Have you ever noticed how many movies are about the little guy getting revenge against the big, bad corporation?

Whether it’s kid (The Lorax) or adult movies (Wall Street), Hollywood loves to bash big companies. The abiding message is that corporations are soulless, heartless machines that will do anything to make a buck … no matter the consequences for the rest of us.

The truth is (usually) a little different.

Most corporations are run by people who genuinely believe that their decisions are in everyone’s best interests. Even executives who believe in Ayn Rand-style individualism and ruthlessness trust that in the long run, everyone is better off that way.

Indeed, from the perspective of the modern corporate executive, raised in the “shareholder value” tradition, corporations do what impersonal market forces tell them to do, period. If that means other people lose out … well, c’est la vie.

There are big market forces at work in the U.S. economy today, and if you work for a big corporation, it threatens your retirement. It may be nothing personal … but it’s still gonna hurt if you don’t adjust accordingly.

Crowding Out Your Retirement

Over the last decade, escalating health care costs, historically low interest rates and an aging workforce have made employee benefit packages much more expensive for corporations.

Meanwhile, employees are dealing with their own financial stress. Baby boomers are behind on retirement savings. Millennials are trying to keep up with student loan debts. But sluggish wage growth makes both hard to achieve.

Consequently, many people worry about paying today’s bills and financing their retirement … and they are increasingly on their own in doing so.

In the post-WWII period, most large U.S. corporations provided health insurance plans, defined benefit pension plans and post-retirement medical plans.

Defined benefit plans have largely gone the way of the dodo bird.

None of the largest 10 U.S. corporations offer them anymore. Less than 7% of U.S. employees are in one. Everyone has moved on to defined contribution pensions and 401(k)s.

But between 2001 and 2015, corporate health care costs doubled. The biggest jump was between 2001 and 2008, when average health care costs rose by nearly 10% a year. Despite a slowdown since then, health care cost increases have still beat pay growth, with the ratio of health costs to pay increasing by 2.5%.

Something had to give.

From 2001 to 2015, total retirement benefits as a percent of average U.S. employee remuneration decreased from 9.1% to 6.8%. The biggest drivers were a fall in defined benefit costs (3.8% to 0.9%) and post-retirement medical coverage (1.2% to 0.2%).

At the same time, active health care expenditures for employees as a percentage of remuneration rose from 5.7% to 11.5% of the average pay packet.

The loser in that scissor movement? Your retirement benefits.

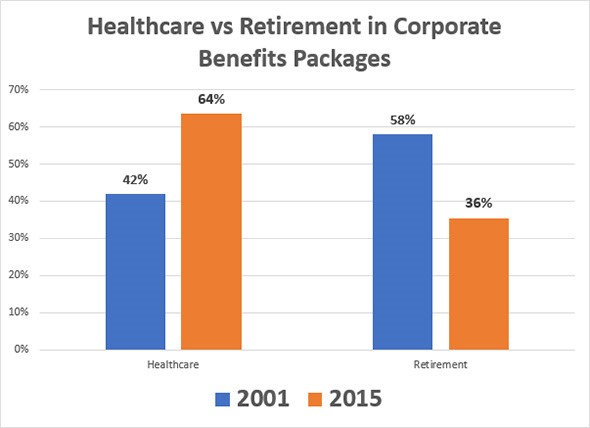

In 2001, 42% of the benefits costs of the average U.S. corporation went to active health care plans. Fifty-eight percent went to employee retirement costs (pension and medical). By 2015, the share of active health care plans had risen to 64%, and retirement costs had dwindled to 36%.

This wasn’t a case of evil corporations versus innocent employees … this was pure market forces at work. As health care costs go up, your retirement benefits go down.

You Vs. the Market

Despite this shift, nearly 80% of U.S. employees say their company’s retirement program is the primary way they save for retirement … up from only 56% in 2010!

This is almost certainly due to poor wage and salary growth since the financial crisis. Many people don’t have the money to set aside in an individual retirement account (IRA) or other retirement vehicle … or at least, they think they don’t.

We know that Social Security is on the skids. What to do?

Here’s my list, all of which are covered in The Bauman Letter archives:

- If you don’t have an IRA, start one. My preference is for the Roth option, in which contributions are taxed but gains and withdrawals aren’t. That’s because I think future taxes are going to go up. Rather pay them now when rates are lower.

- Make your IRA the self-directed variety. Self-directed IRAs (SD-IRAs) allow you to manage your investments yourself, so you can pursue opportunities for greater gains in nontraditional assets such as real estate, private equity, loans, rare tangible assets and other strategies unavailable in plain-vanilla retirement plans. You can even use them to follow market-beating trading strategies like those we offer here at Banyan Hill.

- Do some math. If you’re on a defined contribution plan, run the numbers to see whether you’d be better off reducing the contribution to your employer plan and redirecting the money into an SD-IRA, and/or a health savings account (HSA) . Both give you the opportunity to take greater control of your investment and earn more overall than if you fully contributed to your employer plan.

- Learn how to avoid being ripped off. Most of us pay more than we need to for some of the basics. The Bauman Letter is full of ideas for lowering your telecommunications, energy, food and other costs. Remember, when it comes to building and protecting wealth, saving money is as important as earning it.

Mr. Market isn’t interested in your well-being. And even if they say they are, most employers aren’t either. They are interested in their bottom line.

You should be, too … because in this modern world, it’s entirely up to you.

Kind regards,

Ted Bauman

Editor, The Bauman Letter