A couple weeks ago, Ian King wrote about Modern Monetary Theory (MMT). He explained this idea and showed the problems with it.

MMT basically creates money out of thin air. If that’s possible, governments can pay for everything.

MMT is the perfect funding plan for the Green New Deal, Medicare For All and universal basic income. These programs will cost trillions. But by printing money, governments can cut taxes as spending soars.

This sounds amazing. And it simply requires changing how we think about money.

As consumers, we think money is a medium of exchange.

With money, we can buy meat, for example. Without money, we would have to barter for livestock and the services of a butcher.

Because money allows an economy to function, economists believed that there should be just enough money to support the economy.

Too little and the economy contracts. Too much money and inflation soars.

These beliefs are based on experience. The Federal Reserve decreased the money supply in the early 1930s, making the Great Depression even worse.

Many countries, notably Germany after World War I, printed too much money and created hyperinflation.

But this time, MMT proponents argue, is different.

Do Deficits Matter?

It’s interesting to consider that one of the leading proponents of this theory is Stephanie Kelton.

Kelton was chief economist for the Democratic Minority Staff of the Senate Budget Committee. She was also an economic adviser to Bernie Sanders’ 2016 presidential campaign.

MMT funds free college and other Sanders schemes.

They create deficits. But Kelton and MMT economists argue deficits don’t matter.

We just pay for things by printing money. Then we make debt go away.

The Mississippi Scheme

This isn’t a new idea. France tried it in the 18th century.

King Louis XV had a problem in 1719.

His brother, Louis XIV, ran up large debts fighting wars in Europe.

Plus, government spending exceeded revenue, and debt exceeded the country’s gross domestic product.

France needed money. But investors were leery of lending more to the spendthrift country.

A Scottish expatriate, John Law, offered a solution.

Law was in France after escaping from jail in England. He was a gambler and sentenced to death after killing a man in a duel. While on the lam, Law studied banking.

In France, Law acquired a controlling interest in the Compagnie du Mississippi. France created the company to trade with the French colonies in North America. That included land on either side of the Mississippi River and Louisiana.

Law cut a deal with the French government. The government gave him a 25-year monopoly on trade with the West Indies and North America. In return, Law would use his banking theories to eliminate the government’s debt.

He renamed his company the Compagnie Perpetuelle des Indes. Well-placed rumors about the discovery of gold and silver mines in the colonies pushed the stock price up.

To keep his part of the deal, Law required speculators to pay for their shares with a combination of cash and government debt. The central bank printed money so speculators had funds to invest.

By 1720, Law succeeded. France was debt-free.

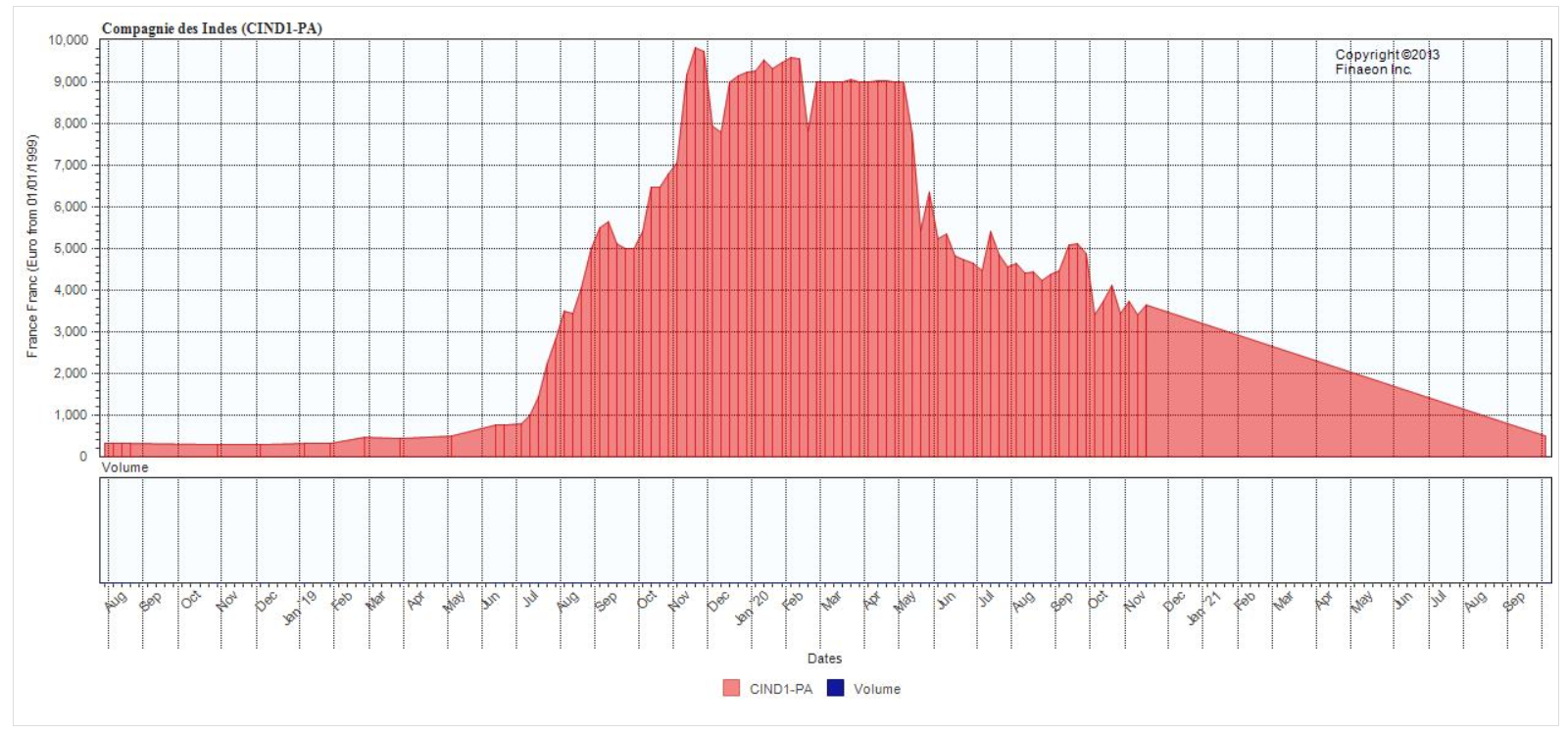

The story has a sad ending for investors, as the chart below shows.

(Source: GlobalFinancialData.com)

Law also faced a sad ending.

By the end of 1720, as the stock price fell, mobs confiscated his property, and he fled France for his own safety. A few years later, he died in poverty.

History Is Trying to Repeat

As Ian King noted two weeks ago: “Plus ca change, plus c’est la meme chose.” (“The more things change, the more they stay the same.”)

You might be thinking this sounds like part of the Green New Deal.

Advocates propose paying for this multitrillion program “the same way we paid for the original New Deal, World War II, the bank bailouts, tax cuts for the rich and decades of war — with public money appropriated by Congress.”

Government gets an equity stake in Green New Deal projects “so the public gets a return on its investment.” That return can fund even more benefits for citizens who made these wise investments.

This all sounds like a scheme John Law would come up with if he was alive today.

Regards,

Michael Carr, CMT, CFTe

Editor, Peak Velocity Trader