Bit of a crazy week in the stock market to say the least.

Over 260 stocks hit 52-week lows this week…

The market proved as volatile as ever…

And Powell’s speech and the Fed raising interest rates another 75 basis points didn’t help much.

As expected, chaos ensued… And fear took hold. So much fear, the Dow fell all the way back to its pre-pandemic highs.

So, what do we do?

In the words of the late Douglas Adams, brilliant author of The Hitchhiker’s Guide to the Galaxy, “DON’T PANIC!”

This is where many traders fall into the panic trap, selling everything and refusing to buy again until the market rallies and they’re too late to make any real profit.

The RSI (Relative Strength Index) that I mentioned on Monday, finally hit the 30 mark…

Meaning the market is officially oversold.

I’ve been shouting this for weeks, but I’m not here to say I told you so…

Instead, I’m here to share with you 4 rules to surviving this.

Call it, AK’s Guide to Survival… Or something like that.

- Rule 1. Trade Smaller

Too many folks are trading the same way in this market that they were two years ago… And that just isn’t smart. There’s too much volatility and risk right now. Smaller positions sizes allow for less room for error and unpredictability. - Rule 2. Use 50% Stop Losses

I usually don’t use stop losses. Because I know that all you need is one good day for an option to spike into the money and turn profitable. But I’ve adjusted my approach in this environment. Stop losses may be conservative, but they help preserve capital. I’ll be using a 50% stop loss in all of my positions going forward. I suggest you do the same. - Rule 3. I Feel Your PAIN

I feel you, trust me. I’m personally down nearly $100,000 so far this year, but I’m not panicking. I’ve been doing this for too long, seen too much to be fooled like that. The markets are oversold… Now’s the time to buy. But caution is necessary. Following the smart money will always lead to profits. While my personal positions may be down almost $100k, my paid service portfolios are up. The signals don’t lie. When in doubt, trust the scanners, just allocate less capital to protect yourself. - Rule 4. If You Are NOT Bullish, Do Not Make Bullish Trades

I know I run the Trade Room, but this isn’t just the AK show, where my word is gospel and you must follow it or else… No, if you are not bullish a signal or a stock, do not take the trade. Instincts are a part of trading. My recommendations are based on MY instincts. If yours are different, follow them.

Now, before we get to the watchlist recap, I just want to share with you some of the best Trade Room chat messages I received this week.

This just goes to show that no matter how volatile the market is, there is always opportunity to profit if you follow the smart money like we do in the Trade Room.

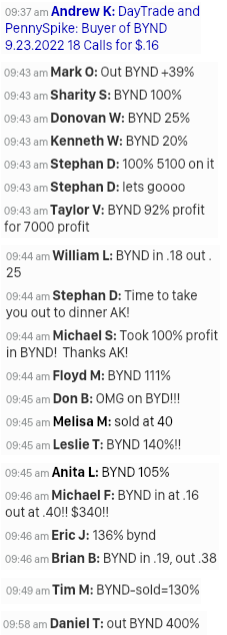

Our best signal came from BYND:

|

As you can see, I called this signal at 9:37, and less than 20 minutes later, members were cashing in triple digit gains… Some as high as 400%!

Fear!? I don’t think so. Not in Trade Kings.

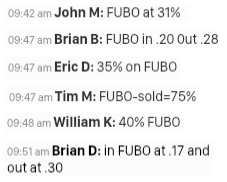

We also had folks make money in FUBO this week:

|

And a handful of other stocks… All with call options:

|

So, again… Don’t Panic. We’re in this together.

Great trading people!

If you’re experiencing fear with the latest market developments, or FOMO in seeing all these gains… you can still sign up for Trade Kings right here. This market clearly isn’t stopping us. Why let it stop you?

One more thing before we get to the watchlist recap…

I just posted this video explaining my plan to fight inflation and discussing how we ended up here in the first place. I even go into detail about how exactly I vet signals that alert me of unusual options flow!

Check out my new video right here!

The Kings Corner Watchlist Recap

With the market getting absolutely crushed this week, the watchlist followed suit.

This was expected when looking at Monday-Friday price charts… A big reason why trading the ups and downs like we do in Trade Kings is much more lucrative…

SI fell 9% from $79.80 to $72.68.

BEKE fell 10% from $17.99 to $16.07.

YUMC fell 7.5% from $49.96 to $46.17.

And SLB fell 11% from $38.88 to $34.44.

Another example of the market as a whole getting crushed but my signals being profitable can be seen in the free trade results from this week:

The idea to buy the SLB October 21, 2022 $46 calls for $0.30 would have worked had you sold at the peak on Wednesday morning, before Powell and the Fed tanked the market.

At the peak, these calls traded up to $0.41, good for a potential 36.6% gain… And that during a week where over 260 stocks hit 52-week lows.

So, the point is, profits are still possible. Just follow the smart money…

Everyone have a restful weekend, and come back on Monday ready to roll.

We’re not finished making money in this market.

Til Monday,

Andrew KeeneEditor, Kings Corner

Andrew KeeneEditor, Kings Corner