“Tesla is going to $2,000 a share in four years.”

That’s the bottom line from ARK Invest’s latest research. It’s a fun read. ARK says shares of Tesla should gain an average of 88% a year because of its autonomous taxi business.

Don’t rush out looking for those taxis yet. There aren’t any. “But don’t worry,” ARK says: “they’re coming. So, the stock must be a bargain at 10.8 times book value, almost 4 times higher than the average S&P 500 company.”

I’m skeptical. I don’t think autonomous taxis will ferry passengers everywhere they want to go anytime soon. The reason why is simple… People don’t trust them.

Waymo operates a small service near Phoenix, Arizona, where I live. Many people I talk to are wary of using it. They prefer a human driver … because people, even when flawed, provide a sense of comfort.

Tesla has data showing self-driving cars are safer. But they need to convince consumers to use their cars … and regulators to approve them in the first place. That’s two uphill battles ARK Invest seems to have ignored. The technology might be great, but it won’t mean anything if regulators don’t allow it to roll out.

There’s also the risk of competition. Companies like Waymo — owned by Alphabet, the parent of Google — are working on the same idea. Apple is also working on a self-driving car. So is Uber. Well-funded competitors are a risk to ARK’s valuation model, which seems to assume Tesla will be the only driverless taxi service in town.

There’s also the risk regulators will shut down testing because the technology doesn’t work as well as it should. Several years ago, Uber’s progress was delayed by a fatal accident. All it will take is one more to cause another years-long delay.

And all this says nothing about the risk of simply owning tech stocks. They’ve been some of the worst performers in the bear market.

Investors in technology stocks need to understand these risks. That means really understanding the technology. Few of us are able to understand the technologies behind the biggest tech companies.

Fortunately, we don’t need to look at tech stocks for annualized gains of 88% a year. In fact, many of the stocks with those gains in the past few years weren’t tech stocks.

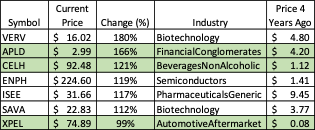

The seven stocks that delivered an average gain of at least 88% a year for the last four years are below. I highlighted three which are decidedly low-tech.

Applied Digital Corporation (APLD) pivoted from being a blockchain company to a consultant that helps datacenters work with their local utilities.

Celsius Holdings Inc. (CELH) makes energy drinks. Its products are found in grocery stores, convenience stores, gyms and spas.

XPEL Inc. (XPEL) offers paint protection, window films and other automotive after-sale purchases.

These aren’t high-tech companies. But they delivered extraordinary returns. And contrary to what you might think, it’s not unusual to see extraordinary returns in non-tech stocks.

However, it is unusual to see 88% a year growth over four years, no matter what sector it’s in. Over the past 10 years, just 16 companies in the Russell 3000 Index posted gains of that size at some point. I don’t expect to see Tesla joining that list anytime soon.

But I did notice something special about the list above…

Look at the column furthest to the right. Most of these stocks traded under $5 per share four years ago.

Several of the biggest winners started from very low prices, the kind of less-than-$5 stocks that Adam O’Dell is hunting for.

If ARK is right about Tesla, the company would have a market cap of more than $6.3 trillion in four years. If the U.S. economy grows by 5% a year, itself an equally absurd assumption, TSLA would be worth 20% of GDP.

This doesn’t mean you can’t pursue eye-popping returns. You just have to look outside the scope of mega-cap tech stocks.

Build-A-Bear Workshop Inc. (BBW) has quietly gained, and held onto, more than 2,800% from its pandemic lows of near $1 to its recent highs.

Build-A-Bear is not a high-tech company. It didn’t take specialized knowledge to understand it. It’s a place where we take kids to make stuffed animals. Kids like going there. We like to see our kids and grandkids doing things they like.

I know ARK has talented researchers on their team. But I wish they’d look beyond tech and instead help us find the next Build-A-Bear.

Fortunately, our team is on that … and Adam is leading the way.

He just released a presentation which details a very special group of $5 stocks. All of them rate in the top fifth percentile of his Stock Power Ratings system, which has historically proven to identify stocks with high odds of outperforming the market 3-to-1.

But for reasons Adam explains in this webinar, he believes these stocks will do much better… as much as 500%, or even more, over the next year.

He just recommended these names to his 10X Stocks subscribers, but there’s still time to join them. You can go here for all the details.

But no matter what you decide to do, I urge you to think outside the tech box as you start to build a portfolio for the next bear market.

Take these lofty price projections with a dash of salt. And, as obvious as it sounds, focus on small stocks with simple businesses going up … not large stocks with complex businesses going down.

Adam and I will continue working to help you find those stocks both here and in Stock Power Daily.

Regards, Michael CarrEditor, One Trade

Michael CarrEditor, One Trade

Why Economists Love Ticket Scalpers

It’s funny. I recently realized that I’ve been spending too much time reading current news that wasn’t particularly useful or insightful.

I still check the headlines first thing in the morning and then again at lunch. But I’ve stopped checking my news feed throughout the entire day, and started picking up a book instead.

Not so shockingly, by eliminating the massive time suck of endless scrolling, I get a lot more done. I’ve even managed to blitz through three meaty books in the past two weeks.

It’s amazing what you can accomplish when you eliminate distractions, like reading the same headlines for the umpteenth time!

At any rate, I’ve been enjoying a book by Paul Oyer called An Economist Goes to the Game: How to Throw Away $580 Million and Other Surprising Insights from the Economics of Sport.

I still have so many unanswered questions. How exactly do professional soccer teams make money from TV when there are no commercial breaks, other than halftime? What’s in it for the TV network?

The book was full of gems.

As an example, I instinctively hate ticket scalpers. They just feel dodgy. But economists love scalpers. Because they create liquidity in what’s often an illiquid market of ticket buyers and sellers. They also potentially create a net gain from trade.

Let me explain: If you buy tickets for a game and can’t attend for some reason, those tickets become worthless to you. But you can sell to a scalper (ahem, “broker”).

Anything you get from the sale puts you in better shape than you were before. Furthermore, the scalper does the legwork for you in finding a buyer. And if they don’t, they eat the loss, not you.

Interestingly, new entrants like StubHub have largely cut out the middleman, and to use terminology from Wall Street, lowered the bid-ask spread.

In plain English, the “bid-ask spread” is the difference between the price the buyer pays and the price the seller gets — the scalper’s profit — has shrunk. The incentive for an enterprising ticker-flipper is smaller now.

The stock market had a similar transformation over the past 50 years. The amount of time, money and brainpower thrown at analyzing stocks has made stock picking brutally competitive. And it’s also squeezed out a lot of the profit for brokers, while ultimately giving us a more liquid market.

But this is generally only true for large companies. The market for smaller stocks is still the Wild West in a lot of ways. So investors generally expect a premium for investing in smaller companies.

This is why size is one of Adam O’Dell’s six critical factors in his Stock Power Ratings system.

I was pondering this while I was looking at Adam’s trading strategy — and his latest research into high-quality small-cap stocks. Precisely because large institutional investors aren’t allowed to own stocks priced under $5 (at least not without jumping through costly hoops), that corner of the market is more illiquid.

You can find real undiscovered gems there that you simply can’t find anywhere else.

At any rate, be sure to tune in to The Banyan Edge Podcast on Monday. We’re having “Banyan Book Club,” where Adam, Amber Lancaster and Ian King are all going to share what they’re reading.

Join us, you might learn something new!

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge