You’ve probably heard the phrase “sell in May and go away.” It comes from the trend of stock returns being worse from May to October and better from November to April.

Now, I say “traditionally” because every year is different. There are plenty of individual examples where May was a bad time to sell and November was a bad time to buy.

This cliché is just a simple example of seasonality. Imperfect as it is, you can’t ignore seasonality. Under the right conditions, it can turn an average trading strategy into an exceptional one.

What many don’t know is, patterns like these go beyond month to month or quarter to quarter. In fact, there are clear patterns even in the short term. I’m talking the scale of weeks and days.

I’ll explain more about that (and how my colleague Adam O’Dell has perfected these short-term patterns) in just a minute.

But first, I want to share something incredible I learned after speaking to an industry insider … whose name I promised not to share.

“Sell on Wednesday and Go Away”

I personally know an accomplished market maker. Their job is to act as the counterparty to every trade order that comes across their desk. If someone buys a stock, they have to sell it to them, and so on.

With a job like that, you get an invaluable perspective on how markets work. And they recently confirmed something I always suspected about the markets, but never knew for sure.

They welcomed me to share it with you … on the condition that I keep their identity to myself. I’m happy to meet that condition if it means I can tell you things you’d never hear about otherwise.

I’ll put it like this…

If “sell in May and go away” is a fun and sometimes-accurate Wall Street cliché…

Then “sell on Wednesday and go away” may as well be gospel.

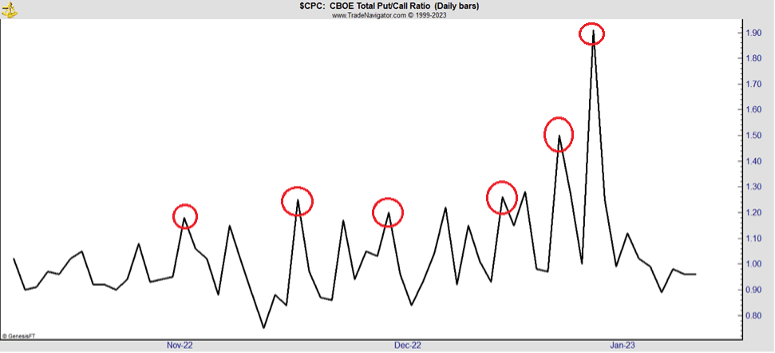

To show you why, let’s first look at the CBOE Put/Call Ratio.

The CBOE Put/Call Ratio compares the number of put options positions to the number of call options. Remember, puts rise in value when prices drop and calls rise along with stock prices.

When the ratio moves above 1, it means traders are nervous about price declines and buy more puts than calls. Lower than 1, and they’re buying more calls than puts. Basically, the ratio measures fear and greed in the market.

The average ratio is around 0.6. This means traders are generally greedy. That’s understandable, as markets go up most of the time.

Check out this chart, though…

(Source: Chicago Board Options Exchange)

This is a daily look at the ratio from the past few months. Notice the big spikes in November and December? These happened when the market started to fall, and traders bought put options to chase the decline.

Those big jumps that I circled in red? Each happened on Wednesday. Every single one.

As a matter of fact, as the S&P 500 fell 2% from its strong start yesterday (Wednesday), the Put/Call ratio spiked yet again from 0.68 to 0.95.

And as I write this, just before Thursday’s open, S&P 500 futures are down 0.75%.

You could interpret that as traders get scared every Wednesday and buy puts … but that doesn’t make much sense. Fear isn’t scheduled in advance.

The Chicago Board Options Exchange (CBOE) noticed this trend too, and they wanted to know why it was happening.

What they found was that market makers were making a specific trade every Wednesday which both helps cause — and benefits from — this regular volatility.

When I found this out, I called up my market maker friend to confirm it. They did. And not only that, they showed me exactly how it’s done.

The Market Maker’s Wednesday Scheme

Fair warning, the following is a bit technical. I’ll break it down as best I can, but the important thing to know is what I’m describing causes regular and considerable volatility on Wednesdays.

On Wednesdays, market makers use an options strategy called “credit spreads” to generate income from a trade that expires Friday. In doing so, they’re essentially selling short one option to receive cash, and buying a lower-priced option to limit their income but also their risk. And they trade thousands of these spreads at a time to increase their returns.

Here’s the thing, though…

They’re trading deep in-the-money credit spreads on stocks that a lot of traders have call option exposure to. In doing so, they’re attempting to exercise traders’ call option positions, forcing them to buy the stock and pay the market makers.

Market makers know that most individuals hold their options until they expire to take their profit. When they do, market makers need to trade shares to meet the obligations of the expiring options. So, they borrow them.

With interest rates at 4%, there’s a short-term trading opportunity. They sell the shares they borrowed to the call holders and receive even more cash. They also earn 4% on all their cash until the options expire.

In short, market makers are not only betting against the stock … but against you. And in doing so, they’re both benefitting from and causing the regular Wednesday volatility.

It’s virtually risk-free money for them — as long as they trade on Wednesday afternoon. If they trade then, the trade settles on Friday and they pocket interest on their cash over the weekend.

If that sounds complicated and risky … that’s because it is. A good market maker knows how to exploit the arcane mechanics of the options market in order to profit.

There is some danger to this. Market makers are playing with borrowed money. If the trade goes against them, they’ll owe millions. At the scale this is happening, it could cause systemic risk to the market.

But, my colleague Adam O’Dell has identified this pattern too. He knows how to avoid the market maker’s scheme.

And he’s even developed a way to beat them to the punch.

Only Buy on This Day

Remember when I told you that seasonality could go beyond looking at a month?

Well, Adam did just that.

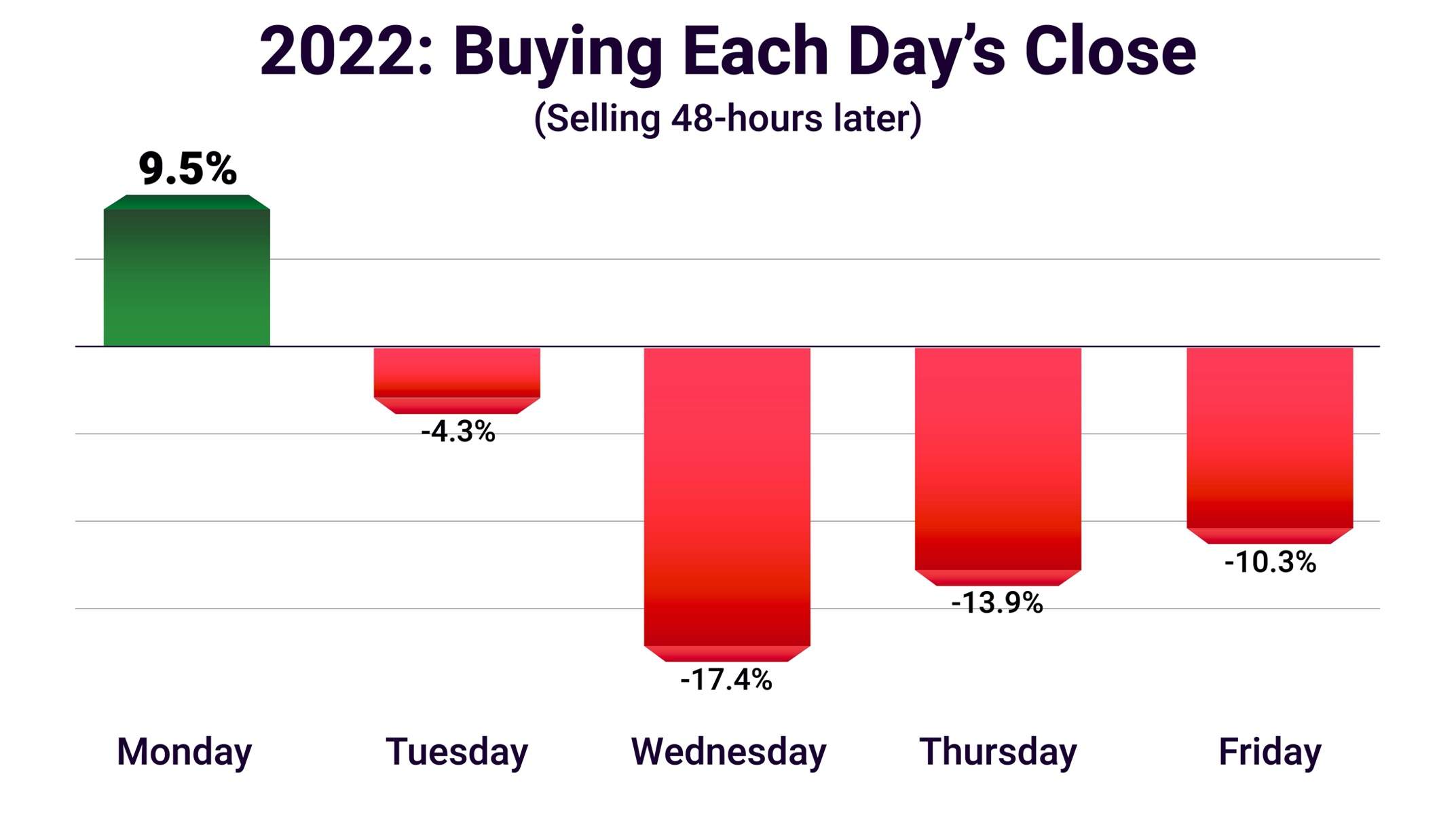

He shared an interesting chart with me a couple weeks ago:

The chart shows returns for 48-hour trades during the week.

As you can see, if you bought at the close on Monday and held until Wednesday every week of 2022, you would’ve made a 9.5% return on average.

Buying on any other day and holding for 48 hours … and you’re losing money.

And what’s the worst day of the week to buy and hold for two days? Wednesday.

Adam realized years ago that buying on Monday and selling on Wednesday was a profitable strategy. So these days, he exploits this anomaly with his Wednesday Windfalls trading service.

For all this complexity, the strategy is simple. Adam buys call options on Monday in three uncorrelated sectors, looking to ride the average gain stocks see during that window.

On Wednesday, he closes those trades out before the market makers work their magic … and the worst two-day performance of the week begins.

So far, Adam has scored over a dozen multibagger trades using this strategy.

That’s not to say there are no losers. You have to accept losses are possible when you trade options.

But so long as you follow Adam’s strategy, you can rest easy knowing that, accounting for both winners and losers, the average trade result is a 9.4% gain since inception…

The average winner is 102%…

And it’s produced standout winners of 192%, 220% and 262%.

Those gains are nice. But, no offense to my good friend … it’s even nicer to outfox the market makers.

Adam’s strategy reduces your risk, helps you beat the market makers and can yield double- and triple-digit gains nearly every week, on average.

Yesterday, he hosted a live Zoom call with his senior research analyst, Matt Clark, and explained how this strategy works.

If you missed it, you can catch the replay by clicking here. And I highly recommend you do.

There’s no reason for market makers to stop using this strategy anytime soon. If you want to dodge their antics in 2023, you should see what Adam has to say.

Regards, Michael CarrEditor, One Trade

Michael CarrEditor, One Trade

Market Edge: Returning to “Fire China”

A little over a month ago, our colleague Ian King wrote a piece that really turned a lot of heads. In fact, we still get readers writing in to share their thoughts about it.

Ian wrote about the reversal of globalization … a big theme here in The Banyan Edge.

But more specifically, he wrote about “firing China.”

Well, there may be one problem there. In the not-too-distant future, there may be no one left to fire!

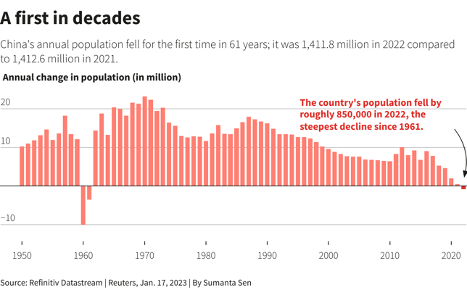

China’s population shrank by about 850,000 last year, the first reduction since 1961.

In 1961, China was in the middle of a brutal famine that killed an estimated 30 million Chinese citizens. This time around, the COVID pandemic clearly played a role, though a longer-term look at the trends shows that, pandemic or not, it was just a matter of time until China started to shrink.

As recently as the late 1980s, China was adding about 18 million new people … or the equivalent of the entire population of Georgia and Virginia… per year. It’s been shrinking ever since and then finally went negative this year.

Now, China has a population of 1.4 billion people. So clearly, the country isn’t going to disappear any time soon.

But after running the One Child Policy from 1980 and 2015. China effectively guaranteed population shrinkage. UN estimates have China’s population shrinking by 109 million by 2050. So what we’re seeing here is just the beginning.

Why does this matter?

Think about what the modern economy looks like. It’s based on continually selling more product to more people. Whether it’s Big Macs or BMWs, the assumption is that there will always be more people to sell to.

But in an aging and shrinking society, that model no longer holds … and everything falls apart.

Does it make sense to invest in new productive capacity if you have fewer end buyers? What about housing? Does it make sense to buy a home if there is potentially no one to sell it to in another few decades?

Chinese stocks are on fire right now, and the China post-COVID reopening trade might have longer to run. But look at the bigger picture here…

With the West looking to “fire China” from the supply chain and with the country’s internal market now shrinking … does this look like a place you’d want to invest?

As Mike Carr and Adam O’Dell preach, it’s important to be adaptive in times of volatility. And right now, that means learning to trade the short term and pull big, quick gains out of the market regardless of the trend.

As Mike showed you today, Wednesday Windfalls is one of the best ways to do that. To learn how you can get involved, go right here.

Charles SizemoreChief Editor, The Banyan Edge Charles SizemoreChief Editor, The Banyan Edge |