The U.S. government and Federal Reserve are dumping trillions of dollars into the economy.

It’s a crazy amount of safety-net money. And it may end up being too much.

Too much money chasing on too few goods is a recipe for inflation. That means everything ends up costing more.

That’s why gold is set to skyrocket.

But let’s not get locked in for takeoff yet.

Two important indicators are telling me that not everyone is ready to bet on gold right now. We’re going to see gold get a bit cheaper. And if we time it right, we can see even bigger gains:

The last time we saw this setup, gold fell 25%.

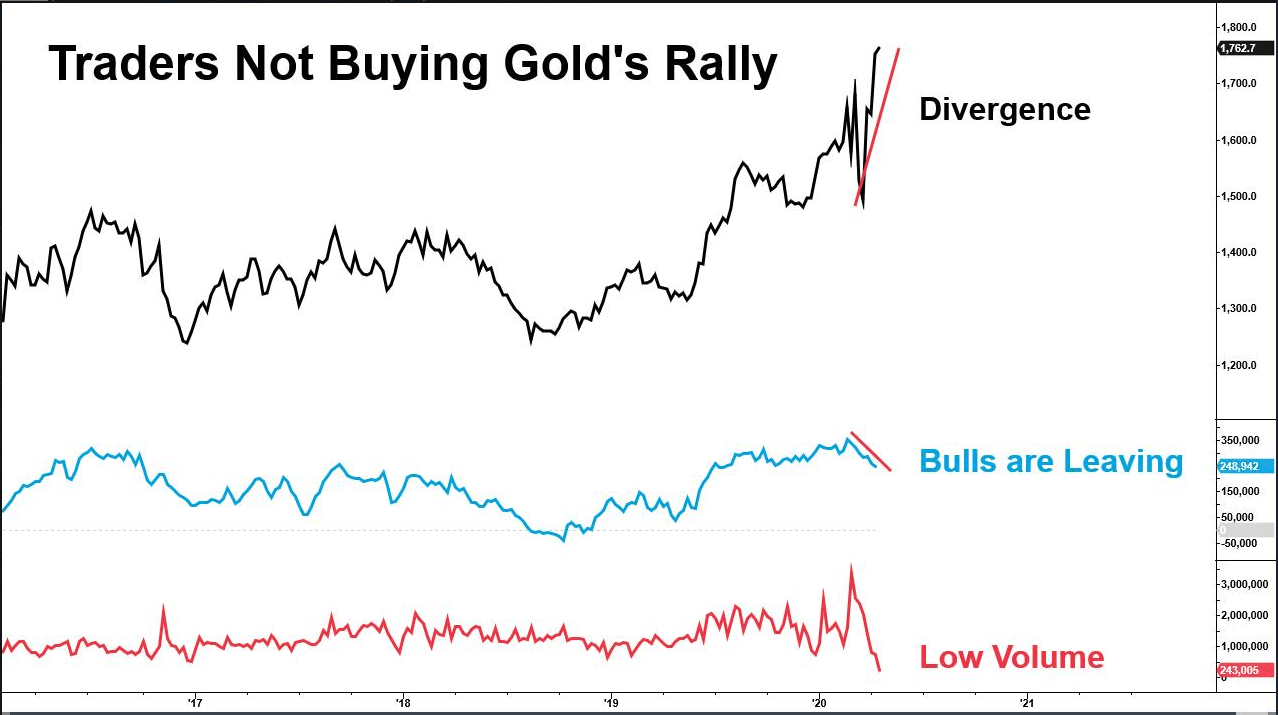

This Bearish Divergence Spells Trouble

The black line is the price of gold.

The blue line is speculators’ bullishness in the gold market. This group includes hedge funds and money managers.

The red line is the volume of trading in the gold market.

What I want you to see is that the price is going up while speculators and volume are falling. This is called a bearish divergence.

It tells me there is a lack of participation in gold’s rally.

Bullish traders are losing conviction.

That’s a problem because the price of gold just made a new seven-year high. There should be plenty of willingness to buy into this strength.

But there’s not.

Without new buyers, gold’s uptrend will roll over.

We could see a 10% to 20% decline in the months ahead.

Want to Buy Gold? Be Patient

You can also check out my video on why investors should wait on gold a bit longer:

Today’s bailout and stimulus money is laying the groundwork that will launch gold into orbit again.

But I caution you against buying into that view too soon.

Governments and central banks deployed money to undo the 2008 financial crisis. That fueled gold’s bull market until 2011.

But the price of gold fell 25% from peak to trough in 2008 after the Fed initiated extraordinary policy and before that bull market began.

Same as today, bulls became disinterested just before that decline in 2008.

Now, I’m not telling you to go sell your physical gold. That serves a different purpose, and that’s fine.

But if you’re looking to trade gold or gold mining stocks — or add to your physical holdings — wait to see if gold can hold above $1,700 per ounce.

I bet it won’t.

If gold can’t hold that level, wait to buy at key support levels near $1,560, $1,500 and $1,450.

Then watch it soar to $2,400 an ounce!

Good investing,

Editor, Apex Profit Alert