In 2015, scientists caught German carmaker Volkswagen cheating on pollution emission tests. It turned out that, no matter how hard they tried, Volkswagen engineers couldn’t make diesel cars perform well and meet emissions standards at the same time.

So they cheated. They built sophisticated software designed to put the cars “to sleep” when testing. That lowered the emissions to acceptable limits … but only during the tests.

The result was a massive backlash against diesel vehicles. In 2016, diesel vehicles sales fell to their lowest volume in seven years. That led to an unexpected bull market … in palladium.

You see, palladium’s largest use is in vehicle exhaust systems. Specifically, it’s used in catalytic converters of gasoline engines. These devices clean exhaust of noxious stuff like nitrogen oxides and carbon monoxide. Platinum serves the same purpose, but mostly in diesel vehicles.

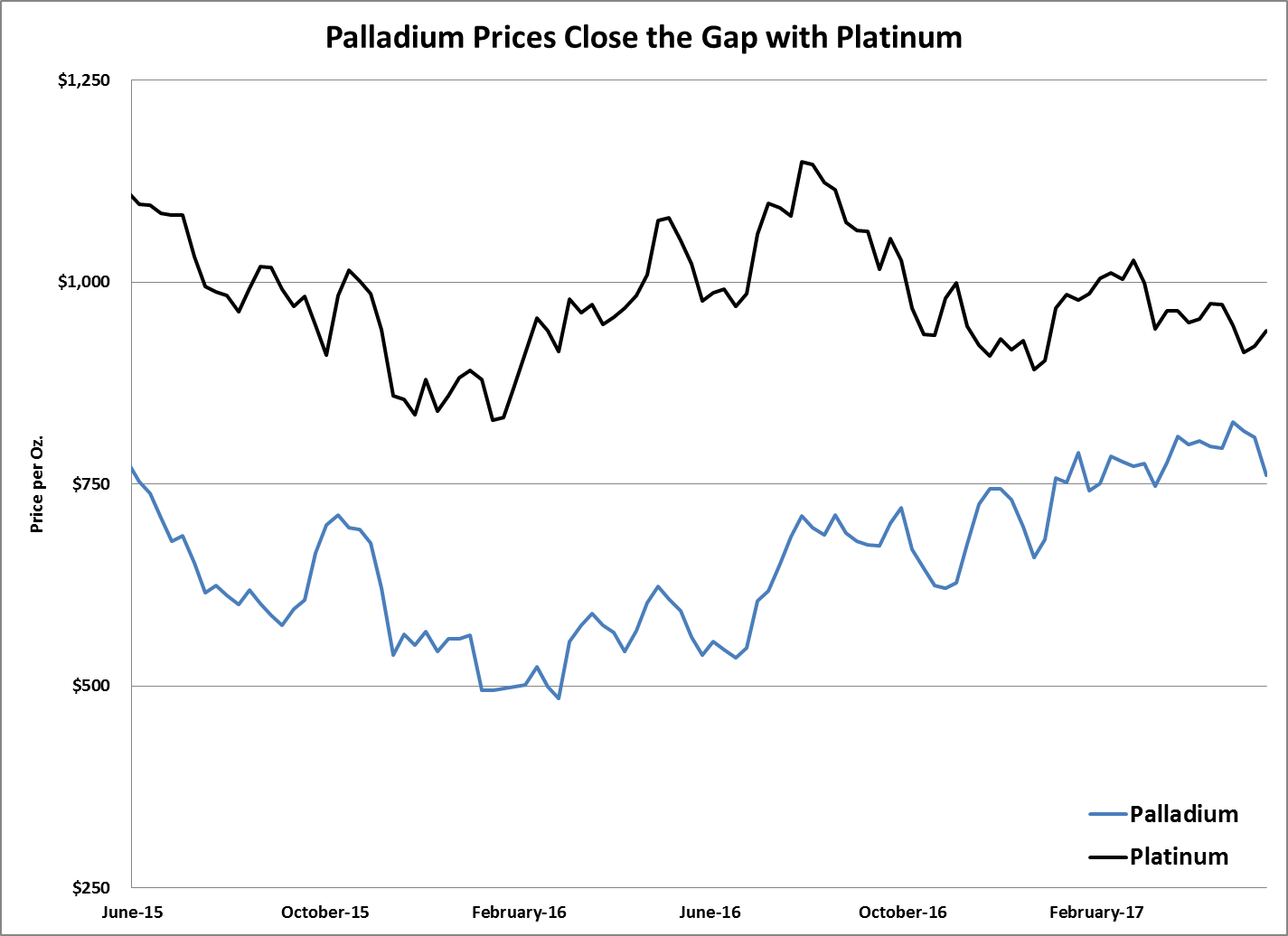

The result of the Volkswagen scandal was lower demand for platinum and higher demand for palladium — much higher demand. You can see what I mean in the chart below:

In 2016, the world consumed a record 9.4 million ounces of palladium. That happened due to the shift in car sales from diesel toward gasoline engines.

Palladium prices bottomed in early 2016 and rocketed higher, up 76% in about 16 months. Platinum, on the other hand, bottomed at the same time and soared 44% to $1,176 per ounce in just six months. Then it fell hard … down to just $939 per ounce today. While the platinum price is up 15% above its 2016 low, it’s down 20% since August 2016 due to low auto sales.

Platinum and palladium prices are now nearly equal … an unusual situation. An ounce of palladium costs about $760, while an ounce of platinum costs about $939. That’s just a 23% premium for an ounce of platinum … a rare narrowing of the prices.

We saw something like this happen back in 1998 to 2001, as electronics sales and the tech boom pushed palladium prices above platinum. That’s the only time palladium became more expensive than platinum. It lasted for just 18 months before palladium prices collapsed.

Since 1993, platinum prices averaged about 2.6 times the price of palladium. At its extreme in 2009, an ounce of platinum was over five times the price of an ounce of palladium.

That’s what makes this bull market in palladium so unusual … and risky. I expect the relationship between platinum and palladium to revert to its average at some point. It could do that in one of two ways: platinum prices rising or palladium prices falling.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist