In my experience, here’s investors’ biggest bear market mistake…

It’s listening to everyone else — CNBC talking heads, strategists and all the rest of the financial commentariat — predict the length, severity and ultimate bottom of said bear market.

It’s the perfect recipe to not make money … ever.

You’ll stay out of the market far too long — until it seems far too late to get back in.

Take it from me. This is the fifth bear market or near bear market of my investing career.

I made this mistake my first couple of times to the rodeo too.

The problem is assuming that the ups and downs of the S&P 500 Index match up to the individual stocks you might want to buy.

Often, the best stocks attract large buyers as they fall and become deeply undervalued. So their shares tend to bottom quickly, even as the broader market keeps heading south.

Weeks or months later, someone on Wall Street waves the green flag and says it’s safe to get into the market again.

But when you suddenly decide to start shopping for stocks — the ones you told yourself you would buy when they got really inexpensive — they’re not nearly so cheap anymore.

And one retail stock is the perfect example.

A Stock You Should Buy Now

TJX Companies Inc. (NYSE: TJX) is the operator of the popular off-price retail chains T.J.Maxx, Marshalls and HomeGoods.

It’s an example of a stock you should buy now — rather than wait for the all-clear signal (whatever that’s supposed to be).

With more than 4,000 stores in the U.S., Canada and Europe, TJX pioneered its highly profitable business model.

It buys overstocked inventories from department stores, pallets of goods from canceled orders, you name it — for pennies on the dollar. It then resells them to bargain-minded shoppers for the equivalent of dimes and quarters.

But like virtually every stock in the S&P 500, shares plunged in a matter of weeks as investors braced for COVID-19’s impact.

Last week, they got it.

TJX said it was closing all of its stores for two weeks, including its e-commerce operations, as well as withdrawing its first-quarter and 2021 earnings forecasts.

TJX Plunged 43% in Just a Few Weeks

(Source: TradingView.com)

What’s interesting now is the value of the stock at these levels.

TJX Hasn’t Been This Cheap Since the Financial Crisis

Over the last 12 months, TJX earned $2.67 a share in profits.

Wall Street typically assigns a target price-to-earnings (P/E) value of 20 to 22 to own the stock. In other words, traders will pay up to 20 times its last 12 months’ worth of profits to buy the shares.

Yet if we divide the recent $36 stock price by those trailing results, we get a P/E ratio of 13.

The last time TJX traded at a P/E value that level or lower was in the waning days of the financial crisis.

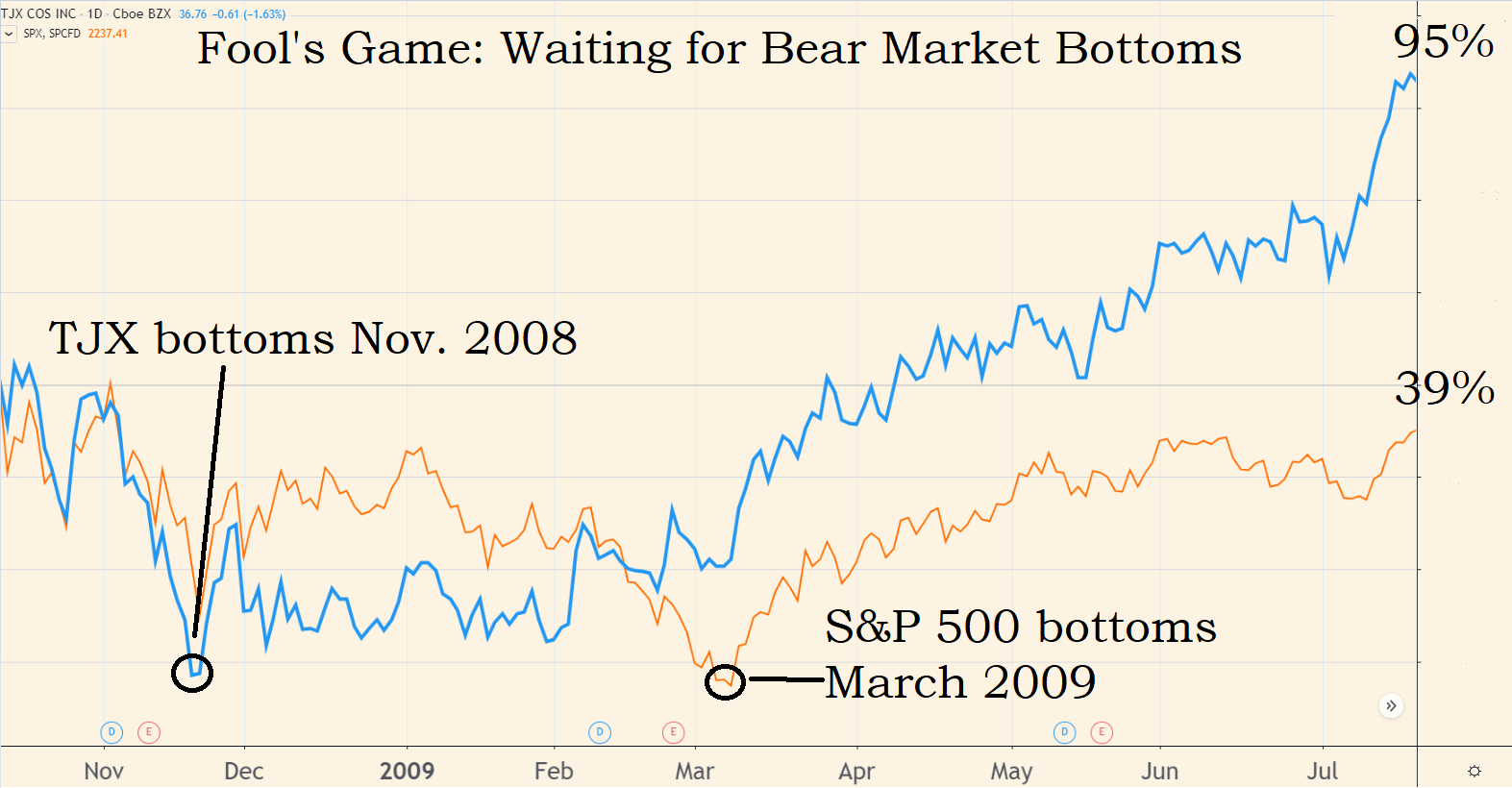

This chart from 2008 shows that TJX’s stock bottomed months before the S&P 500.

It took the express train to larger profits long before the index finished its decline and chugged out of the station:

(Source: TradingView.com)

Yes, the impact of COVID-19 makes it harder for retailers or Wall Street analysts to forecast revenue and earnings. But that’s the whole reason you focus on quality names at a time like this.

As TJX noted in its recent announcement, the company entered 2020 in “a very strong financial position.”

The virus outbreak (and economic shutdown) is a temporary condition. TJX has a business model that works well in good times, bad times…

And uncertain times like now.

Best of Good Buys,

Editor, Total Wealth Insider