Above All … Don’t Panic

I have to level with you.

Making jokes and finding a positive spin on the market after this weekend isn’t fun.

My heart breaks for the people in El Paso, Texas, and Dayton, Ohio. I live less than an hour from Dayton. I know some of the families affected.

To say that it wasn’t an easy weekend … that’s an understatement.

To make matters worse, we have a massive pullback in the market to deal with. The Dow, S&P 500 and Nasdaq are all down more than 2% today.

The reason? U.S.-China trade relations.

The trade war escalated again over the weekend when China allowed the yuan to drop further against the U.S. dollar. Economists see this as retaliation for the fresh 10% tariffs placed on Chinese imports to the U.S. The yuan to USD now at 0.14 cents.

In laymen’s terms, the price of imported goods from China just went down due to the yuan’s drop, effectively nullifying the new 10% tariffs.

U.S. consumers might not notice the impact, but U.S. exporters will. A weaker yuan means a stronger dollar. And that means higher prices for exported U.S. goods such as machinery, soybeans, corn, planes — you name it.

The stock market also doesn’t like uncertainty. That’s the real rub here. The new tariffs and China’s willingness to allow the yuan to drop bring a new level of uncertainty to the market. And that breeds fear.

Fear is one thing we don’t need more of right now.

The Takeaway:

I struggled with a takeaway today until I realized you don’t read Great Stuff for answers. You read Great Stuff for investing advice and entertainment.

The best advice I can give right now is to have compassion for your fellow man and to exercise caution in your investing.

Even though the market is down nearly 3% across the board, knee-jerk fear reactions will cost you. (That goes for pretty much everything in life.)

Hold on to investments and stock in companies you know are solid for the long term — companies with a vision for the future and a solid business plan. Cut back on speculation and take some profits off the table so you can reinvest that capital later.

Above all, find a voice in this cacophony that you can trust. Great Stuff and the rest of the staff and experts here at Banyan Hill always have your best interests at heart.

If you’re looking for a place to start preparing for a worsening market outlook, Banyan Hill expert Ted Bauman’s years of experience in wealth and retirement preservation are an excellent choice. Click here to get started now.

Above all, don’t panic, and stay safe out there.

Good: Bitcoin > Gold

It was hard finding positive market news today. But Great Stuff has come through with a few shining tidbits of happy to brighten up your day.

First up, bitcoin (BTC) continues in its role as the real hedge against a market drop. The leading cryptocurrency is up more than 7% today as investors flee stocks for safe-haven investments.

Historically, this safe-haven role has been played by gold. But the malleable metal is no longer in fashion with the current crop of investors. Case in point: Gold is up only about 1% today.

Bitcoin is the new hotness when dealing with trade wars and global uncertainty.

Looking to grab your own stash of cryptocurrency but don’t know where to start? Banyan Hill expert Ian King has you covered. Click here to grab your own crypto stash!

Better: Tyson’s Chicken Dance

Despite all the market hype surrounding Beyond Meat and Impossible Foods, meat — real meat — is still going strong. Just ask Tyson Foods Inc. (NYSE: TSN), resident king of chickens and purveyor of Jimmy Dean sausage, Ball Park Franks and Hillshire Farm products.

Tyson reported impressive earnings growth in the third quarter, with earnings arriving at $1.84 per share, beating Wall Street’s expectations.

Revenue was a little lighter than expected, rising to $10.89 billion versus the consensus target of $11.04 billion — but investors are in a forgiving mood in today’s market bloodbath.

The company maintained its full-year guidance but indicated that rising demand could be in the cards due to African swine fever outbreaks.

“Given the magnitude of the losses in China’s hog and pork supplies, the impending impact on global protein supply and demand fundamentals is likely to be a multi-year event,” CEO Noel White told investors.

TSN shares gained more than 8% today.

Best: Appetite for Reduction

This biotech’s surge today will make your stomach churn … or stop churning, actually. Allakos Inc.’s (Nasdaq: ALLK) leading drug candidate, AK002, promises to treat patients with eosinophilic gastritis.

Easy for you to say.

This rare disease involves a patient’s white blood cells causing injury and inflammation to the stomach. Allakos’ AK002 just met its primary endpoint in a phase 2 clinical trial, with a 95% reduction in eosinophils.

In other words, AK002 works.

It works so well that investors sent ALLK shares skyrocketing nearly 120% today.

With the market in turmoil, you might be wondering what the super rich are doing with their money. (Or you might not, whatever…)

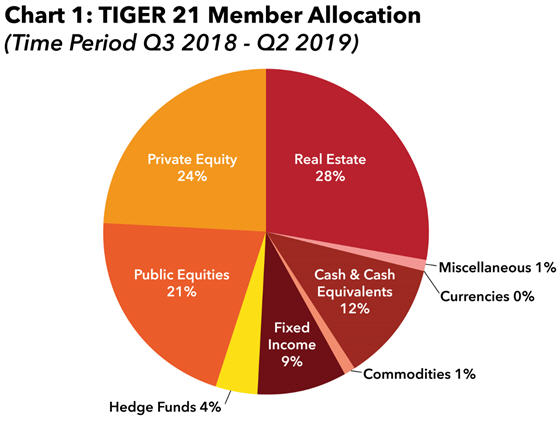

According to Tiger 21 President Michael Sonnenfeldt, the market is “priced to perfection and rising economic inequality, leading to greater polarization in America and elsewhere.”

Tiger 21 is a group of 750 investors with a total net worth of more than $75 billion. This group is now holding cash reserves at levels not seen since 2013. Real estate remains their primary investment, but commodities are starting to make a comeback. According to Tiger 21, that cash is being moved out of private and public equities.

It’s a cautious stance reinforced by today’s market sell-off.

Great Stuff: OK Computer

Is it just me, or are computers getting a bit uppity lately?

They’re taking over our jobs, beating chess grandmasters and living unfettered lives in our pockets … shut up Siri, no one asked you!

Now, they’re claiming to beat the market with an artificial intelligence-driven exchange-traded fund (ETF).

The AI Powered Equity ETF (NYSE: AIEQ) by EquBot is the newest entry by computers into the stock market. It’s powered by IBM Watson, the same computer that beat Jeopardy! star Ken Jennings.

So far this year, AIEQ is beating the market. It’s up about 15% compared to the S&P 500’s gain of 13.5% — including today’s losses.

“The idea is to recognize patterns across management teams, across financial statements, across news [and] things like social media, to identify trends that are occurring in the marketplace and to capture the companies that are going to appreciate the most over the next six to 12 months,” says EquBot COO Art Amador.

A 15% return? That’s cute.

Year to date, Banyan Hill expert Paul and his subscribers are beating the market and putting AI to shame.

Just look at these returns:

- Profits Unlimited — Up 21.9%!

- True Momentum — Up 31.48%!

- Extreme Fortunes — Up 36.73%!

Watson may have beaten Ken Jennings, but it has nothing on Paul .

You can find out more about Paul’s services by clicking the links above.

Before I go, here’s a quick reminder that you can view all the back issues of Great Stuff on the web. Visit now, it could brighten up your day!

Finally, don’t forget to write in to GreatStuffToday@banyanhill.com. I love reading your email. And who knows, you might end up in this week’s edition of Reader Feedback!

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing