The “good ol’ days.”

Now, that’s a phrase I have heard too much.

Whether it’s on the radio, TV or from my grandparents, it’s a phrase that implies the past was better than the present. Heck, even my parents reflect on the “good ol’ days.”

But I remind my kids all the time that times are way better now than they ever have been.

There is always evil lurking throughout the world, but when it comes to the most people being out of poverty and living a decent life today and hopefully for the foreseeable future, life is better than anything we have experienced in our “good ol’ days.”

But there is one thing we all depend on that won’t be nearly as good as it was in the “good ol’ days” anytime soon…

Kiss Your Yields Goodbye

I’m talking about traditional sources of income.

Back in the “good ol’ days,” a typical one-year bank CD (certificate of deposit) could easily yield 5% to 10% with no risk.

Today, you’re lucky to find a bank CD that yields over 1% … and that’s over a five-year period.

The main reason is that interest rates have been pinned lower by Federal Reserve policy.

The Fed, however, is in an interest-rate hike cycle.

That means it is committed to increasing benchmark rates, which should also boost your yields on the bank CDs you can invest in.

The rate-hike cycle started back in 2015, and the Fed has now hiked rates four times, including twice this year. At its upcoming meeting next week, it’s widely expected to announce the fifth rate hike in this cycle.

Many people think that just because the Fed is raising rates again that we may get back to the “good ol’ days” of 5% yields at your bank — but that simply is not the case.

And the latest tool reminding us we are not going to get near that level is the yield curve.

The Yield Curve

The yield curve is simply the difference between longer yields and shorter-term yields. It flattens when the two are getting closer, and expands when they are widening.

If higher short-term rates due to the Fed’s rate-hike cycle are going to stay around, the long end of rates should be getting a boost too — but we have not seen that yet.

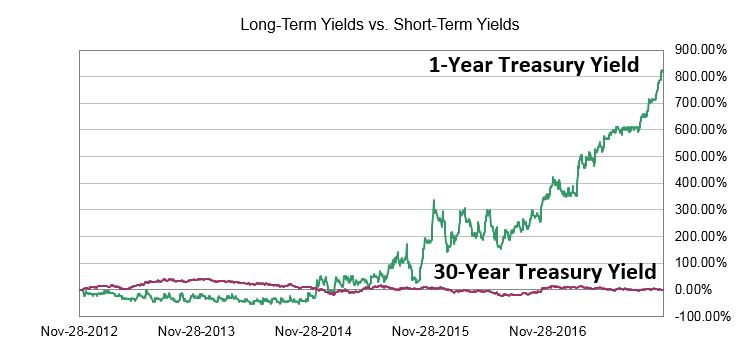

Take a look at the change in the yield curve over the past five years in rates:

You can see the one-year Treasury yield has soared. Percentagewise, it’s an 800% increase, while the 30-year yield has barely budged.

That’s because investors are discounting the effects of rising short-term rates. They don’t think inflation (prices for goods) will rise rapidly.

Without inflation picking up, the expectation is still for longer-term yields to be subdued.

And in turn, that means your banks are in no rush to increase the yields on their CDs and savings accounts, leaving you to rely on alternate sources of income.

One of my favorite sources of income is a strategy I use in Pure Income. If you’d like to learn more, click here.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert

Editor’s Note: Whether you’ve been trading for years or are completely new to it, Michael Carr’s Precision Profits research service gives you every tool you need to hit the ground running and start profiting right away — including the details behind his strategy, and tips to make sure you get the most out of your membership. To find out how Precision Profits can quickly help you make enough money to change your life, click here.