My in-laws are looking to retire to Florida.

They’ve lived in Boise, Idaho, for the last four decades and are ready to trade their mittens and snow shovels for flip-flops and T-shirts.

I’ve been scouring Zillow listings at night and talking to local real estate brokers about a potential destination for them.

One thing is certain: The Florida real estate market is as red-hot as ever. According to one real estate broker, the supply of homes for sale is running at 50% the normal rate.

This shouldn’t be a surprise. Mortgage rates are at record lows. The 30-year fixed rate is at 2.75%.

And Florida is not only a destination for retirees but also for the new swarm of employees permanently working from home.

It’s not just Florida. The housing boom is happening all across the country.

In January, U.S. new home sales were up 23.7% over January 2020’s total. And that was before the pandemic.

What I think we are seeing is that real estate buyers assume interest rates won’t stay this low forever, which is why everyone is rushing out to buy a new home and lock in a low rate.

And today, I want to highlight a way to invest on a potential jump in interest rates in 2021.

Low Rates Lead to Higher Rates

March 9, 2020, was one of the most uncertain days in human history.

The coronavirus was spreading rapidly through Europe, and countries had begun issuing mandatory lockdowns.

While the U.S. only reported 259 cases that day, it was evident that we’d soon start seeing the same impact.

The Dow Jones Industrial Average had its worst day since 2008, tumbling over 2,000 points. Financial pundits were claiming we could be on the verge of another Great Depression.

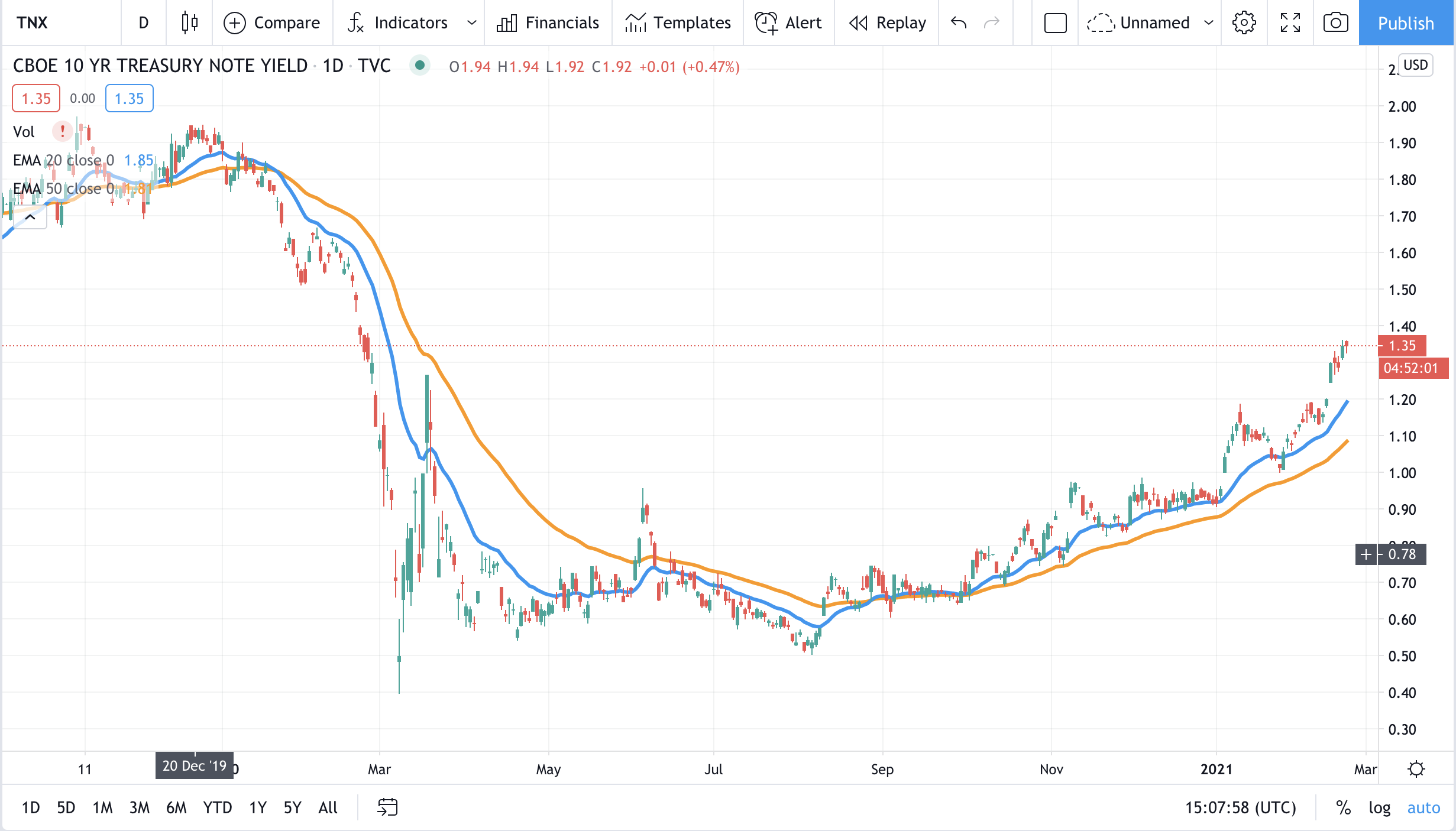

But the biggest news of that day was that the U.S. 10-year bond touched a record low of 0.32%.

That marked a 100 basis point drop in less than three weeks. It was also the lowest yield in 234 years.

Investors were fleeing risky assets, such as stocks and commodities, and buying the safest asset in the world: the U.S. 10-year bond.

The Federal Reserve sprang to action, announcing support for all financial markets and restarting its bond-buying program, also known as quantitative easing, or QE.

At the time, I wrote that the Fed’s actions were going to lead to the “mother of all bubbles.”

The government opened its coffers and signed the $2.2 trillion CARES Act, which was enough to stabilize the markets and prevent a total economic collapse.

Economic Growth Is Coming Back

So here we are, nearly a year later.

The pandemic has largely run its course. Vaccines are being deployed faster than the virus is spreading.

The stock market is 76% higher, and the real estate market is as strong as it’s been in over a decade.

Economic growth is coming back. With all this stimulus, a roaring stock market and expected herd immunity, the second half of this year could see the strongest economic growth in decades.

The most bullish Wall Street forecasts see the economy expanding by 7% to 8% in the second half of the year.

And that leaves us with the bond market.

Yields are climbing this year. The U.S. 10-year yield climbed 15 basis points last week and is now at 1.34%.

The prospect of strong economic growth means that 10-year rates should keep climbing toward 2%.

For investors worried that a 2% 10-year interest rate would choke off current demand for stocks, let me remind you that the 10-year yield in 1999 was 5.65%.

1 ETF for Higher Yields

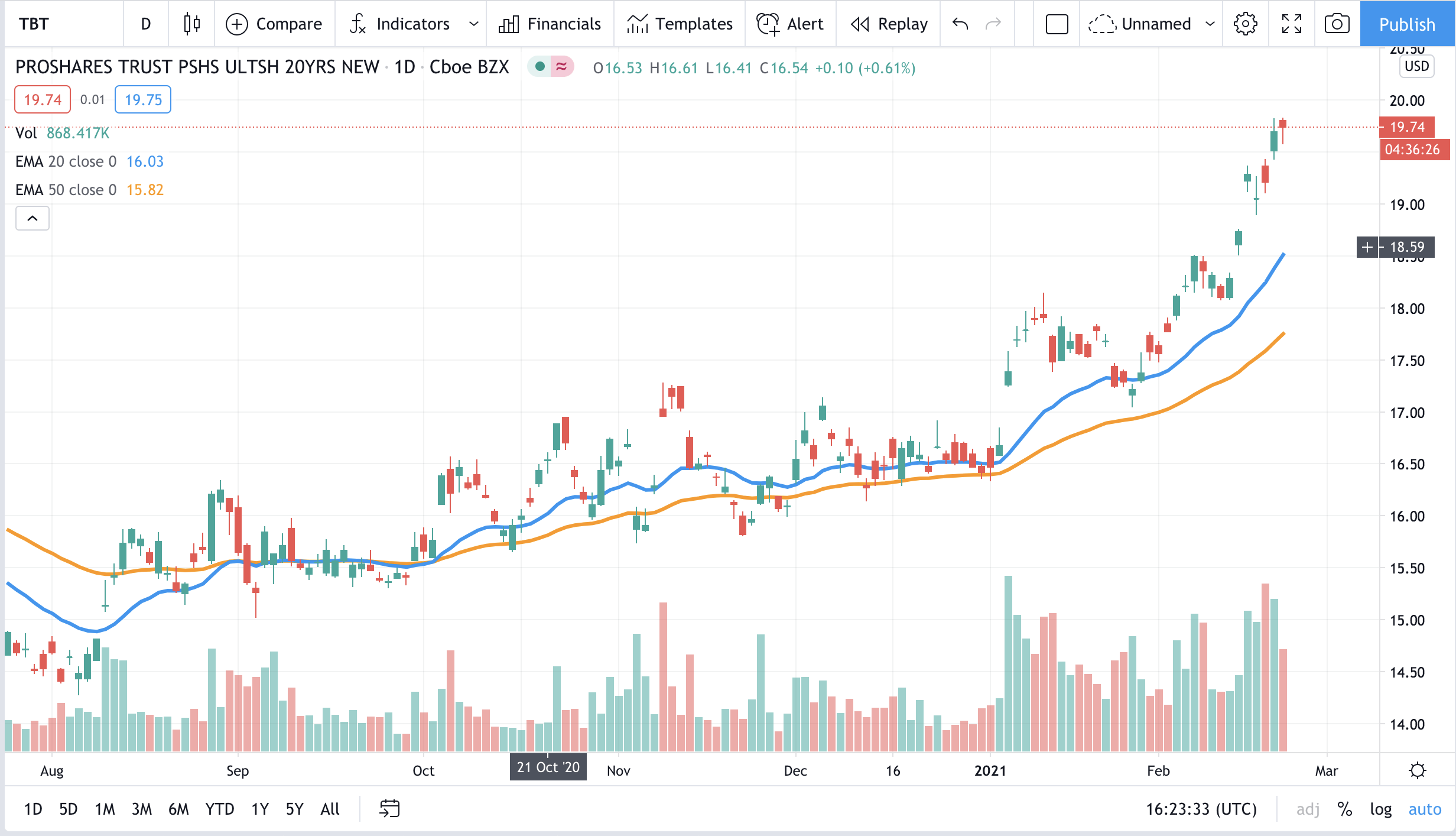

So here’s the play: Buy the ProShares UltraShort 20+ Year Treasury ETF (NYSE: TBT) as a bet on higher interest rates.

This exchange-traded fund provides two times inverse exposure to the ICE U.S. Treasury 20+ Year Bond Index, which tracks the performance of U.S. government bonds with remaining maturities greater than 20 years.

Put simply: When bond yields go up, prices go down, and TBT goes up at two times the rate of the price drop.

In order to accurately track bond moves, TBT uses a combination of swaps and futures to reset daily.

This is a great tool to hedge portfolios against rising interest rates. If rates rise sharply, so will the price of TBT.

TBT has a 0.92% expense ratio and currently has $484 million in assets under management.

Over the last three months the fund has had an average volume of 1.5 million shares per day, which suggests it is relatively liquid and easy to get in and out of.

Since inception in 2008, TBT has exhibited a strong monthly correlation (0.97) with the U.S. 30-year bond rate, reinforcing its ability to accurately track bond yields.

If you’re expecting higher interest rates this year on surging economic growth, this could be your best bet.

Regards,

Editor, Automatic Fortunes