Europe effectively declared economic war on Russia this weekend.

With Russia’s top 10 banks from the SWIFT system, their vital income from oil and gas exports is gone. It’s a devastating blow that will soon send aftershocks through global markets.

In this week’s episode of Your Money Matters, Ted Bauman and Clint Lee take a closer look at what will result from these unprecedented sanctions.

Click here to watch this week’s video or click on the image below:

Transcript

Ted: Hello everyone. This is Ted Bauman here with Clint Lee with your weekly Your Money Matters. I’ve been in South Africa for a while, so here I am back in Atlanta, and we’re going to talk today about developments in Eastern Europe. Now we’re recording this on Friday. The assumption is that things are going to get worse rather than better, but we’re going to be talking about some of the trading opportunities that come out of this, but remember this doesn’t mean we approve of war. Not at all. In fact, I am personally horrified, but what we’re seeing is just something that’s completely unacceptable. And what we’re saying is, “Look, this is going to have an impact on global markets, the obvious thing to do is to try to trade it as best you can.”

But let’s start with just what happened yesterday, I don’t have a chart to show, but essentially the market, right across the board, markets dipped dramatically and then recovered to the point where it was really a big U-shaped dip. And this just goes to prove that I think you need to pay attention to what we say. Our approach is that big profits come from the big picture. And the big picture is short-term trends are driven by technical trading. A lot of it is algorithmic. A lot of it is options hedging. It’s an incredibly complex field, but when you get rapid movements like this, don’t trade them. You need to stick through whatever you do. Don’t sell on the first couple of hours of something like this.

The “Bread Basket” of Europe

So today what we want to focus on is that big picture, which we mean the fundamentals, and that’s all about commodities, because a lot of people don’t realize, but that whole section of Southwestern Russia and Ukraine historically has been the bread basket of Europe and indeed of much of the world going back hundreds of years, even to the Middle Ages. And so, having this cut off from the world, as a result of this is going to have dramatic implications.

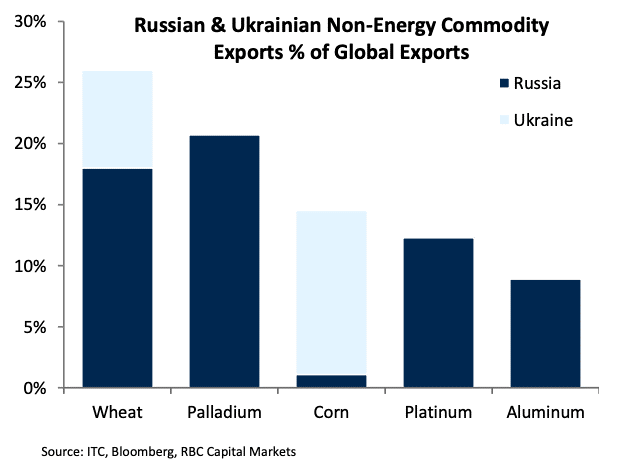

Now, here’s a chart that shows the relative share of global exports of non-energy commodities by these two countries:

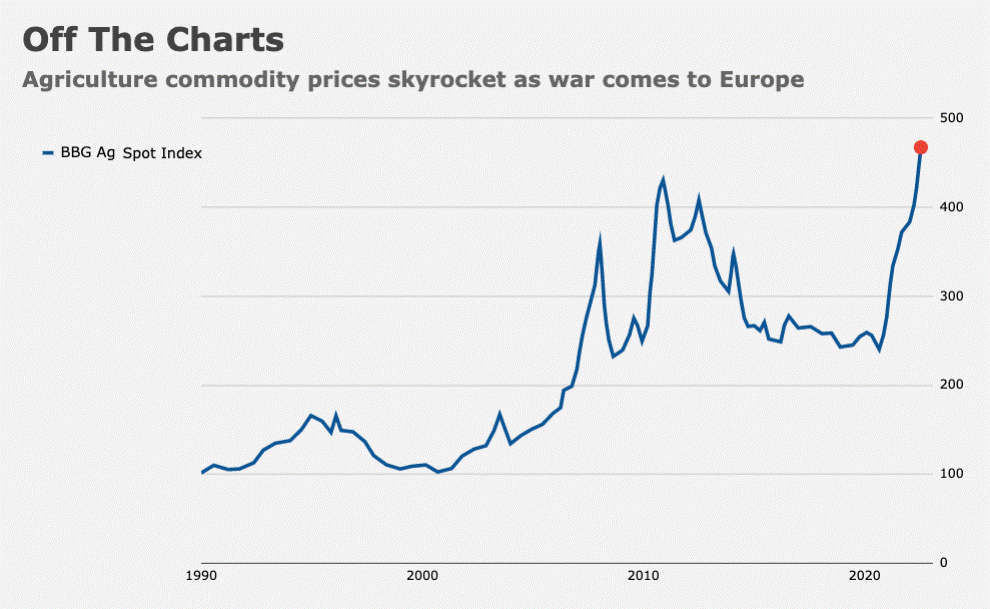

More than 25% of wheat, 15% of corn, 20% of palladium, as I explained two weeks ago in my Your Money Matters recommending that you buy palladium companies, which took off like a rocket, that just predicted and then platinum and aluminum. All of these are major commodities that come out of this part of the world that have significant shares of the global market. Here’s a chart that shows the impact on agricultural commodity prices:

They took off very rapidly starting last year, but they have been rising and we’re going to see a big uptrend.

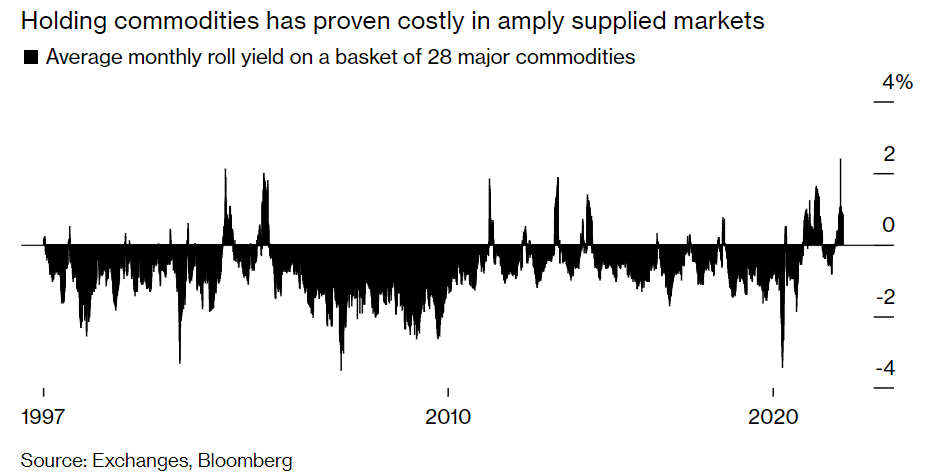

Last chart here shows the average monthly roll yield on a basket of 28 major commodities:

And it just shows you that we are at a point where the futures markets are predicting very tight supply of these commodities, but Clint, I’m going to hand over to you. Let’s talk about the energy situation.

Natural Gas & Energy From Russia

Clint: Yeah let’s talk about the energy situation. One thing I’ll mention really quick on that chart you just showed with the roll yields. A lot of times what this means is that the futures curves for those commodities themselves are now downward-sloping. And that’s how you get this, this positive roll yield. And it doesn’t happen a lot historically. And what it indicates is very tight supplies in the short term or expectations that supplies are going to get short and you can definitely see that in one area is with the energy sector. It’s well known how much natural gas flows from Russia to Europe. I think Europe depends on as much as 40% of its natural gas supply from Russia.

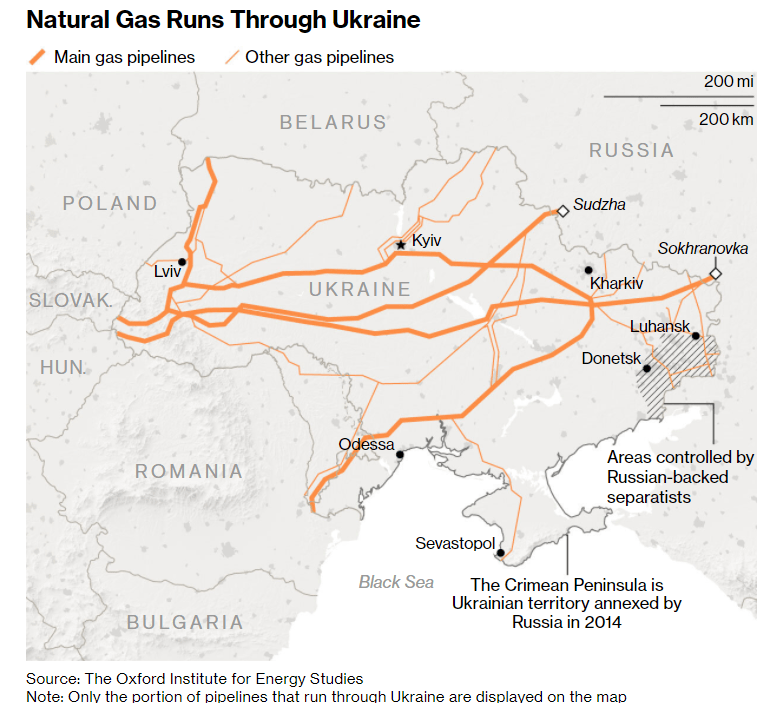

Here’s a quick map just showing where these pipelines originate and the area that they go through:

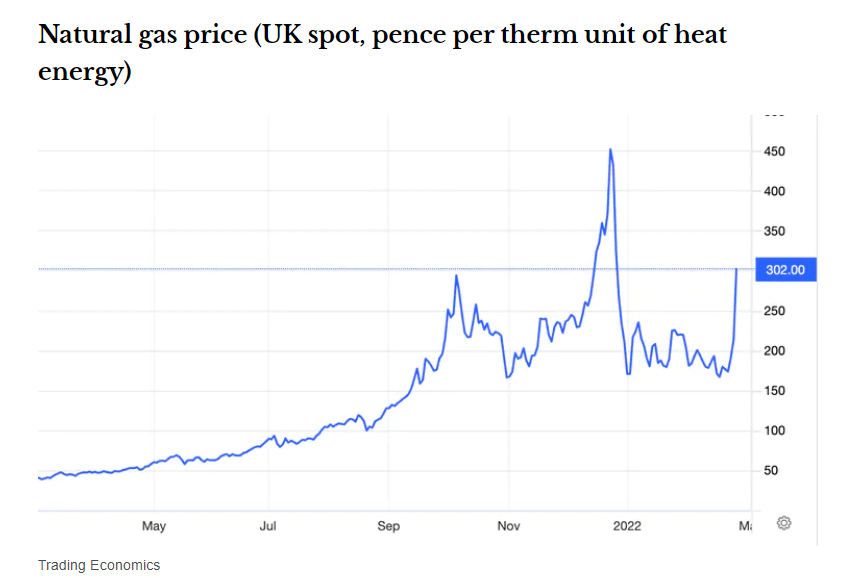

They are all intertwined through Ukraine. And so that’s what has so many people on edge right now, and the potential impact to energy prices right there. You’ve seen a huge spike in more localized regions of Europe. Here’s a chart with the UK’s natural gas prices:

Things have been escalating for a while, and they calm down, and then on the right-hand side of the chart you see, the big spike right there in natural gas prices. Now we talked about how Russian and Ukraine are the bread basket of Europe, the impact to certain metals, the energy side. I think one of the things we want to talk about too is some of those lesser-known impacts that are occurring, right?

The Big Picture on Potash

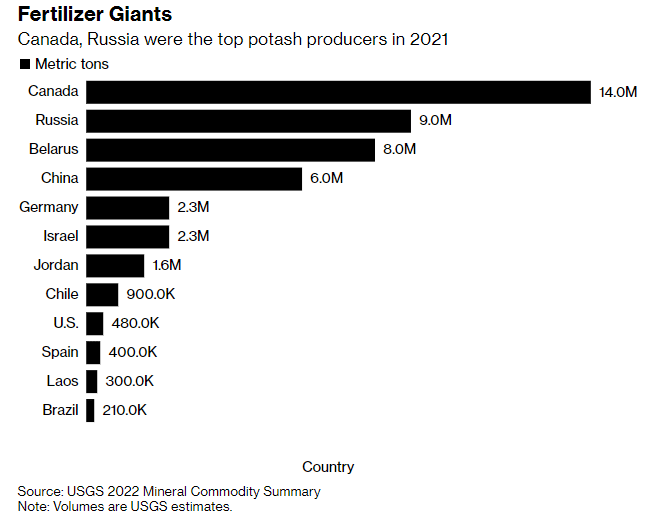

Ted: Yeah. And I have one in fact, to talk about fertilizers, here’s a chart that shows the potash producers, potash being a major component of most agricultural fertilizers.

After Canada, it’s Russia and Belarus, which of course at this point is just essentially a client state of Russia, so if you add those two together, those two are actually the biggest suppliers of fertilizer component potash in the world. And if there are sanctions imposed on Russia and probably by extension to Belarus, because Belarus has been misbehaving. They’re the ones who hijacked an airliner to capture a dissident and all… It’s likely that those two will be shut off from the global supply. Here is a picture of CF Industries’ stock price charting. Just look, it’s been trending up for a while:

So it’s a little difficult to see that, the impact of the crisis, but essentially from late 2021, when Russia started moving troops into position, look what’s happened to this company’s price. Now here’s an interesting thing. And this is why I think it’s important to listen to people like us. You might think, “Well, let’s buy CF Industries,” right? “Let’s buy a company that does this stuff.” Well, you know what happened, when there were big problems previously in natural gas supply, they had to shut down production because they depend on natural gas in the production of potash. So don’t just go ahead and buy anything folks, you’ve got to understand the relationship between the different parts of this.

Clint: Right.

Ted: And Clint, I think you pointed out something related to microchips that just blew my mind. I had no idea. Tell us about that.

It’s Not Just Neon…

Clint: Yeah, I was researching this recently, and just on that, on that potash point, really quick, where this really comes into concern for food supplies is not only do you have Russia and Ukraine as the so-called bread basket, but potash, it’s a key nutrient and fertilizers, whether it’s the supply being threatened, or the price of fertilizer going up, there’s some signs that farmers won’t be using as a result of that as much fertilizer in the grow… As we approach growing season, and that impacts crop yields. So, as nations might need to look elsewhere for food supplies, crop yields could be challenged because of that.

So, then here’s another aspect as it pertains to the chip industry and the semiconductor supply chain, that the semiconductor supply chain globally just is absolutely fascinating to me because you can have just one company or one country just dominating a certain aspect of that, and that’s what we have going on right now with Russian and Ukraine. So neon, you know, which I believe is a noble gas, correct me if I’m wrong, but neon is used in the lithography process when you’re manufacturing semiconductors. So that’s the process of etching that circuitry design onto a silicon wafer. Well neon’s used that process. Russia produces 90% of the neon utilized. And not only that, but 60% of the neon that’s then refined for use is done by one company, and that company’s located in Ukraine.

Ted: So this is the kind of stuff that people just don’t, that they think, “Okay, we can muddle through,” but this could have a catastrophic impact on the production of microchips. And of course that leads to the idea that anybody who’s got stockpiles of them is going to make a lot of money. You have to look at the potential impact on the automotive industry, but all this stuff is going to be coming out, I predict you’re going to see Bloomberg, everybody’s going to be writing about this in the next couple of weeks.

But at this point, it’s too early to say, I think they say that right now, chip manufacturers have about two to four weeks additional inventory, but if they are cut off from neon, which could very well happen, if sanctions go through, on everything that Russia exports which should happen, then we’re looking at a major, major problem here. But I just want to now turn to another issue which is transport. Here’s a chart that shows steel plants in Ukraine:

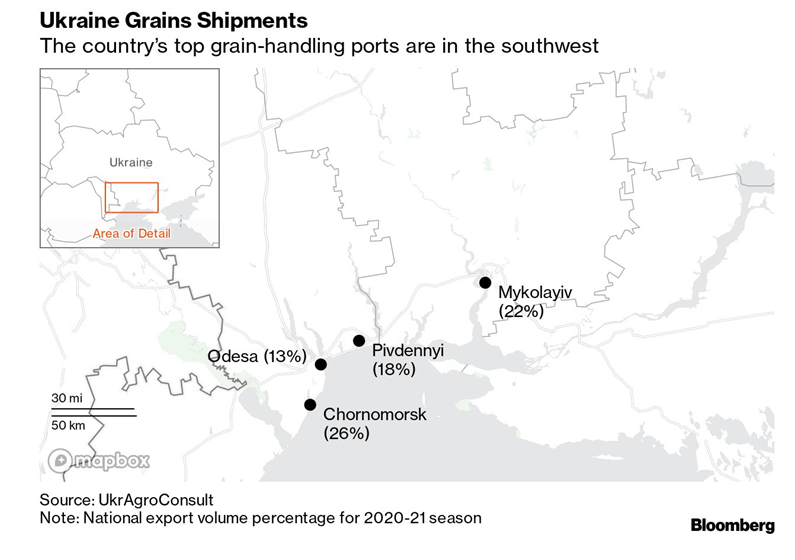

And they are one of the major producers of iron ore in the world, and they produce steel from this. Outside of China, they’re one of the major producers. But look at where they are. These are all basically sitting right in the middle of the combat areas of this current situation. Then look at Ukraine grain shipments:

All of them down there on the Black Sea, all of them being majorly effected, they’re basically going to be shut down. I mean, even if without sanctions, I mean militarily, the Russians have come in and destroyed a lot of these port facilities. So we can expect major, major global implications on the commodity side.

Now Clint, how would you be playing this? I mean, I think, like we spoke about CF Industries … don’t rush in and just buy a company because they’re in this, you got to understand the background. Are there any ETFs that we can trade do you think on this? I know we’ve recommended a couple in, we have a new service in The Bauman Letter where we look at commodities, but how would you play commodities in general?

Clint: You make a great point. If you’re looking at a specific company, understand its supply chain and where the weak links may be at.

Ted: Right. Something we all learn from COVID, right?

Clint: Right. Exactly. I think right now with what we’ve talked about, I mean, you can kind of see the supply constraints and pricing pressures that are evolving across just the commodity space in general. And so one thing you can look at is just some commodity ETFs to give you exposure. You can get targeted exposures too. If you wanted to play more on the agricultural side of things, Invesco DB Agriculture Fund (NYSE: DBA). On more of the industrial metal side, Invesco DB Base Metals Fund (NYSE: DBB). If you just want broader exposure, we’ve talked about iShares S&P GSCI Commodity-Indexed Trust (NYSE: GSG) on here before. Now that has a lot of oil in it, so just something to be aware of. So yeah, there’s plenty of ETFs out there where you can get very broad exposure to what’s going on in the commodity space, or you can be very targeted if you want to look at more on the agricultural side or more on the metal side and so on.

Ted: So, I was looking across my charts this morning and what was up today. VanEck Steel ETF (NYSE: SLX) is up big time today. You’re seeing Energy Select Sector SPDR ETF (NYSE: XLE) is also up, Materials Select Sectors SPDR ETF (NYSE: XLB), that’s the select sector ETF, these are all up substantially, basically in anticipation of this. So rather than go fishing for specific companies, I would basically recommend anybody who wants to play this, look at the ETFs, because the ETF guys, the guys who run those funds, are the ones who basically know all the stuff we’re talking about. They know the supply chain issues, they’re going to evolve their holdings based on what’s going on in the markets, and they’ll do it responsibly. But certainly, if you look at the metals, the agricultural, and the energy ETFs, you can’t go wrong right now, sadly. And I think that’s the thing to remember: The only reason you’re going to make money out of this is because of this unconscionable act, and what are we going to do? We just got to take it from where it goes…

Anyway, that’s it from us this week.

We’ll see how things go next week and we’ll try to drill down. I think Clint and I, and our research team, are going to be looking for specific opportunities that we can play. And I suspect it’s going to continue to be along the commodity side, but remember, there’s a big issue in the background here that we’re going to be mulling over all week, and that is that we’re going to get inflation because of this, because when commodity goes up in price, it causes price inflation. But when it’s an exogenous shock like this, the only mechanism that the Fed has to combat is to raise interest rates, which leads the economy to slow. But that won’t stop the inflation. And that brings up the dreaded S-word, “stagflation.” Well, let’s see what the market has to say about that between now and next week, and then we’ll talk to you then. Thank you. Bye!

Good investing,

Angela Jirau

Publisher, The Bauman Letter