Markets can change rapidly. Just look at this year.

We started 2018 with the promise of record-breaking gains. However, war in Syria, trade war with China, sanctions against Russia and a looming fight with Iran roiled the market.

Global growth could take a hit. If that happens, we could see a major reversal in the market. A falling S&P 500 would be bad news for all our portfolios.

That means we need to look toward the oldest store of value to insure our portfolio — gold.

Gold holds value unlike any other because it is an element unlike any other. It’s heavy, yet soft. It shines but never tarnishes. You can’t print it or make it in a lab.

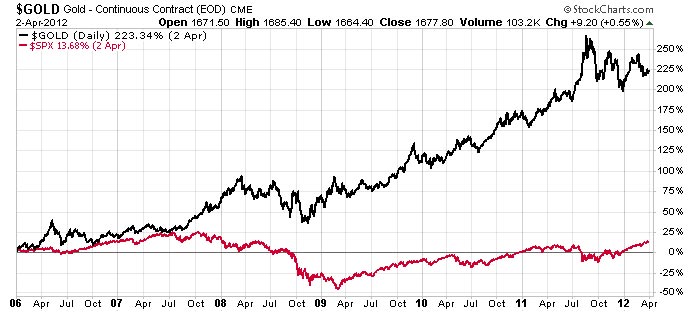

For thousands of years, gold was money. More important, the world still views gold as an insurance policy against financial troubles. Here’s what happened during the last financial crisis:

As you can see, through the 2008 crisis, the price of gold never faltered. It ended each year at a higher value than it began. Investors wanted a safe place to put their money, and their answer was gold.

From 2006 to 2012, the value of gold rose 223%. The S&P 500 went up just 14%. Since 2007, the yellow metal returned 25% more than the S&P 500.

That’s why recent market turmoil has investors looking to gold once again. Wise investors are adding this precious metal to their portfolio … just in case.

Right now is the perfect time to get into gold. Investors are still optimistic about the S&P 500, but they are getting jumpy. Volatility is on the rise. The market seems stretched out and overvalued.

At the same time, gold prices are still well off their peak. A repeat of the market crash of 2008 will send gold prices soaring.

We know that no market goes up forever. That means a bear market is just around the corner. Gold is the best hedge against a falling stock market.

If you are considering holding gold, one of the easiest ways is to buy shares of a gold trust like the iShares Gold Trust (NYSE: IAU) and the Sprott Physical Gold and Silver Trust (NYSE: CEF). (Note that CEF shares may appear listed as the Central Fund of Canada, which was acquired by Sprott earlier this year.) These funds hold physical gold that we can buy in our brokerage account.

Regards,

Anthony Planas

Internal Analyst, Banyan Hill Publishing