman Sachs recently led a $100 million round of funding into biotech.

Family offices, which typically manage money for families who have over $100 million, are even pouring money into it.

Just this summer, the Financial Times reported:

“Biotech is the ultimate impact investment — family offices can’t get enough of it.”

And Warren Buffett is even a believer…

When the potential of DNA technology became apparent, Berkshire Hathaway made its first biotech investment ever … to the tune of $192 million.

The writing on the wall here is clear: This is just the beginning of a huge new wave of growth.

I’m not alone in making this conclusion, either.

Vanguard, the world’s largest investment fund, confirmed my prediction in an exhaustive, multi-report study of upcoming mega trends.

This report covered EVERYTHING — every mega trend from AI to Big Data, solar, and lithium-ion batteries…

And in the words of Vanguard’s Global Head of Investments:

“If I had to pick one field that was going to be bigger than the Internet … it would be DNA technology.”

So, how can YOU start cashing in?

The Green Zone Guide to Biotech Fortunes

My Green Zone Ratings system rates stocks on six objective, measurable factors to help identify stocks that my research proves will beat the market:

- Momentum.

- Volatility.

- Size.

- Value.

- Quality.

- Growth.

We divide the value factor into subfactors such as the price-to-earnings ratio and price-to-sales ratio.

We break down these subfactors further to cover different timelines and other specific criteria.

All that to say, our value factor rating is robust. It picks apart a stock’s financial statements, then rates the stock relative to other stocks in our universe.

Now, given the nature of biotech stocks, I’m willing to be somewhat flexible on the value factor.

When your expected payoff from a blockbuster drug is years in the future, your traditional value metrics based on earnings and sales won’t look perfect in the here and now.

Finding top-rated stocks in this sector that also rate well on value gives us an extra degree of confidence. But it’s not always going to be possible when we’re looking for the next biotech breakout.

With that in mind, my team conducted an “X-ray” of the iShares Biotechnology ETF (Nasdaq: IBB).

Here’s a look at some of the ETF’s most promising holdings, rated by their Green Zone Power Rating:

The Top 10 Green Zone Biotech Stocks for March 2024

These are some outstanding scores … and I say that as someone who looks at Green Zone Power Ratings for hundreds of different stocks every day.

Most notably, we’ve got eight different stocks in “Strong Bullish” territory…

And among those eight stocks, the average score is 92 for both Quality and Growth.

Like I said before — we’ve got some bad marks for value here. In both cases, this is just something that comes with the territory.

That X-ray should give you a good starting point for your next biotech investment.

But if you’d like to make things even easier, I believe I’ve zeroed in on what may be the single hottest biotech investment of the century so far…

To good profits,

Chief Investment Strategist, Money & Markets