It Can’t Rain All the Time

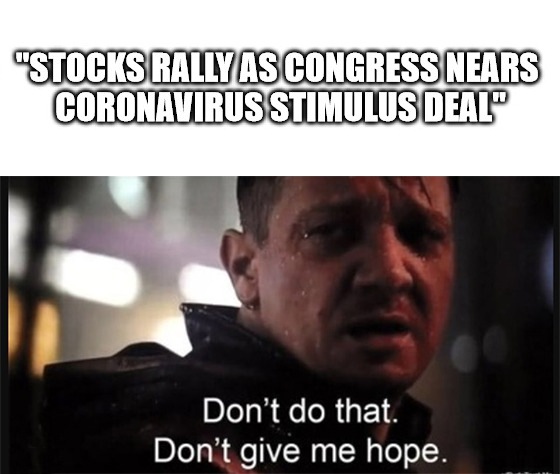

Hope for a light at the end of the tunnel — that, dear readers, is why Wall Street rallied today.

Hope that legislators in Washington, D.C., finally set aside their differences to help the American people.

The Federal Reserve has already taken care of Wall Street — “unlimited stimulus” is nothing to laugh at. As Great Stuff reader Larry S. put it yesterday: “This is huge.”

And yet, Main Street USA still waits on pins and needles for Congress to finally reassure the rest of the country.

The latest stimulus bill promises to boost a U.S. economy struggling with massive layoffs, overcrowded hospitals and suffering businesses.

While this bill would be a major step forward to combat the effects of COVID-19, we still have a long way to go in this fight.

We’re reminded of this today as Japan postpones the 2020 Olympics. The only other postponement in Olympic history was the 1972 Munich Games, which were delayed for a day due to terrorist activities.

The Olympics didn’t take place at all in 1916, 1940 and 1944 due to world wars.

How’s that for perspective on COVID-19?

We’ll have another stark reminder later this week, when the Department of Labor releases its weekly jobless claims report. Bank of America expects initial jobless claims to hit 3 million due to mass layoffs following coronavirus shutdowns.

The Takeaway:

Mr. Great Stuff, the market is rallying! There’s hope for a deal! Why are you always so negative?

If I sound negative, it’s because I’m trying to be honest with you! It’s impossible to make sound investing decisions when you’re blasted with extreme market sentiment every day.

Today’s message is that everything will be OK … that Congress and the Fed are riding to the rescue.

Honestly, everything will be OK. Congress and the Fed are riding to the rescue.

However, it’s just as honest to say that there’s no magic wand, no legislation to pass and no amount of stimulus to dump on the American economy to make this all just disappear overnight.

You need to know that.

So, while everything will be OK eventually, you need to keep protecting yourself and your investments for the time being.

I’m here to look out for you (and make you laugh if I can). And if I sound like I’m politically “left of center” or “right wing” while doing that, then so be it. (Seriously, I’ve been called both in the past week … so I must be doing something right.)

Now, if the markets’ mixed messages have you feeling particularly uncertain on days like today, congrats! That means you’re paying attention.

This may ruffle a feather or two out there … but, with the right flavor of diversity in your portfolio, there’s no need for certainty.

Gasp! How can that be, Mr. Great Stuff?

Just ask Ted Bauman, an expert here at Banyan Hill. Ted diversifies like no one’s business. In fact, his readers in The Bauman Letter had diversification at their fingertips long before this mess began…

The Bauman Letter is actually three diversified model portfolios in one: long-term gain opportunities, short-term rallies and opportunities to generate income in the meantime.

Not to mention, Ted’s also the man with a plan when it comes to tax season. (I bet you forgot about all that while looking for toilet paper, huh?) Yes, I know the Feds extended this year’s tax deadline … but just think about all the slackers you’ll beat by getting it done now!

And if you click here, you can discover some of Ted’s clever ways that you could pay $0 in federal income taxes — legally, that is.

Good: Stardog Champion

In a sign that risk tolerance may be on its way back into the markets, shares of speculative space syndicate Virgin Galactic Holding Inc. (NYSE: SPCE) blasted off again. (Prepare for trouble, and make it double?)

Morgan Stanley (NYSE: MS) analyst Adam Jonas (My name is Jonas…) upgraded SPCE from equal weight to overweight this morning, prompting a 20%-plus rally in the shares. Jonas cited Virgin’s “healthy cash position” and noted that the company should weather near-term headwinds well.

The “story and the balance sheet remain intact,” Jonas concluded.

Regular readers know that Great Stuff has been critical of investing in Virgin Galactic — and for good reason. The company has no revenue, no earnings and its spacecraft only reach the bare minimum of what’s considered space.

That said, the space tourism market is attractive … or it will be once more Earth-based issues like COVID-19 are addressed. Even after it crashed more than 60% in the past month, SPCE still appears overvalued — especially after today’s upgrade-induced rally.

The main takeaway here is that risk tolerance toward speculative bets like SPCE is making a bit of a comeback. And that’s healthy for the market.

Better: Outshined

With all this market uncertainty, gold is finally coming into its own. What’s more, Goldman Sachs Group Inc. (NYSE: GS) believes that now is the time to buy.

Why? Because the gold market has reached an “inflection point.”

According to Goldman, it goes like this: The Federal Reserve’s recent moves to buy unlimited amounts of Treasurys and mortgage-backed securities eased liquidity concerns in the market. With liquidity (i.e., cash flow) now more stable, investors will be more willing to sell gold to raise cash and expand their balance sheets.

However, Goldman notes that we’ve reached “an inflection point where ‘fear’-driven purchases will begin to dominate liquidity-driven selling pressure, as it did in November 2008.”

In layman’s terms, investors will increasingly sell gold to gain liquidity (cash), but safe-haven buying will drive prices higher.

That didn’t make it any simpler, did it? The bottom line is that gold will rise again on safe-haven demand amid market uncertainty, and technical factors in the market should no longer limit its upside.

Case in point: The SPDR Gold Trust (NYSE: GLD) exchange-traded fund (ETF) is up big today, and it remains a Great Stuff suggestion for avoiding the worst that this market has to offer.

Best: Nearly Lost You

In 2018, crashing crypto demand nearly sunk Nvidia Corp. (Nasdaq: NVDA). The company was making money hand over fist selling high-powered graphicsprocessing units (GPUs … graphics cards for the computer) to crypto miners looking to score it big in bitcoin’s Wild West.

Now, those teraflop GPUs are finding a different use entirely. According to Needham analyst Rajvindra Gill — who upgraded the stock from hold to buy — Nvidia’s chips are increasingly attractive for analyzing genomes and viruses, speeding up the process “from days to less than one hour.”

After all, if Nvidia’s GPUs can crunch coins on the blockchain, they can analyze viruses just fine.

Gill also touted Nvidia’s balance sheet, noting that “during this uncertain time, superior balance sheets remain supreme.” The company sits on $8.9 billion in cash — more cash on hand than all but one of the 21 chip companies in the iShares PHLX Semiconductor ETF (Nasdaq: SOXX).

On a final note, Great Stuff would also like to point out that gaming revenue could climb for Nvidia as more people stay at home to avoid the coronavirus. Definitely put this stock on your watch list.

I feel like we need a bit more perspective on COVID-19’s impact on the markets and the U.S. economy. This Chart of the Week comes from this Visual Capitalist article, which shows how we went from a 10-year bull market to a bear market in just 16 days.

That’s unprecedented. It’s faster than the 2008 financial crisis … faster than 1987’s Black Monday … and almost twice as fast as the Great Depression.

So, when people ask me why I sound negative … it’s not that I’m being negative, per se. It’s that I’m trying to keep you grounded in the reality of the situation.

For those looking for a positive spin, we’ve also seen unprecedented steps taken by the U.S. government and the Federal Reserve to address the situation.

I commend their action, but you still need all the facts. You still need to prepare for this to drag on for a while.

Be patient. Opportunities will arise, and with Great Stuff and Banyan Hill at your side, you’ll be prepared to take advantage of them.

Great Stuff: Set Me Straight

I holler, you holler, we’re all hollering this week.

So far, y’all have had a field day writing in to share your thoughts with Great Stuff … and I love it! Yes, even those emails calling me a socialist, fascist, pacifist, masochist — keep ’em coming.

If you haven’t taken a second to write in to GreatStuffToday@BanyanHill.com, well, what’s stopping you?

You have approximately two days to make this week’s edition of Reader Feedback. (That’s one sundown and two sunups for my folks who booked it off the grid … wait, how are you reading this?!)

In the meantime, don’t forget to check out Great Stuff on social media. If you can’t get enough meme-y market goodness, follow Great Stuff on Facebook and Twitter.

Until next time, good trading!

Regards,

Joseph Hargett

Editor, Great Stuff