Natural resource investing is always difficult because there are so many factors. The underlying commodity prices rise and fall daily, and you are always afraid that you made the wrong decision.

Navigating these markets is similar to captaining a boat. You need to know when the waves are taking you where you want to go and when to run for shelter. In the case of silver, we have a long-term bull market shaping up even though the short-term trend in silver prices was down.

As I said in the first article I wrote for Winning Investor Daily, that price volatility makes silver a great metal for speculation. The trend is up and heading higher. We’ll see a peak in silver prices close up around $20 per ounce in the next few months.

That’s great, because it should send the underlying stocks higher … and it already has.

Silver Stocks Deliver Real Wealth

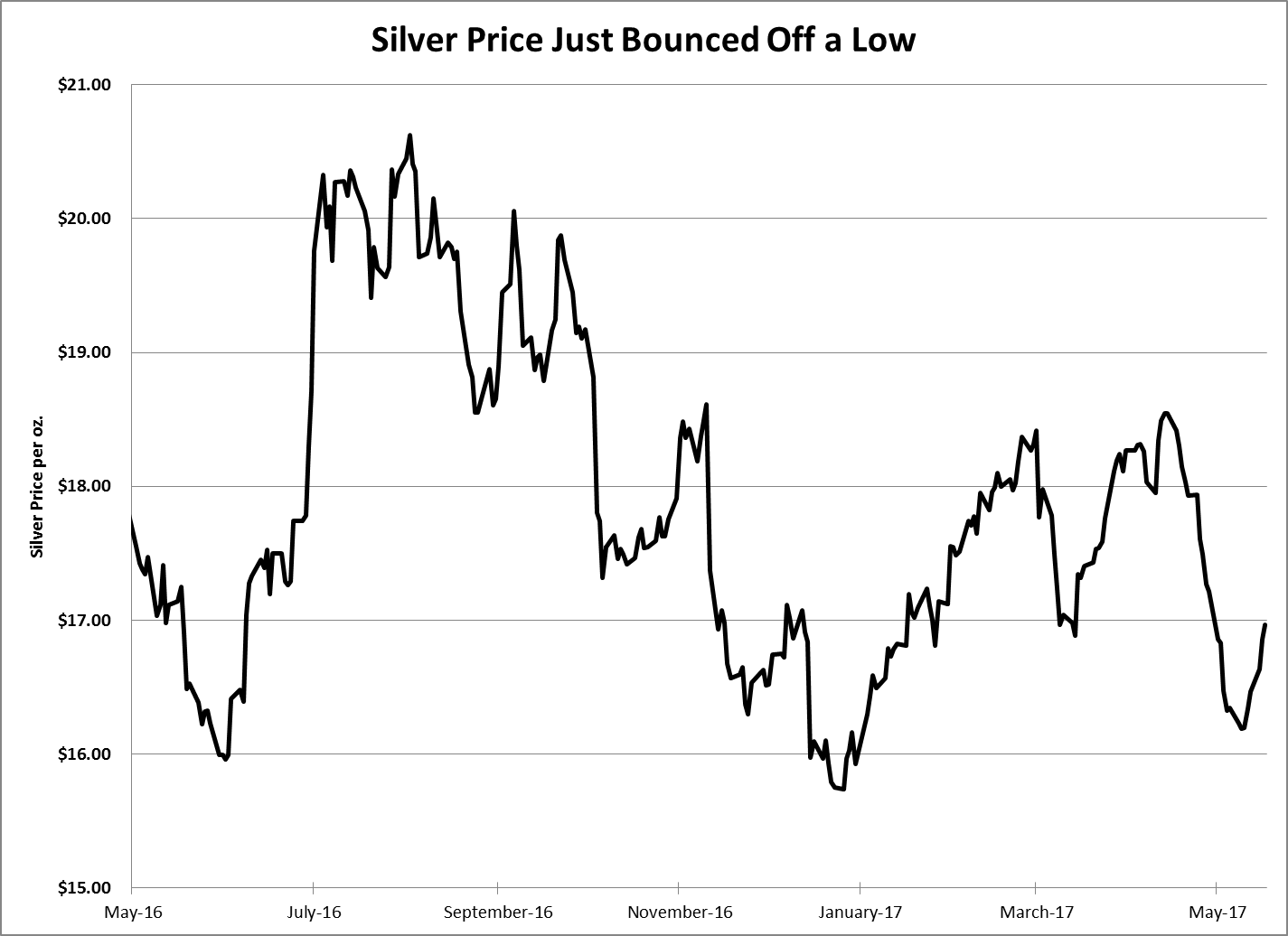

Silver prices collapsed since mid-April, back close to their lowest point in the last year. As I told you back in March, silver is the world’s most fickle metal. Prices can rise and fall double digits in just days or weeks. That’s what we’ve seen over the past two months.

The recent low of $16.20 per ounce is just 3% above the previous low back in December 2016. You can see what I mean in the chart below:

The important thing is that the price is above that low. And the recent high in April was higher than the previous high in early March. That pattern — higher highs and lower lows — usually means that we have a long-term bull market.

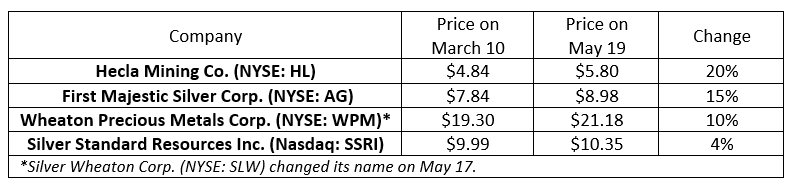

The result was gains for the four silver stocks I told you about back on March 10. The table below shows us how we did:

As you can see, all four companies’ shares are up even though the silver price is down. That’s because these stocks were hated back in March, and the uptrend is in place now.

If you bought in when I talked about silver back in March, congratulations! You are up over 12% on your trade in just two months! That’s a fantastic gain, and it’s the sort of thing that happens with natural resource stocks. If you haven’t bought these stocks yet, they are still worth buying today because they could run much higher.

If you have positions in those stocks, don’t forget to watch your stops. We should use 30% for now. That gives us some cushion if the stocks pull back a bit before moving higher.

(A 30% stop means if the price falls by 30% below the recent high price, you should sell. That’s how we will preserve 70% of our investment [100% – 30% = 70%]. For example, Hecla Mining’s highest price since we bought it is $6.15. So we would sell our shares if they fall below $4.31 per share [70% x $6.15 = $4.31].)

We don’t put those stops in the market; we keep them to ourselves. You can use a spreadsheet or an app to do it. Speculating in these kinds of stocks requires a little bit of maintenance; however, a double-digit gain in a few weeks makes it worth it.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist