No doubt, the pandemic’s impact on the economy and stocks has been uneven.

Some stocks have done well, while others have hit bankruptcy. And as far as we know, we may still not be feeling the full effects of an economic shutdown.

We’re keeping our eyes open.

And today, we’re seeing that investors’ favorite recovery darlings had a terrible, horrible, no good, very bad day on Monday.

Investors love the Nasdaq-100 Index, a group of the biggest 100 stocks listed on the Nasdaq stock exchange, because 45% of the index is made up of technology and 20% of communications stocks. These sectors represent the digital economy where companies were better insulated from pandemic-lockdown pressures. In some cases, the shift in economic behavior actually helped these darlings.

Some days are like that.

We’re looking at Monday’s trading session because of how it unfolded … and Mondays are influential in determining short-term forecasts.

It was a bearish engulfing pattern day for the Nasdaq-100 Index. A bearish engulfing day is a day where the index falls from open to close more than it moved the entire previous day’s trading range.

My Chart of the Week shows us a bearish engulfing day could mean little for these recovery darlings … or it could mean a big sell-off is coming:

This is a daily candlestick chart. Each candle, or bar, represents one trading day.

Candles are blue when the close price is above the open price. Candles are red when the close is below the open.

On Monday, the index of Nasdaq-100 stocks opened above Friday’s high and ripped to new highs.

Then everything changed.

The index stopped rising and started falling.

It erased its gains and fell below Friday’s close. And kept falling.

The index closed below Friday’s low.

The reversal from high to low makes it a key day reversal bar. That means the bulls were in control, but they lost control and the bears finished the day with control.

A reversal suggests further selling is to come.

But Monday’s session tells us even more than that.

The reversal was significant because it was also a bearish engulfing day.

As we showed you above, the body — the red part — of Monday’s candle engulfed Friday’s entire candle. Monday opened above Friday’s high and closed below Friday’s low.

I’ve noted in the recent days that we’ve seen this with red arrows on the above chart.

Bearish candles haven’t produced much follow-through selling during the market’s rebound. The bulls keep regaining control.

But if you take a look, you’ll see a bearish engulfing reversal bar happened right before the major sell-off we saw in February.

We can’t guarantee whether this will be another case of the stock market brushing it off … or a crushing correction.

We need to be open to the potential of a move that drops the Nasdaq by 12% or more.

But we’re not just basing that on this candlestick chart. Take a look at the chart below.

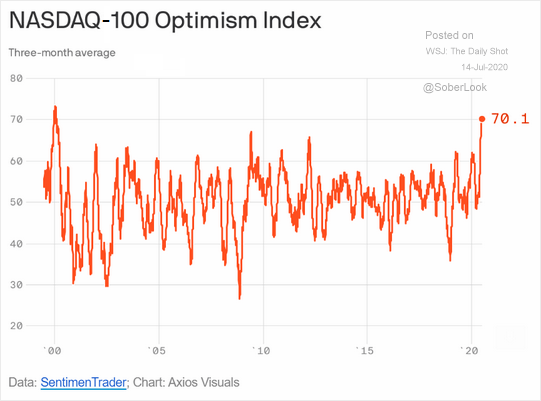

Investors Are Too Optimistic

This chart shows the three-month moving average of sentiment for the Nasdaq-100 index:

I know this chart looks busy, but bear with me.

This tells us the level of Nasdaq-100 investors’ optimism, and it gives us context for Monday’s price action.

We haven’t seen optimism like this since the tech bubble in 2000 — the left side of the chart. Extremes like this tend to correspond closely with tops and bottoms.

Sure, one bad day isn’t going to derail a bull market.

But one bad day could set off a string of bad days in a market and that is extremely optimistic.

Selling continued early on Tuesday, but then reversed. Nasdaq-100 futures closed a bit higher. That was the market’s way of shaking out the weak-handed traders who jumped on the signal from Monday’s bearish engulfing candle.

Here at Winning Investor Daily, we’re committed to bringing you the best research from our analysts. We don’t work for Wall Street, so we don’t have a stake in the status quo. We aren’t sitting and hoping for a recovery, we’re doing deep dives on the market and bringing you our best advice.

Today, our advice is to be watchful.

Consider tightening up short-term exposure to all stocks until we can be sure that investors aren’t dwelling on Monday’s bearish engulfing reversal.

In the meantime, we’ll be updating you on the latest moves.

Good investing,

Editor, Apex Profit Alert