The incomparable musician and mystery writer Kinky Friedman says if you really want to see fireworks over indoor smoking, forget cigarettes. Light up a cigar.

For a financial writer like me, the equivalent is calling for government spending.

Cue the fireworks … because I do.

You may be tempted to stop reading right here. Hear me out.

My take isn’t rooted in politics. As an economist, I approach taxing and spending based on an analysis of what it is meant to achieve, and whether there are any alternatives.

One thing is clear … if the United States wants to remain a great and prosperous country, we need to start investing in our future.

But the most important investments aren’t going to come from private enterprise. They must come from government.

Here’s why.

The Market Won’t Provide Everything

In the “circular flow” model of a market economy, individual households supply labor to businesses. They receive wage income in return. Businesses sell goods and services to those same households. Households use their wage income to pay for them:

The problem is that businesses will only produce goods and services that people will pay for. Yet there are many things people would gladly pay for … but businesses won’t produce them.

For example, shippers and consumers who need the products they carry all need lighthouses, and would happily pay for them.

But it’s impossible to run a lighthouse profitably. You can’t exclude someone who refuses to pay — known as a “free rider” — from its benefits. The light reaches everyone, payers and nonpayers alike.

So nobody pays. No lighthouses get built. Shippers avoid places without lighthouses, at their inhabitants’ cost.

A lighthouse is a “non-excludable” good — like national defense, urban firefighting and the justice system. That’s why all lighthouses are created and run by the government.

And there are other goods the free market doesn’t produce.

Such products must be provided on a mass scale to be feasible. That means a big capital investment. And because competitors could undercut them, rational businesses don’t make that investment.

Building a network to provide transport, electricity, water and sewerage, for example, is extremely expensive.

Businesses never invest in such products on their own. That’s why they are all public utilities.

No Prosperity Without Government

The diagram below shows the real world economy. It adds in foreign trade, financial institutions and government:

Note the arrows in the top right quadrant: taxes, government borrowing and government purchases.

Ideally, all those arrows should focus on things everyone needs and wants, but that the free market won’t provide on its own.

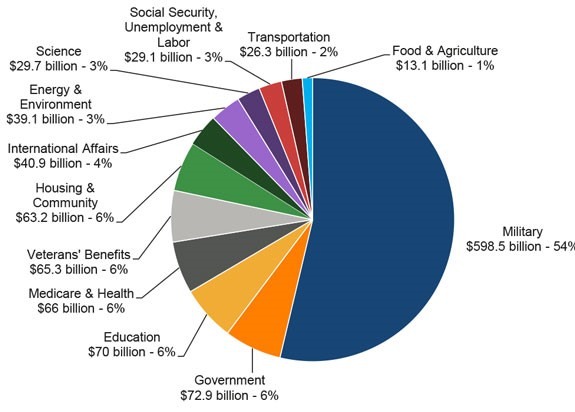

Here’s a recent budget for the discretionary part of federal spending — the things that Congress gets to choose every year:

Sixty percent of it goes to military spending and veterans’ benefits.

Less than 10% goes to things that could provide big benefits to everyone, including energy, science, transportation and agriculture. The $66 billion health budget is mainly Medicare.

There is no budget category at all for the critical infrastructure of modern life, like broadband access.

The bottom line is that, aside from military spending, relatively little of our nation’s discretionary budget is devoted to things that we really need but that the free market won’t provide on its own.

We can see the result in potholed highways, collapsing bridges and decrepit public transportation networks.

A Real-Life Example

My mother has lived in rural Tidewater Virginia since the 1980s. To this day, she can’t get broadband internet service.

Comcast and AT&T say there aren’t enough potential customers to justify rolling out necessary infrastructure.

The result is a dying community.

Young people can’t work in fast-growing technology jobs if they stay at home, so they leave. Working families wanting to move away from the city reject the area for the same reason. Older retirees stay away when they realize Zoom calls to the grandkids are impossible.

The result is plummeting property prices and tax revenues. The county can’t fund its schools, roads and public services such as policing and firefighting. The area is in decay.

One thing my mom’s county does have, though, is electricity.

That’s thanks to the Rural Electrification Act of 1936.

In 1930, 90% of U.S. farms had no electricity. Private producers told the Roosevelt administration there was no sustainable private enterprise model that could reach them.

So the 1936 Act made low-cost loans to nonprofit, rural electric cooperatives owned by their users. They financed transmission lines to connect to commercial electricity providers and wired rural homes.

This was the result:

You Don’t Get What You Don’t Pay For

If we want nice things — like a globally competitive economy that works well for everyone, not just the elite — we need to pay for it … so that government can provide it.

We can raise taxes or reorganize our budget to devote more of it to these things.

One thing we can’t do is nothing … unless we are prepared to tolerate a lot more communities like my mom’s.

And of course, as readers of my Bauman Letter know well, investing in companies positioned to benefit from that kind of government spending is a great way to make money!

Kind regards,

Ted Bauman

Editor, The Bauman Letter