Well, well, well. Look who just overtook Cathie Wood’s ARK Innovation ETF (NYSE: ARKK).

A dollar invested in Berkshire Hathaway — the proverbial “tortoise” of the stock market — in January 2020 has earned more than one invested in ARKK, the “hare” beloved by the risk-on crowd.

If you called ARKK’s top and sold it in February 2021, you would have made a lot of money.

On the other hand, whoever bought ARKK from you has lost half their money in just a year’s time.

Going even further, if you took your ARKK gains and put them into BRK.B on February 12, you’d be up 30% on that trade.

(Click here to view larger image.)

The chances that any investors actually made that “switcheroo” are vanishingly small. The move looks good in hindsight … but at the time it would’ve seemed ludicrous to most investors.

That’s why you should always follow one key rule when it comes to maximizing your long-term potential…

Don’t be a trader … be an investor.

Let Me Make 1 Thing Perfectly Clear

Invariably, whenever I question ARKK and similar “disruptive” investments, someone will say I lack vision. I don’t understand the opportunity … I’m too negative … I’m a permabear.

As they say here in South Africa: “that’s rubbish.”

Of course, I appreciate the power of disruptive technologies.

I’m an economic historian by training, after all. I know what steam engines, railways, internal combustion engines, jets and microchips did for the economy, and for investors.

But I also know that technologies and companies are two different things.

Did you know, for example, that dozens of entrepreneurs tried to commercialize internal combustion automobiles in the decades before Henry Ford figured out how to do it profitably? Early investors who recognized the technological opportunity still lost their shirts.

I understand perfectly well that electric vehicles, telemedicine, video conferencing, video streaming, the Internet of Things and other history-making technologies are going to shape the future and make investors a lot of money. I couldn’t agree more with Cathie Wood that it’s important to get in on these trends early.

But not every company competing in those spaces is going to succeed. Those that do succeed are going to do so by steadily increasing their market share, building their share value along with it.

Buying disruptive companies at astronomical valuations in anticipation of that steady growth isn’t investing. It isn’t really trading, either.

It’s gambling.

And I’m not a gambler.

Avoiding the “Hare Hype”

The secret to investing in disruptive technology companies is to avoid the ones in the headlines. Look for the sleepers that few people pay attention to.

Tesla is a great example. I like its products. I’m impressed with the design ethos. The quality of its management is illustrated by the fact that whilst other automakers had to stop production for want of microchips, Tesla’s engineers simply rewrote their own software to use whatever was available.

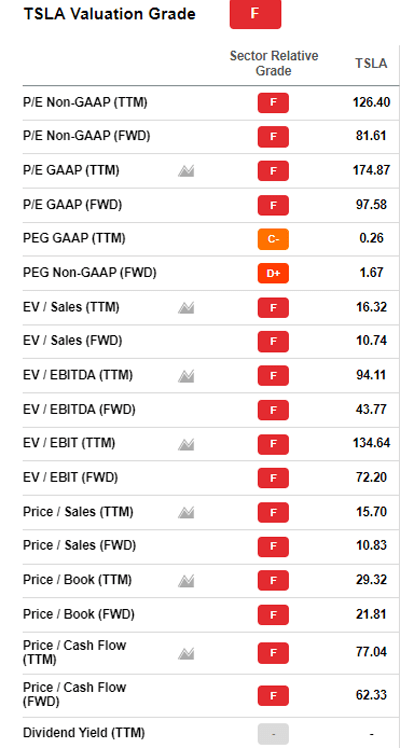

But I’m not touching Tesla stock:

Its valuation is one of the most excessive on the market (see table above).

Its price performance has been driven largely by “stories” … the narrative that the company’s fans share about Tesla and about its charismatic CEO.

Tesla is set up for a classic “first mover” fall. Dominating a market with few competitors is one thing. Competing with the entire global automotive industry is entirely another.

Whatever Elon Musk’s merits as a visionary and engineer, he is an unscrupulous businessman. He regularly and shamelessly uses social media to boost his stock price, then issues new shares to take advantage of the jump. That’s a great way to finance your company, but a terrible way to treat investors.

Rather than a hare like Tesla, I prefer to invest in tortoise companies creating and developing game-changing products quietly … precisely in order to avoid the pitfalls of hype.

Let the Winners Pick Your Winners

That still leaves a problem, though. How do you find these hidden gems?

The answer for me is simple. I follow the money.

I don’t mean retail investor money, or even hedge fund money. And I especially don’t mean venture capitalists, who generally play Musk’s hype-based game.

Instead, I follow the smart money.

I pay attention to deep-pocketed investors with intimate knowledge of the industry in question.

When one or more of these quiet but clever investors decides to put his or her personal money into a company, I take note … especially if it’s a company that doesn’t get much press coverage. (A big bonus is if it doesn’t have a Twitter feed.)

During tough times like this, it’s just a smart way to invest.

Kind regards,

Ted Bauman

Editor, The Bauman Letter