When is a sock puppet worth $400 million?

No, that’s not a trick question.

Just ask the folks from the now-failed startup Pets.com.

Back in 2000, during the early stages of internet investing, Pets.com made a massive splash with its quirky marketing campaign.

The whole campaign centered around a now-infamous sock puppet with a microphone taped to its paw.

The ads were everywhere too — from Super Bowl commercials to Good Morning America appearances.

And investors loved the gimmick.

They bought up shares until the company reached a $400 million market cap at its peak.

But aside from the used sock puppet, they weren’t getting very much for their money.

During its first year, Pets.com earned $619,000 in revenue … while spending nearly $12 million to fund its massive ad campaign.

The market quickly came to its senses.

Pets.com shares quickly plummeted from $11 all the way down to $0.19. The company threw in the towel soon after, announcing its liquidation in January of 2001 — less than one year after its IPO.

Since then, the company’s sock puppet has been retired to a kind of Hall of Shame.

It’s become the punchline for one of the stock market’s biggest jokes.

Yet at the same time, it’s an important reminder of what happens when investors get too carried away with exciting new tech trends…

New Tech’s “Venture Capital” Phase

Right now, the market is going through its biggest tech-fueled transformation since those early days of the internet — thanks to artificial intelligence.

In fact, AI’s economic impact will be much larger and more widespread than anything we’ve seen in the internet era so far.

But like so many other tech mega trends before it, AI is still maturing.

That means the technology, the market and even the investors are all still evolving.

Currently, we’re in what I like to call the “venture capital” phase of AI investing. You could also call it the Wild West if you’re feeling a little less charitable.

So the market is flush with all sorts of brand-new AI investments, and we don’t have many established frontrunners.

Information can be sparse, but enthusiasm isn’t in short supply. So investors are pouring cash into anything that’s even remotely AI-related.

Now some of these early AI companies will inevitably go the way of Pets.com. Some already have.

BigBear.AI (NYSE: BBAI) famously captured media attention near the very start of the AI boom.

The company made lofty promises about developing AI solutions for military and business. But like Pets.com, BigBear.AI didn’t have much to offer investors.

Since going public via SPAC in 2021, shares have sunk 85%.

But there’s also plenty of reward to go with the risk of investing in AI this early.

Just like how some early internet investors lost money on Pets.com … while others earned life-changing fortunes from Amazon and eBay.

We can expect the same will be true for early AI investors.

(Editor’s Note: Adam’s 10X Stocks subscribers had the chance to double their money in just three months from a single AI trade earlier this year.)

As a result, this kind of investing isn’t exactly for everyone.

Some investors would rather “dip their toe” into AI by sticking to big, established tech giants like Google’s parent company Alphabet Inc. (Nasdaq: GOOGL) or NVIDIA Corp. (Nasdaq: NVDA).

The logic makes sense. After all, why waste time chasing “The Google of AI” when you can just buy Google and be done with it?

Unfortunately, the opportunity isn’t so cut and dry…

Why Not Stick With the Sure Thing?

I actually recommended Google to my Green Zone Fortunes subscribers in January of 2022 — based in no small part on its early AI successes.

After acquiring AI research lab DeepMind in 2014, Google proceeded to grow revenues by more than 20X in just five years!

Unfortunately, 2022’s bear market tumble triggered our stop-loss to exit the position.

Alphabet is still a great investment overall, but shares have already risen by more than 51% this year, largely thanks to the growing hype around AI investing.

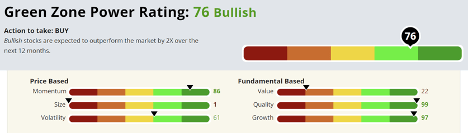

When I recommended it in January of last year, Google’s Green Zone Power Ratings sat at 91 out of 100. That’s an outstanding and “Strong Bullish” score.

But now, it’s sunk to 76:

As you can see, that’s still “Bullish.” And it’s still a great stock to have in your portfolio.

The same is true for NVIDIA.

Last year’s bear market hit the world’s most valuable chipmaker hard. But this year’s AI fever has helped shares more than triple since the beginning of the year.

As a result, it’s still a great stock … but NVIDIA’s Green Zone Power Ratings are still at just 66 out of 100:

These ratings are a powerful tool to help filter out the hype and the noise — leaving you with the unbiased facts about a stock’s performance, and its potential for the future.

In both cases, we’re still bullish.

But due to the recent volatility and weak value ratings, we’re likely to find better ratings (and better opportunities) with other AI investments.

The Second Wave of AI Investing

Between this year’s run-up in Big Tech companies and the crash of once-hot SPACs like BBAI, it’s clear that the first big wave of AI investing is already in the books.

The second wave of any new technology is typically going to be more competitive, more streamlined, and more effective.

We’re already starting to see some of those types of opportunities emerge in the market.

At the same time, AI isn’t just transforming WHAT we invest in…

It’s also changing HOW we invest…

Most of us can remember what it was like before the internet, when it would’ve been unthinkable to tap a few keys on your keyboard and call up years of stock market data.

We take our browsers for granted today, but internet access spurred a massive leap forward for Main Street investors.

A recent long-term study from the University of Chicago’s Becker Friedman Institute found that the internet led to large increases in both stock market participation and risk-adjusted returns.

In their words, internet access led to a “democratization of finance.”

So it wasn’t just about buying the best internet stocks.

It was about figuring out how to use the internet to find the best stocks.

Now that’s happening all over again with AI. And the upside will dwarf what we saw in the early internet era.

Because AI gives us the power to analyze billions of data points 125,000 times faster than the human brain.

It can learn, adapt and evaluate opportunities in ways we haven’t even realized yet.

That’s why I recently began working with TradeSmith CEO Keith Kaplan.

Keith and his team have spent $18 million and over 50,000 man-hours developing the most cutting-edge financial innovations on the market.

And his latest system could be the breakthrough that sends AI-powered investing into high gear.

It’s a predictive Analytical Engine (An-E for short) that can determine where a stock is headed in the next few days, weeks, or even months.

Keith and I sat down with Chris Hurt to reveal how this system has already forecasted stock prices with remarkable accuracy … and how Main Street investors can start using it today…

See the full presentation HERE.

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets