I noticed an unusual situation in the mining sector. It could pay off big down the road…

Giant miners Rio Tinto and BHP Billiton outperformed the iShares MSCI Global Metals & Mining Producers exchange-traded fund (ETF) by 28% over the past year.

The odd thing is that this ETF (BATS: PICK) holds nearly 31% of its value in those two stocks.

Iron Ore’s Rebound

It doesn’t hold any gold or silver miners, which are locked firmly in a bear market. It just holds big industrial metal miners. Its top holdings are:

- BHP (18%)

- Rio Tinto (13%)

- Glencore Plc. (5%)

- Vale S.A. (5%)

- Anglo American Plc. (4%)

- Nucor Corp. (2%)

- Posco (2%)

- Freeport-McMoRan Inc. (2%)

It’s odd that a fund with nearly a third of its assets in two stocks would underperform those two stocks by so much … but it has. Which tells us that those two companies are running away from their peers.

That illustrates the huge divide in the mining sector today.

There are two camps in the mining sector right now: the stocks that are rising and stocks that aren’t. The reason for that is a mystery. There are some hints … but no concrete conclusion.

Iron ore is part of the story as one of the fundamental commodities. It’s a rare bright spot in the metal universe today.

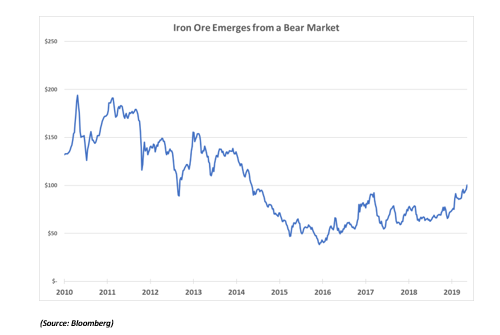

It entered a bear market with gold and copper in 2011. Like its metal peers, it bottomed in 2016. From top to bottom, its price fell 80%. It devastated the iron mining industry.

Then it spent the next two years going up and then going down. But lately, prices are on the rise, as you can see in the chart below:

Iron Ore Price Movement

As the price fell to a low of $38 per metric ton amid a glut of supply, companies like United States Steel Corp. (U.S. Steel) took a huge hit.

U.S. Steel sold its then unprofitable Serbian assets for $1. Then it took a $1.8 billion write-down on assets it bought in 2007, and laid off thousands of workers. It also went through two CEOs during the grinding bear market.

Then the iron ore price started to rise. It just hit $100 per metric ton, its highest price since 2014. That’s a 161% gain from its low at the end of 2015. Most analysts want to point to that recovery in iron ore as the reason BHP Billiton and Rio Tinto are ripping higher.

But that’s not the whole picture…

Electric Vehicles: Fueling the Demand for Metals

Pure iron ore producers like Vale and ArcellorMittal either track PICK’s performance or underperform it.

Now, BHP Billiton and Rio Tinto are riding a larger wave than just the rising iron ore price — they are the smart money’s choice for hedging the future.

Both companies are multicommodity producers. Along with iron ore, Rio Tinto sells aluminum, nickel, copper, diamonds and gold. And BHP Billiton sells copper, silver, coal, diamonds, aluminum, nickel, manganese and more.

These two companies are going to be critical to the electric vehicle (EV) movement.

That’s going to be a huge source of metal demand. The International Energy Agency predicts that the EV market will grow 2,100% by 2030.

As I told readers of my Real Wealth Strategist newsletter: “This trend will shape natural resource investing for decades.”

That is the main reason Rio Tinto and BHP Billiton shares are moving higher and faster than all the other mining companies.

The smart money is preparing for a huge bull market in metals. These investors want to own the best in the business … and both Rio Tinto and BHP Billiton give them that.

Those two companies sell most of the metals that go into car batteries. And the demand for those batteries is going to skyrocket.

To take advantage of the momentum in car batteries and metals, consider exposing your portfolio to either BHP Billiton (NYSE: BHP) or Rio Tinto (NYSE: RIO) That’s what the smart money is doing today.

Good investing,

Matt Badiali,

Editor, Real Wealth Strategist