With a fresh cup of coffee in hand, I sat down to read through emails from subscribers last Monday. The mailbag was full of questions about gold, oil and pot — lots of questions about pot companies.

I’d like to share one that caught my eye:

With Tilray (Nasdaq: TLRY) pulling back to the $50 mark, would you consider this a company to invest in? I know there has been some negative news about Tilray in recent months, but it seems as if there might be positive movement for this stock in the near future. Or are there other companies that still represent better value when looking for stocks traded on the U.S. exchanges?

The emphasis is mine — value caught my eye.

Value is an important metric in investing, if not the most important metric.

To quote Warren Buffett: “Price is what you pay; value is what you get.”

Value captures both utility and price.

This reader is interested in finding the best value in pot stocks. I applaud him.

He didn’t want a cheap penny stock. He saw a stock that was getting cheaper and wanted to know if it now offered a good value.

That’s a question we should all ask ourselves when we see price movement.

A Metric for Company Valuation

That same day, my colleague Michael Carr sent out an email that sparked a discussion about creating a new metric in the marijuana industry.

While ratios like price-to-earnings (P/E) and Enterprise Value to EBITDA (EV/EBITDA) are classic stock valuation metrics, they fail to capture the industry nuances.

In gold, we use the price-to-gold-production ratio. It tells us how many shares of a company it takes to buy an ounce of gold produced by the miner.

When compared against other gold miners, it’s a great way to quickly sort out the cheapest from the most expensive stocks.

Ratios are a great way to see if a company is expensive or cheap compared to its peers. But one metric, or ratio, is not enough to tell you the full story.

The young cannabis sector was missing its metric — one that could be used to quickly sort companies for further research.

For expensive companies, we ask why they are expensive. Is there still value there?

And the same for cheap companies. It may be cheap, but are there issues? After all, being cheap doesn’t mean being valuable.

A New Standard to Measure Marijuana Companies

I tapped into the combined experiences of Michael Carr, Brian Christopher and Matt Badiali. Running my own ideas by them and getting their feedback, I created the enterprise-value-to-production ratio.

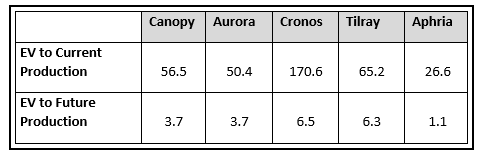

It compares the enterprise value (EV) of a company against the value of its current products to consumers. To make it more comprehensive, I added another line to include the value of future production at peak capacity.

Below is a table with my findings for the five largest Canadian producers by market cap.

Based on current production, Cronos and Tilray both look expensive. Moving to future production, both remain above the sector’s average ratio of 4.4.

Cronos and Tilray both had slow starts for production and sales. Initial production runs were less than a fifth of that from Canopy or Aurora. Even at full production, they aren’t growing enough product to justify their valuations.

Returning to the reader’s initial question, there are better values in the marijuana sector than Tilray.

In our Real Wealth Strategist newsletter, we hold only one of the companies from the table above. It’s a company we believe still has great value!

For more marijuana market updates, check out my latest Marijuana Markets POTcast below.

Good investing,

Anthony Planas

Internal Analyst, Banyan Hill Publishing

Want to learn more about what readers think about Banyan Hill? Check out Banyan Hill Publishing reviews from real subscribers here!