The stock market has gone almost straight up since the election, with the S&P 500 up more than 13% in about 16 weeks. If this pace could be sustained for a full year, the S&P 500 would gain more than 42%.

This rapid gain is a sign of a potential bubble and needs to be examined closely. If there’s a rational reason for the gain, then we aren’t in a bubble, and we should consider adding to our market exposure.

The reason for the gain might be the expected change in tax policy. President Donald Trump is working with Congress to reduce the top corporate income tax rate from 35% to 15%. It seems unlikely he will get everything he wants, but lower taxes seem likely.

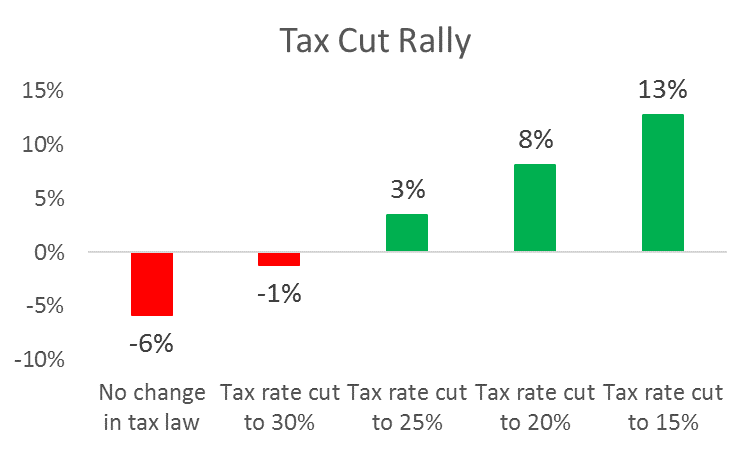

Standard & Poor’s estimates that every 1% reduction in the corporate tax rate could add 1% to the earnings per share of companies in the S&P 500. Using a price-to-earnings ratio of 17 to estimate the fair value of the market under different scenarios provides the price targets shown below.

At a 15% tax rate, the S&P 500 could reach 2,700.

These are most likely conservative estimates of the upside potential. Tax reform would be likely to extend to personal income taxes, where lower rates would increase consumer spending and add even more to a company’s profits.

Lower taxes and higher consumer confidence could push the S&P 500 to 3,000 and the Dow Jones Industrial Average to 26,000. These targets seemed unreachable just four months ago but now appear likely within 12 months.

Stocks seem to be benefiting from rational exuberance, and dips should be looked at as buying opportunities.

Regards,

Michael Carr, CMT