The Federal Reserve decided not to increase the federal funds rate when it met last week.

Its median forecast shows no rate hikes this year at all. That is down from two in December.

In 2020, only one hike is expected.

This was not good news for bank stocks:

(Source: Wall Street Journal)

Bank stocks fell 10% in the week that followed, as measured by the KBW Bank Index.

Boy, it sure is tough to be a bank.

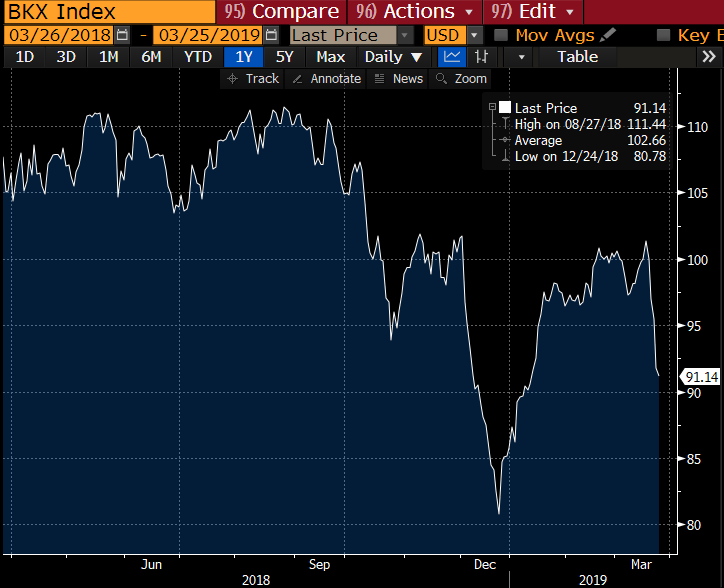

When the Fed raised rates in December, bank shares fell too:

(Source: Bloomberg)

Shares fell 6% after this increase. That continued a fall in their prices that began on December 3.

As an investor, this should be confusing. Banks go down when the Fed raises rates and when it lowers them?

It doesn’t make much sense.

So, what are you to do?

We’re Not in a Hurry

The trend is your friend … unless it’s not.

The KBW Bank Index is currently moving in the wrong direction:

You don’t need to try to time the bottom.

Wait for bank stocks to begin moving higher before you consider taking a position.

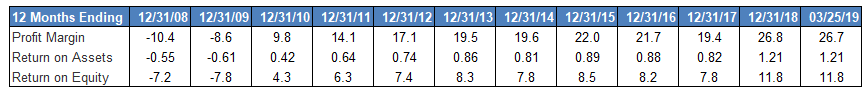

Bank Fundamentals Are Solid Today

Bank finances are as strong as they have been in a long time.

Profit margins and return on assets of the 24 banks in the index haven’t been this strong in a decade.

Plus, these banks are yielding more than 2.8%. That’s nearly a full percent more than the S&P 500 Index.

There are other reasons to be less worried about banks, too.

The financial media has been talking a lot about the inverted yield curve.

This occurs when the shorter-term Treasury yield is greater than the longer one.

(Remember, yield is the interest payment divided by price. Treasury yields go up when prices fall. Like a dividend yield and a stock price.)

If banks raised money and lent it based on these rates, it would be bad.

For example, it would be a problem if banks had to pay customers more on their savings accounts than they could lend the money for. Your bank wouldn’t stay in business for long.

Luckily for us as bank investors, that’s not how banks work.

An Important Distinction

The 3-month Treasury yield is about 2.44% today. Most banks don’t pay their customers that much, though. You can find an example here and there, but not many.

(If your bank pays you that much on your checking or savings account, please let us know at SovereignInvestor@BanyanHill.com. We’d like to know the name/city of your bank, the rate/type of account and a link to the bank’s rates, if available.)

Per Bankrate.com, the average savings and money market rates are 0.10% and 0.21%.

Further, banks don’t lend money at 10-year Treasury bond rates. They make a lot of loans at LIBOR rates.

LIBOR stands for the London Interbank Offered Rate. LIBOR is the most liquid and common interest rate index in the world.

(Please note, some of their rates are based on the fed funds rate, so there is exposure here. My point is not all of them are.)

You can see why that distinction is important here:

The yellow line is the 10-year bond yield. The pink line is the 3-month LIBOR.

Many bank loans are based on the LIBOR rate. (For example, LIBOR plus 2%.) About half of adjustable-rate mortgages in the U.S. are. And private student loans, too.

You can see the LIBOR rate is currently 21 basis points (2.6099% minus 2.393%) greater than the bond yield. And it has been more stable than the U.S. rate.

Banks make more on each loan if they base their lending on the higher rate.

So, given the makeup of bank assets, the picture isn’t quite as bleak as one might think.

The Bottom Line for Bank Stocks

We need to be careful here.

The Fed slowed its interest rate increases. One reason it did so is it may be worried about global growth. If the world slows down, so will U.S. banks.

That said, I showed you above why the picture isn’t as bleak as the market’s sharp recent sell-off of banks suggests.

That doesn’t mean you should buy banks right now, though. I recommend you don’t ever buy something while it is falling.

However, you should look at them again when the bleeding stops. In the meantime, put together a wish list of bank stocks and consider this strategy:

Banks are as healthy as they’ve been in a long time. And the Fed keeping rates low should encourage people to borrow … which will help bank prices, too.

Good investing,

Brian Christopher

Editor, Insider Profit Trader