The best buy in the natural resource space today is gold miners.

Period.

These stocks are too cheap. If you took their fundamentals and put them in any other sector, they’d be a screaming buy. But gold miners are out of fashion today.

I told this story at the Prospectors & Developers Association of Canada conference on Sunday. It fell on deaf ears … which is great. That means we have time to buy these stocks. They are cheap and hated.

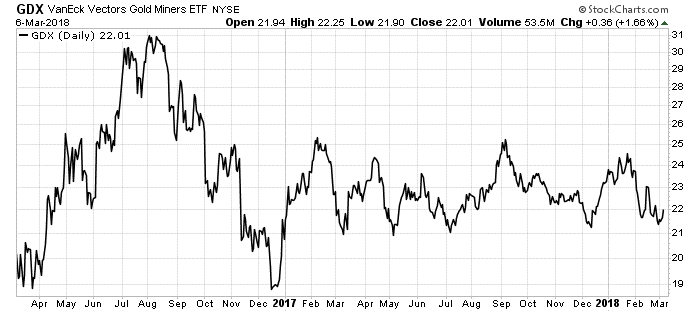

In fact, major hedge funds like David Einhorn’s Greenlight Capital and Peter Thiel’s Thiel Macro sold out at the end of 2017. Between the two, they sold nearly 12 million shares of the VanEck Vectors Gold Miners ETF (NYSE: GDX). In total, major hedge funds sold 40 million shares, over $345 million worth, of GDX.

That led to the exchange-traded fund dumping major gold mining stocks. GDX is now down 28% from its high in August 2016:

However, the average gold price was slightly higher in 2017, at $1,258 per ounce. In 2018, the average gold price is $1,331 per ounce. And its forecast looks good to remain high all year.

Which leads us to where we are today … cheap major gold miners.

The Year of Gold Miners

The funny thing about this is that major gold miners just had a great year. In 2017 they ended with lower costs, lower debt, more cash and more gold production than they had in years.

Hedge funds think that trend is over … but they are dead wrong.

Gold miners’ price-to-cash-flow ratio is extremely low. It’s so low that in order to return to its 20-year average, the prices would have to double. Let me say that again. For the major gold miners to return to their average price-to-cash-flow value … their stock prices must double.

Here’s the thing, cash flows are still going up. The gold price, the stuff that gold miners “make,” is going up. That means the companies’ profits are going up too.

These stocks are cheap by another metric: The number of shares you can buy with an ounce of gold. Historically, you could buy 3.7 shares of the Gold BUGS Index, which tracks major gold miners. Today, an ounce of gold will buy 7 shares. That means gold stocks must go up at least 90% just to get back to the average valuation.

And they will. Let me tell you why:

- In 2017, major gold miner Barrick Gold Corp. (NYSE: ABX) cut its debt by 19%. It cut its debt by 50% since 2014.

- Major gold miner Goldcorp Inc. (NYSE: GG) plans to grow gold production by 20% and cut costs by 12.5% by 2020.

- Major gold miner Newmont Mining Corp. (NYSE: NEM) saw free cash flow grow 88% in 2017. It raised its dividend by 87%.

I could go on, but you get the picture. These companies are becoming better businesses. The stuff they make, gold, is going up in price. Thanks to the recent fall, they are extremely cheap today.

All we need is an uptrend, and this is an easy double in price.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist