In last week’s video, I provided an economist’s perspective on bitcoin.

This week I’m broadening my horizons to look at a few of the hottest “next-generation” coins that could actually soar by providing REAL-WORLD value to investors and the global economy.

Click here to watch this week’s video or click on the image below:

Transcript

Hello, everyone. It’s Ted Bauman here with your weekly Friday video from Big Picture, Big Profits. Last week, I talked about cryptocurrency, specifically bitcoin. Predictably, I had a lot of people pushing back, saying I didn’t know what I was talking about. But here’s a hint. I was playing a bit of devil’s advocate there. Now, I do believe that most people are buying into the crypto market, particularly with bitcoin, without really knowing what they’re doing. And they’re going to lose their shirts. And ultimately, I believe that bitcoin probably faces more headwinds than tailwinds. And if it lasts and becomes what its true believers want it to be, I’ll be surprised. And true, that is partly because of the risk of regulation. Don’t ever underestimate the power of governments to take away things that make you free.

Cryptocurrency’s Unique Advantages?

Now, today, I want to talk about the “what’s for” question, because that’s really the key thing. What’s it all for? What’s it going to do for us that is going to give it value? Now, since the launch of bitcoin 13 years ago, there’s been about 15,000 other crypto assets of some kind or another launched. Most of those that tried to be currencies like Bitcoin have failed, because bitcoin rules the roost on that score. But the ones that have succeeded and gained value, like Ethereum, do something very different. And that’s what I want to talk about today. The problem is that most crypto investors actually don’t know any of this stuff. They just basically put their chips on a bunch of squares on the crypto space and hope they’re going to make money. Now, the funny thing is that this applies to Wall Street as well.

There was an interview on a Bloomberg podcast last week where Sam Bankman-Fried, who’s a big player in the crypto space, said: “Look, most of the Wall Street houses that are investing in crypto are basically doing it without really knowing what they’re doing.” They’ve got FOMO like everybody else. Some guy comes down from the management suite and says to the crypto desk, “Hey, I see people making money on this. Why aren’t we?” And so, the guys go out and buy the crypto. Hope that it’s going to become something worthwhile. And ultimately, they rely on the same thing as everybody else, FOMO. They rely on the fact that other people also want the coin to make its value go up. They don’t really understand what the coin or the asset or the token is going to do for anybody. That’s not sustainable.

There was an interview on a Bloomberg podcast last week where Sam Bankman-Fried, who’s a big player in the crypto space, said: “Look, most of the Wall Street houses that are investing in crypto are basically doing it without really knowing what they’re doing.” They’ve got FOMO like everybody else. Some guy comes down from the management suite and says to the crypto desk, “Hey, I see people making money on this. Why aren’t we?” And so, the guys go out and buy the crypto. Hope that it’s going to become something worthwhile. And ultimately, they rely on the same thing as everybody else, FOMO. They rely on the fact that other people also want the coin to make its value go up. They don’t really understand what the coin or the asset or the token is going to do for anybody. That’s not sustainable.

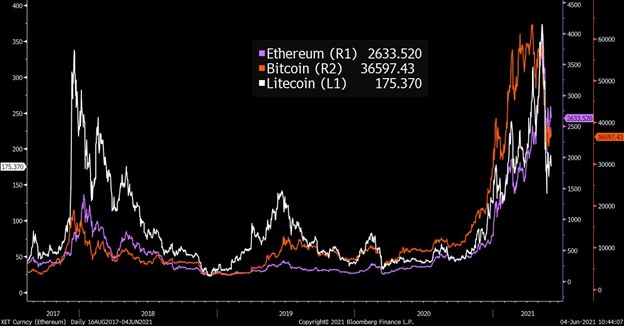

Now, the reason why this is so important is because until we break this tendency for people to see crypto as an undifferentiated space, for people just to see crypto as something that’s hot and big and makes a good alternative to the stock market, then we’re going to continue to see things like this. This is a chart that shows how Ethereum, for example, and bitcoin and litecoin all move up and down together:

Even though their use cases, such as they are, are completely different, there’s no reason why they should be behaving like this. The only reason they are doing that is because most investors don’t understand what they’re investing in. So my goal today is to try to disaggregate this and to try to demystify some of it, and actually to point you in the direction of real sustainable profits from crypto.

Now, to do that, the first thing we want to do is understand a little bit more about bitcoin as a currency and how it differs from some of the other crypto assets that are out there.

Now, bitcoin is what we call a bear asset. Fiat currency is technically a liability of a central bank. Central bank issues money. It’s responsible, theoretically, for making good on that money in the future. That’s why we worry about the stability of central banks. On the other hand, crypto is like gold, or rather bitcoin. If you have it, you have it. You don’t owe anything to anybody else. Nobody owes anything to you. And you can’t lose that value unless, of course, somebody steals it from you or the electricity goes off.

Now, the critical thing here is that this is possible because of bitcoin’s base layer. Now, bitcoin’s base layer, the one that’s so clunky that it can’t really serve as a way of transacting easily, as I explained last week, it may not be able to do that. But one thing it can do is allow you store value in a way that would allow you to transfer that value to somebody else if you really wanted to. It wouldn’t be easy. It might take a long time. It wouldn’t be like buying a pizza or something like that. But, theoretically, it’s robust enough. It’s auditable. It’s censorship resistant. It would allow you to be able to retain value and protect that value from people trying to take it away from you, like, for example, our government. Now, the critical thing is that because of that, it’s not competing with everyday payment networks like Visa or MasterCard. It’s competing with central banks themselves. Instead of trying to be a means of everyday payment, I take the point that Bitcoin is really about the future. It’s about what happens if things get so bad that you can’t really rely on fiat currency, not because of inflation. I don’t think that’s the big issue.

The bigger issue is when governments start doing the kind of things that we’ve seen them do recently like in Canada, when the Canadian government froze the accounts of people participating in the trucker strikes, even though they’d not been convicted of a crime. That’s a really bad thing to do. And in fact, it was a terrible mistake. It probably is going to make people even more keen on Bitcoin and undermine the very things the Canadian government was trying to achieve. Then you’ve got the Russian situation. They would love Bitcoin, because it would help them to get around the problems that they’re facing with their frozen-dollar assets.

The bigger issue is when governments start doing the kind of things that we’ve seen them do recently like in Canada, when the Canadian government froze the accounts of people participating in the trucker strikes, even though they’d not been convicted of a crime. That’s a really bad thing to do. And in fact, it was a terrible mistake. It probably is going to make people even more keen on Bitcoin and undermine the very things the Canadian government was trying to achieve. Then you’ve got the Russian situation. They would love Bitcoin, because it would help them to get around the problems that they’re facing with their frozen-dollar assets.

Bitcoin Is Valued as a Hedge Against Uncertain Future

Now, because of this and the artificial scarcity of bitcoin, people value bitcoin as a hedge against an uncertain future. And the more concerned you are about that uncertain future, the more paranoid you are, the more tin foil hattish you may be. For example, the more you will value Bitcoin and place a premium on it vis-a-vis fiat currencies. The problem is that as that premium rises, Bitcoin becomes even less useful as a currency and more attractive as a speculative asset. And as a result of that, bitcoin really doesn’t perform any current function that you can say generates any value. It’s simply a way of people trying to hedge against an uncertain future.

And just before I move on, remember that bitcoin is not exactly as safe as people think. There’s fraud all over the place. It’s actually less secure than fiat money in the sense that 20% of all Bitcoin tokens ever mined, about 3 to 4 million out of the 18 or so million mined, have actually been lost, because people lost the keys, the crypto keys to their wallets. Imagine that. Imagine how that must feel.

Now, the second thing is it’s actually possible to identify who transacted using bitcoin wallets based on the blockchain itself. You can use metadata to figure out who’s done what. That’s not exactly the anonymity that was promised. However, I take the point that you have to devote a lot of attention, a lot of resources to be able to do that. For example, when the federal government recently identified two people in New York who somehow got their hands on a lot of crypto that had been stolen from exchange some years ago. So that’s just a flying overview of bitcoin. I accept that bitcoin has a potential value as a store of value against an uncertain future, bearing in mind all of its risks. That doesn’t mean that buying it as a speculative asset is a good thing, though. I think there are better ways to use your money.

What About Central Bank Coins?

The second type of crypto asset is central bank digital currencies. I don’t like these. You shouldn’t like them either. Essentially, they turn the bitcoin project on its head. They give governments more control. This is exactly why the Chinese government wants to be able to turn the yuan into a digital currency. They can shut people’s money on or off at will. They can impose a negative interest rate on money to force them to spend it. They can do all kinds of things to interfere with your life and your economic and financial activities. We don’t want that. So I’m very much opposed to central bank digital currencies. However, I think they’re probably going to happen anyway, precisely because governments like power.

Private Blockchain Tokens

The third form of crypto asset is private blockchain tokens. That’s where the action is. That’s where the value is. That’s what I’m going to be talking about today. Now, in order to understand that we need to start asking ourselves what I call the what’s-it-all-for question. Now, the best way to understand crypto tokens as opposed to bitcoin and other cryptocurrencies is to think about Chuck E. Cheese.

Chuck E. Cheese is also a system that issues tokens. Those tokens are redeemable for goods and services. Within the Chuck E. Cheese ecosystem, you can play video games, you can play pinball, you can play ski ball, whatever you want.

Chuck E. Cheese is also a system that issues tokens. Those tokens are redeemable for goods and services. Within the Chuck E. Cheese ecosystem, you can play video games, you can play pinball, you can play ski ball, whatever you want.

Now, within the Ethereum system, for example, the Ethereum token is redeemable for space on a network of computers that run applications on top of its blockchain. In other words, all those decentralized computers that are performing all the calculations that make Ethereum work can also do other things. So in that way, Ethereum is like a Chuck E. Cheese of distributed computing. And in the end, these applications that run on top of the Ethereum blockchain are like games at Chuck E. Cheese. The key thing is that if people find these applications useful and want to access them, there will be a demand for Ethereum that goes beyond just speculation. People will be paying for a useful thing. And the more useful it gets, the more they’ll be willing to pay for it.

Now, within the Ethereum system, for example, the Ethereum token is redeemable for space on a network of computers that run applications on top of its blockchain. In other words, all those decentralized computers that are performing all the calculations that make Ethereum work can also do other things. So in that way, Ethereum is like a Chuck E. Cheese of distributed computing. And in the end, these applications that run on top of the Ethereum blockchain are like games at Chuck E. Cheese. The key thing is that if people find these applications useful and want to access them, there will be a demand for Ethereum that goes beyond just speculation. People will be paying for a useful thing. And the more useful it gets, the more they’ll be willing to pay for it.

The Crucial Difference Between Currency and Token

Now, here’s the first critical point. When you move from being a currency to being a token in this way, the necessity of pure belief and faith decreases. You need pure faith to believe that Bitcoin has value, because it doesn’t have a use case other than a hedge against an uncertain future. For bitcoin to have value, you and everyone else in the system has to accept that it has value. Either you believe that or you don’t. If you stop believing it, if everybody stops believing it, the value dissipates and you’ve got nothing. With a token on the other hand, there’s less faith involved.

If someone hands you a hundred dollars’ worth of Chuck E. Cheese tokens, for example, you may not want them. But you do know that if you go to a Chuck E. Cheese, you’ll be able to use them to play the games there. If you like Chuck E. Cheese games, they’ll be valuable to you. If not, you can sell them to somebody who does. So, you don’t have to subscribe to any Chuck E. Cheese ideology to get either value, use value, or exchange value from them. In other words, tokens that are built on the basis of something like the Ethereum network that provide real things that real people want, can increase the value of Ethereum tokens independently of speculation and belief.

Tokens Can Deliver Real-World Value

Now, here’s the next critical point. With crypto tokens, you may not need faith, but you still need a point. When you buy crypto tokens, you should be doing so in the expectation that the system that those tokens operates will produce real-world value beyond just speculation and blind faith. So, how’s that happening in the current world? And how can you use that as a guide to identify which crypto tokens you should be investing in? Well, there are a couple of different ways people are using them. The one that most people have probably heard about, the least useful, one is non-fungible tokens or NFTs. These are blockchain-based tokens that prove ownership of a digital asset, usually some form of artwork, like a bored ape, for some God unknown reason why people are into that.

Now, although the digital art itself can be duplicated endlessly, like any digital thing, the NFT is supposed to prove that the person who owns that digital token is the ultimate owner of the code. So far, this has turned out to be a pure vanity market, which actually seems to be collapsing. The guy who bought the NFT that associated with Jack Dorsey’s very first tweet on Twitter recently tried to sell it for multiple millions and didn’t get really any offers at all. So that seems to be a dead end.

The second potential use of these tokenized, blockchain-based tokens, or crypto, is decentralized autonomous organizations or DAOs. Now, DAOs are networks of people who hold a specific crypto token. The idea is that the network is governed by the smart contracts that are embedded in the blockchain code rather than by individual leaders within the organization. Holding the token entitles each holder to vote on how the network should be used based on how many tokens they have. So if you have a lot of tokens in your DAO, you have a lot of influence over what it can do. And so what ends up happening is that people create potential platforms that they can use for the DAO.

Now, there’s been a lot of problems in this space. The video that I mentioned last week on YouTube that deconstructs this whole space shows why it is becoming just as problematic as many other unequal systems. Basically, it ends up with people essentially having to put more money into the systems to make them work. They become like Ponzi schemes. But the idea of a decentralized autonomous organization is something that grows out of a non-currency crypto token. So that is something that potentially has use.

The third use is what’s called decentralized finance or DeFi. These involve specialized tokens that are used to finance other activities like acquiring Bitcoin or Ethereum or something like that. You buy the tokens because you can stake them in a liquidity pool and collect trading fees from other participants. Or you can lend them to other people in return for yield. This is called yield farming. You can post them as collateral, in order to borrow more of the coins and do more of this.

The idea is that this will disrupt traditional finance and eventually whatever DeFi system becomes the best one that most people use, will become a defacto form of borrowing and lending that will displace bank borrowing and lending. So far, the main use of this has just been speculation on more coins. The people who tend to buy into these systems are really doing it because they want to go long on more of the coins, not because there’s an actual use case demonstrating value in the real world yet. However, it is possible that it could do so.

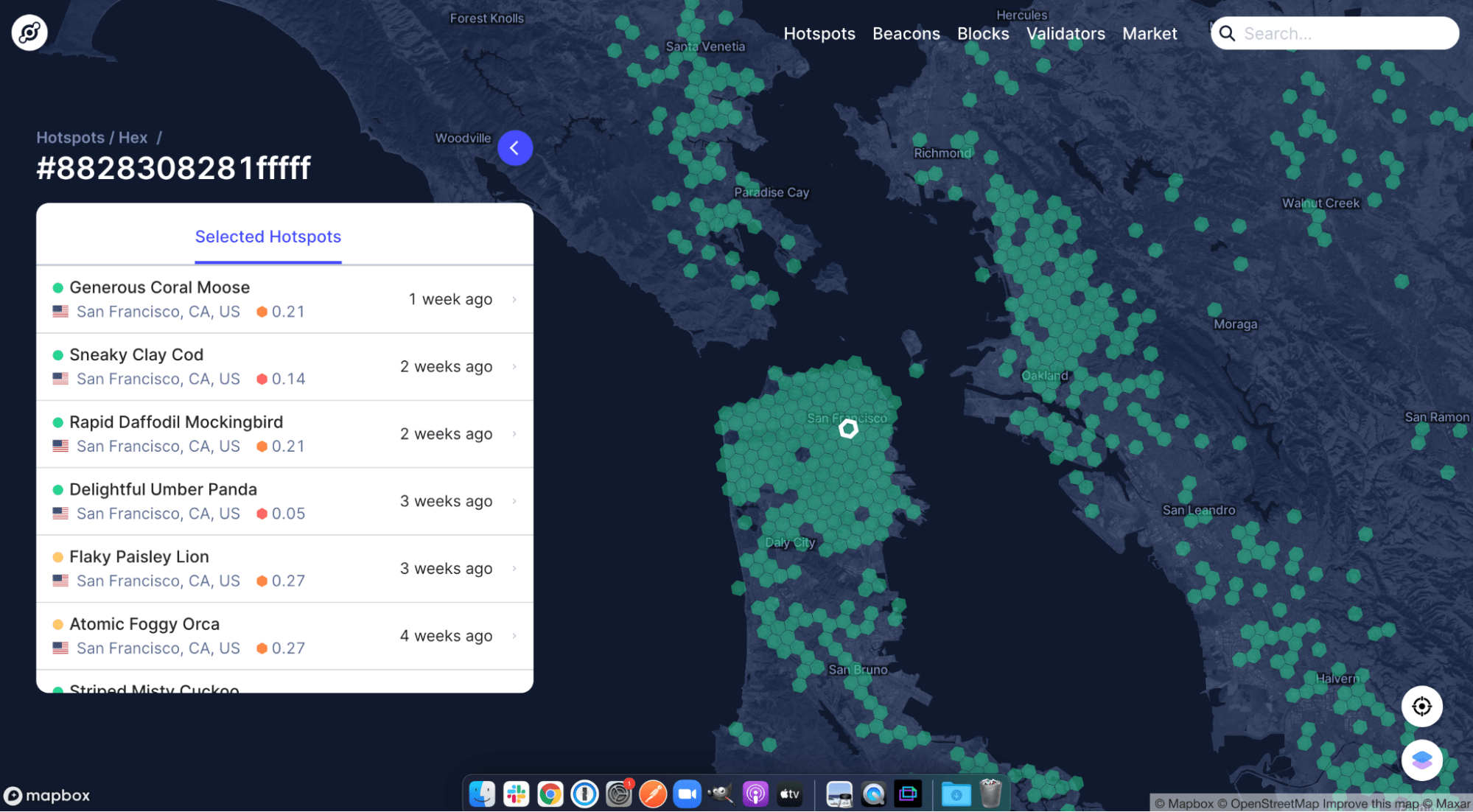

The last form, the one that is probably the most valuable and that has the most legs on it is digital services used through blockchain. Now, for example, there’s a decentralized distributed 5G wireless network called Helium that depends on people setting up Helium nodes that act like wireless nodes around your home.

So for example, if you set up a Helium base station that can act like a mini cell phone tower, other people can access a wireless network without having to go through Comcast or AT&T or anybody else like that. Now, in exchange for running this wireless node, you will earn HTNs, which are the tokens that go into the Helium network.

Now, all of this means that something is being created that people will have a real use case for, a real value. And that if you get in early and if you stick in there and if the thing develops into what it’s supposed to be, you won’t be earning a return because of pure speculation in faith. You’ll be earning a return, because the question of what’s it for has been answered in a useful way. Now, my basic take towards crypto is that this is the key question.

The Difference Between Speculation and Investment

And that means that if you’re going to invest in crypto, you need to understand the difference between speculation and faith and real probable future use value that can actually generate returns because they create real value for real people.

Now, the best way to do that is to have somebody guide you. And I’m going to do something I rarely do, and that’s say, don’t follow me because of that. Have a look at my colleague, Ian King. There is a link in the description below this video that will give you access to his most recent product, which is designed explicitly to help you navigate through this world, to avoid the pitfalls that I talked about last week, to avoid the kind of stuff that’s just speculative. And to actually help you identify the tokens that potentially have real value in the future, because they do real things, because they do things like create 5G networks that might work, that might actually end our slavery to Comcast, for example. Or decentralized finance that ends our dependency on banks and actually means that we start earning interest on loans rather than Wall Street. All these things can happen.

But the only way to get to the ones that are really going to deliver value is by depending on somebody like Ian. And so, I strongly recommend that you click on his link and go and have a look at his service. Now, at the end of the day, I hope I’ve answered the question as to whether I am just an aging boomer who doesn’t know what I’m talking about. I do think that crypto is an important invention. However, I tend to be on the skeptical side for all the reasons that I have mentioned. I believe that if you want to buy bitcoin, you should understand that the main reason to do it is as a hedge against an uncertain future. And not because its price is just going to go up always. That is a bad reason to buy anything, as we’ve seen from the stock market recently.

But there is a way to make decent, good money because it produces real value in the real world, from the crypto space if you know what you’re doing. And if you want to learn quickly, follow my friend, Ian King. Discover why the Ian King next gen coin is at the center of this explosive crypto trend and what it could mean for the future of digital assets.

This is Ted Bauman signing off. I’ll talk to you again next week.

Kind regards,

Ted Bauman

Editor, The Bauman Letter