I reached out to my good friend Cactus yesterday. He’s an independent oil producer in Abilene, Texas. That’s the epicenter for U.S. oil.

I try to spend a week or two out there every year to keep my finger on the pulse of West Texas.

The latest collapse in oil price and demand will hit Cactus and his industry hard. After the usual catching up about family and ranch conditions, we jumped into the oil business. Specifically, Chesapeake Energy Corp. (NYSE: CHK).

“Everything they do is wrong” were Cactus’ first words.

Chesapeake used to be a world leader in natural gas fracking. In 2012, it was the second largest natural gas producer in the U.S. It led the charge in many of the U.S. shale gas plays in Pennsylvania, Ohio and Texas.

It overspent constantly. It paid huge premiums to lease land. And it leased tons of land, based off of high expectations.

Then, natural gas prices collapsed. They fell from over $8 per thousand cubic feet (MCF) in February 2014 to $1.49 per MCF in March 2016. It was awful for natural gas producers.

The company tried to pivot to oil, but it was a disaster.

Chesapeake racked up massive debts, over $13 billion in 2013. But back then, it had the revenue ($18.8 billion in 2013) to support it … for a while anyway.

The problem was, the company never generated any free cash flow. As longtime readers of Real Wealth Strategist know, we love companies with free cash flows.

Positive free cash flow means that the company has made more money than it needs for the year. In other words, it is profitable. That cash can go to paying down debt, paying shareholders or stashed in the bank against a rainy day.

Chesapeake was never profitable. From 2013 to 2019, Chesapeake’s free cash flows were negative $12.5 billion. More importantly, it never had a year that had profitable free cash flow. Not one.

And its share price reflected that. The company did a 1-to-200 reverse split on April 13. That means every 200 shares of Chesapeake that you had became one new share. It did that to meet the stock exchange’s listing requirement.

The New York Stock Exchange requires at least a $1 per share. If the price falls below that, the exchange will ask that a company do a reverse split, like Chesapeake had to do.

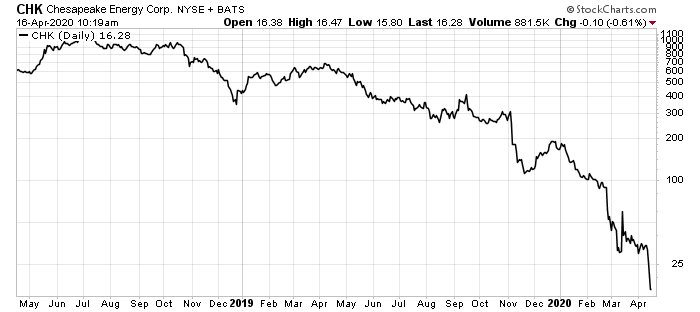

Normally, a stock roll-up like that isn’t terrible. You aren’t losing any value … theoretically. But in Chesapeake’s case, the share price collapsed like a popped balloon. Just look at this chart:

CHK: Share Price Collapsed Like a Popped Balloon

The split-adjusted share price fell from $200 in January 2020 to $16.28 today. That’s a decline of 92% in four months. That’s a total loss. And it could fall further. It wouldn’t surprise me at all to see Chesapeake file for bankruptcy soon.

That’s a huge blow for the former No. 2 gas producer in the U.S. And Cactus thinks this downturn will claim many more former rock star shale companies.

Producers Flee Natural Gas

After the crash in natural gas, most shale companies pivoted to oil. It was an expensive move that didn’t pay off for many of them.

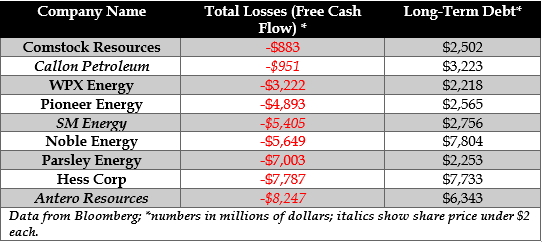

That led me to my latest research question … which other shale companies haven’t had a profitable year since 2013?

Here’s a partial list:

The italicized companies are in the same boat as Chesapeake. If share prices are too low, they will have to do reverse splits at some point.

As you can see, these companies dumped a lot of capital into the ground. The total amount lost was $44 billion. Most of that came from loans. These companies owe $38 billion in long-term debt to banks. The combination of low oil prices, a poor track record of performance and a massive debt spells bankruptcies galore.

As I said, this is only a partial list of the higher-profile oil explorers. It’s going to get uglier in the oil patch. Do not go bargain hunting now.

There will be a time to invest in oil. And a couple of specific stocks will soar. It’s coming soon.

The risk will be high, but the reward will be incredible. There will be the potential to double or triple your investment. And I’ll let you know when it’s time.

Good investing,

Editor, Real Wealth Strategist