Ukraine On The Scarecrow, Blood On The Plow

Scarecrow on a wooden cross, Russia in the barn. 42 million hectares that used to be Ukraine’s farm.

They grew up like their daddies did; their grandpas cleared that land.

Great Ones, when I was five, I walked the fence while grandpa held my hand. True story, which also happens to be a line in a John Cougar Mellencamp song.

Now, I wouldn’t go as far as to say: “I’m somewhat of a farmer myself.” But I’ve been around the tobacco and hay fields more than a few times. In fact, I learned to drive on a tractor at about the age of 13.

Things might’ve been different for me if I’d taken up farming as a career choice. But farming is back-breaking work at the best of times, and I despise hay more than Anakin hates sand. So, here we are.

Alright, farm boy, are we ever going to get to that scary freaking headline up there?

Great Ones, it’s just my job … and I hope you understand.

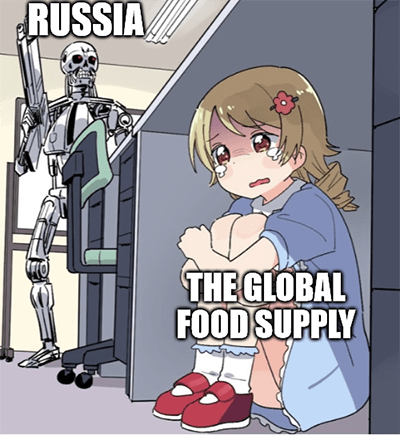

By now, y’all are painfully aware that Russia’s invasion of Ukraine has thrown several major monkey wrenches into the global economy.

The most obvious of these is the oil and gas market, which we have hit on numerous times before.

But the one practically nobody is talking about right now is agriculture. You know, wheat, corn, soybeans, barley, rice … the biggest food commodities on the planet?

Most of y’all probably already know that Russia and Ukraine are among the biggest oil and natural gas producers on the planet. And you’ve seen what the Russian invasion has done to prices in those markets.

Despite what the Facebook memes say, this war is the real driver for soaring energy costs.

What you might not know — except for Great One Norman K. — is that Russia and Ukraine are both major global grain producers as well. (Norman, you got the jump on me by pointing out Russia as a major grain supplier. I got you, man.)

Wheat’s The Problem, Man?

On average, Russia produces some 75.5 million metric tons of wheat per year and exports roughly 30 million metric tons.

Meanwhile, Ukraine exports about 20 million to 25 million metric tons of wheat per year. On a global scale, these figures put Russia as the No. 4 wheat exporter and Ukraine at No. 7. Combined, the duo is the third largest wheat exporter on the planet.

Outside of wheat, USDA data indicates that, in 2021, Ukraine produced 41.9 million metric tons of corn, 31.66 million metric tons of oilseeds and 9.9 million metric tons of barley.

That’s not only a lot of grain … that’s a lot of grain not making it to the market right now.

Many countries stopped trading with Russia, thus limiting supply. Russia’s traditional customers, such as Turkey, Egypt and Iran, are still buying grain exports. But even those figures are falling well below historic levels.

“The U.S. Department of Agriculture last week also raised its estimate for Russian wheat exports in the current season to 33 million tons, though that remains short of the 35 million tons it forecast before the war,” Bloomberg said.

Meanwhile, Russia is blockading Ukrainian ports. It’s gotten so bad for Ukraine that the country only exported 643,000 metric tons of grain since May. Last year at this time, Ukraine had exported 1.8 million metric tons.

Furthermore, you can expect these figures to plummet to near zero as Ukraine begins to have its own food supply issues due to the war.

If you haven’t put the pieces together yet, Great Ones, let me do it for you:

We are looking at a global food crisis in the making.

If you want me to, I’ll say a prayer for your portfolios tonight…

A Gold Harvest Moon

Instead of just praying, Great Ones, how about we do something about it? From an investing standpoint, at least. What? I’m not a farmer or a god, despite my delusions of grandeur.

Let’s nip one thing in the bud first. I don’t expect food shortages in the U.S. We have quite a bit of agricultural production stateside, and other grains such as rice and soybeans will help blunt the impact here, I believe.

However, we will see more inflationary pressure on food prices. I mean, we’re all familiar with supply and demand, right? When supplies are short and demand doesn’t fall, prices rise. Which is what we’ll have here in the U.S.: increasingly expensive food.

Now, part of me feels just a little bit dirty talking about profiting from this situation. But I’m going to fall back on an old Gen X saying: It is what it is. As investors, we’ve got to do what’s best for our financial well-being … and sometimes, that means taking advantage of a bad situation the best you can.

Grain prices are already nearing 20-year highs across the board, and if the Russian invasion doesn’t end right now — highly unlikely — those prices will soar even higher. We’re looking at potentially record wheat, corn and soybean prices, with rice and barley close behind.

OK, so we’re buying grain futures now?

I mean, if you know how and have plenty of money you can afford to lose playing commodities futures … go ahead, I guess? But I’m not going to recommend directly trading commodities or futures at all in Great Stuff. It’s just too much to tackle for the average investor … and too risky. I don’t recommend it.

What I do recommend here are exchange-traded funds (ETFs) that track commodities. Here are three of my favorites:

- Teucrium Wheat Fund (NYSE: WEAT).

- Teucrium Corn Fund (NYSE: CORN).

- Teucrium Soybean Fund (NYSE: SOYB).

Now, don’t expect these ETFs to directly track wheat, corn or soybean spot futures prices. Those are way too volatile and expensive to track directly.

The Teucrium ETFs instead track futures contracts across multiple maturities, thus minimizing the effects of short-term price spikes versus long-term expectations. It’s a more balanced and safe approach than just buying front-month futures contracts.

As for returns, SOYB is up 23% since before the Russian invasion, CORN is up 35% and WEAT is up a whopping 55%!

Many on Wall Street think these prices are going to come down soon. They’re downplaying the food shortage crisis in much the same way they tried to downplay energy prices and inflation.

Don’t believe them. This food situation is going to get much worse before it gets better. Heck, it’s not just the financial media and Wall Street’s talking heads that are ignoring the problem … even governments are failing to get out ahead of this brewing crisis.

I’ve said before that I’m not a fan of ETFs, but commodities investing is a horse of a different color. I personally prefer to trade commodity ETFs. It’s just cleaner and easier than dealing with futures contracts, especially for non-professional investors.

So, if my suggested ETFs don’t float your boat, check out the ETF Database for a full list of potential agriculture-related ETFs by clicking here.

Be advised, the top agriculture ETF listed on the ETF Database — Invesco DB Agriculture Fund (NYSE: DBA) — is filled with U.S. Treasurys instead of actual commodities. So, if you’re looking for a pure play on grains like wheat, corn and soybeans … I’d suggest looking elsewhere.

Before you go, I would like to make one final note.

Maybe stocking up on agriculture ETFs isn’t your preferred way to trade the bear market. Maybe you’re more of a “bonds and cash in the mattress” type. I get it … but you do need a strategy. No matter what. You can’t just wing the bear market and hope your portfolio comes out unscathed.

Oh, just you watch me!

Please, just … no. You have options (quite literally). That’s because master trader Michael J. Carr has devised an ingenious and versatile strategy that any investor, new or experienced, can embrace AND have their chance to profit from.

The most important part? This works whether the market is headed up or down. Bull or bear, this is all you need to make simple trades and profitable returns in a week or less in any market.

You can see what makes Mike’s trading strategy so remarkable right here.

As always, thank you for coming to my Great Chat! If you have a stock or investing idea you’d like to see covered in the Great Stuff weekend edition, let us know at: GreatStuffToday@BanyanHill.com.

And if you have that burning yearning that only more Great Stuff can satisfy, you should check out our deets here:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Regards,

Joseph Hargett

Editor, Great Stuff