Interest rates aren’t going anywhere.

Federal Reserve Chair Jerome Powell made his hawkish stance clear during last Friday’s Federal Reserve meeting at Jackson Hole, Wyoming.

After months of economists’ debating, the Fed’s message is clear: Rates won’t be cut until we reach 2% inflation.

“We keep at it until the job is done,” Powell said. While this isn’t exactly a relief, at least it’s definitive.

But I also think he’s trying to take a page out of Paul Volcker’s playbook — when he raised the federal funds rate to 20% to kill off inflation.

It was a drastic move that ultimately helped him establish credibility with the markets.

But why?

Well, it wasn’t just that Volcker had brought the rate to 20%. It was the idea that if he needed to bring the rate to 100%, he would.

And this is basically what killed inflation. Because just like the crests and dips in the market, inflation can be very psychological.

Once you believe that prices are going to go higher, you will willingly pay them.

But here’s an important question — one that Amber and I are answering today…

What does all this mean for our stocks?

(Or read the transcript here.)

🔥Hot Topics in Today’s Video:

- Market News: Fed Chair Jerome Powell mapped out the next steps in the inflation fight at the annual Economic Policy Symposium on Friday. As expected, his stance was hawkish with a “higher rates for longer” position… [1:40]

- Mega Trend: It’s time to make way for the growing non-oncology precision medicine market — a rising frontier to watch! Buy this exchange-traded fund (ETF) to ride the trend. [10:02]

- Crypto Corner: Michael asks us about the prospects of a Grayscale Ethereum Trust spot ETF and the future of Ethereum. [15:50]

- Reader Question: How will the tech sector perform after the Nvidia report wears off? Plus, some comments from our Tide Riders! [19:15]

Until next time,

Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

China’s Helping the U.S. Reshoring Boom

Ian called it. Last year, he wrote that Uncle Sam was “firing” China and predicted a major reshoring boom in the United States.

He and I recently talked about how China is flirting with deflation, in a world in which virtually every other country is struggling with sticky inflation. Of course, this partly is because of the drive to disengage from China. A breakdown in trade between China and the West is simultaneously contributing to inflation here and deflation there.

So what’s the reality of China’s economy?

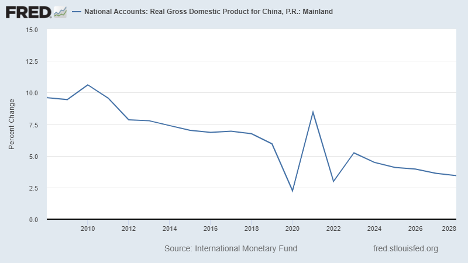

Let’s take a look at some recent stats. It wasn’t that long ago that China’s gross domestic product grew at 10% per year, or even better. Not even the 2008 meltdown, which wrecked the global economy, had a noticeable impact on growth.

But starting around 2010, China’s growth started to sag … and it never really stopped.

(The figures below, shown beyond the second quarter of 2023, are estimates by the International Monetary Fund).

The consensus among economists is that China’s economy will grow at about 5% this year. That might not sound bad to us, but remember, this is a country that was growing at 10% per year not that long ago.

And by 2028, the growth rate is expected to be closer to 3%. Also remember, these estimates likely don’t take into account the full impact of reshoring, as most economists are just starting to recognize this as a trend.

The numbers actually get worse the deeper you look. Bloomberg did a survey of economists and found that exports are expected to drop about 3% this year. The previous survey from earlier this year had economists forecasting a reduction of about 2.3%, so it seems that they are coming to realize that the reshoring trend is accelerating.

But for an even great sign of weakness, the same survey estimated that Chinese imports would drop 5.6% this year, up from the previous estimate of a 2.8% drop.

Yes, we think of China as an export country, but China imports goods and services from overseas. And as belts get tightened in China, there is less demand for imports.

And remember my comments on deflation?

Well, the survey expects that the Chinese Producer Price Index will fall by a good 3% this year.

The great reshoring boom of the next decade is a trend we plan to follow … and we expect to profit handsomely from it.

But the other side of that coin is the great implosion of the Chinese economic miracle. This too will potentially set up some spectacular opportunities to profit, as American companies bring their production plants and facilities back into the U.S.

And Ian’s latest research is focused on how several of these companies (and even Wall Street) are investing in small towns … in a tech innovation that’s already disrupting virtually every sector of the market.

Regards,

Charles Sizemore

Chief Editor, The Banyan Edge