I stared at the words on the screen…

“My favorite ‘safe’ stocks don’t feel cheap, and my favorite ‘cheap’ stocks don’t feel safe,” wrote the hedge fund manager.

“Hence, my decision to shut down.”

And with that statement, hedge fund value investor, Whitney Tilson, told his investors recently that he was closing up shop. He’ll return their $50 million and head for the locker room.

And why not? America’s legion of passive investors are about as bullish as can be…

Maximum Bull

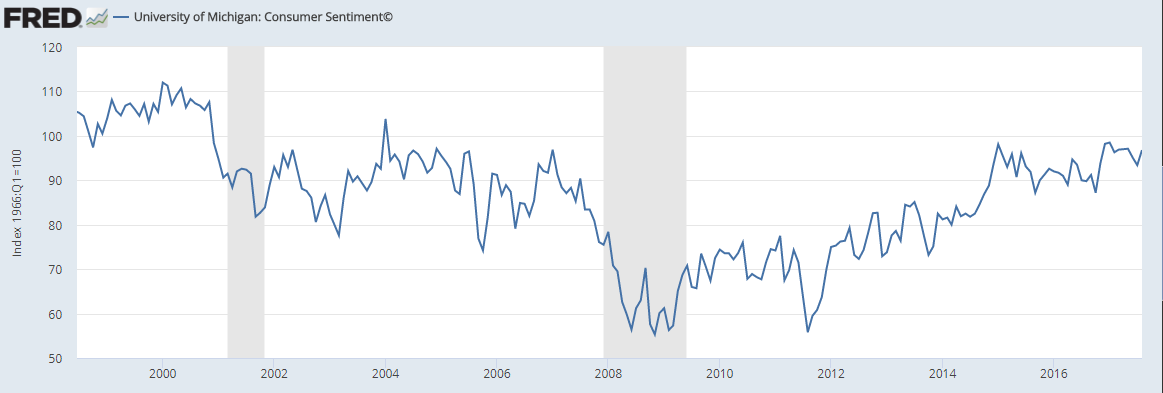

Last week’s University of Michigan consumer sentiment survey had an interesting statistic. A whopping 65% of everyone who took part in the survey said they believed stock prices will go up in the next year. And overall consumer sentiment continues to be perched at 10-year highs:

That 65% level just happens to be the highest level of bullishness among small, regular, everyday Main Street investors ever recorded.

I’ve often said that “Wall Street reserves the right to yank the carpet out from underneath us,” when it comes to bull markets. It usually happens when regular investors least expect it.

That’s why Tilson’s decision to leave the hedge fund game strikes a resonant note with me.

I remember late 1999 and early 2000. It felt very much like now: a bulletproof, “no fear” environment where all one had to do was stay invested and everything would work out just fine.

The Dot-Com Craze

Value investors were out of favor back then too.

Warren Buffett’s a financial god now. But for 10 months straight in 1999 and early 2000, investors were selling their shares of Berkshire Hathaway hand over fist.

From high to low, Berkshire Hathaway shares fell 42%!

I was at that year’s annual shareholder meeting in Omaha, Nebraska. Buffett was as calm and avuncular as ever. He recognized it for what it was — a time of irrationality when good assets were being thrown away on the cheap.

As crazy as it sounds to say now, the dot-com craze made Buffett’s company feel old and out of step with the times. And so investors sold.

An Irrational Market

Another famous value investor of the era — Julian Robertson and his $6 billion Tiger hedge fund — called it quits.

Here’s what Robertson wrote to his investors back then: “In an irrational market where earnings and price considerations take a back seat to mouse clicks and momentum, such logic does not count for much.”

Ironically, Robertson closed his fund in March 2000 … the same time that the Nasdaq hit a peak that wouldn’t be seen again for almost 15 years.

Which brings us back to today. Because it looks like we’re primed and ready for it to happen once again.

Kind regards,

Jeff L. Yastine

Editor, Total Wealth Insider

Editor’s Note: Jeff just revealed a shocking new opportunity in the market’s most overlooked sector. The last time we saw an opportunity anywhere near this big, investors had the rare chance to make extraordinary gains of 4,851% or higher. Click here for complete details.