I don’t know what this says about me, but if something is too popular … I’m skeptical.

Sometimes it’s a small trend. Maybe my neighbors are talking about how great the new coffee shop down the street is. Then my wife mentions how snug it was. Or, for Pete’s sake, my toddler says she likes the muffins there.

Of course, I’m only human. I eventually admit (somewhat grudgingly) that the new coffee shop is actually the promised land.

But, on the other hand, sometimes it pays to be a contrarian.

Nobody trusts the stock market right now. Every time there’s a multiday rally like last week, it’s quickly dismissed as a “bear market rally.”

This is where contrarian investors thrive.

I’ve been here before … and as long as the earth keeps on turning, I’ll be here again.

I lived through the dot-com bubble, the 2008 crisis and the 2020 COVID crash. And every time, the media were all up in arms about this being the next “Great Depression.” They said that stocks would be down for 10 years and that it was time to get out of the asset class for good.

Yet every time, within the next six months to a year … assets were either at all-time highs or headed back there.

Now, I’ve made no secret of the fact that I expect a Middle Class Massacre over the next year…

Where, as the rich get richer and the poor get poorer, the people left in the middle will get squeezed…

But you don’t have to be caught unprepared.

In spite of everything, there’s one class of stocks that I expect will rally amidst the bloodshed…

Finding Opportunities Amidst the Bloodshed

There’s an old saying on Wall Street: “When it’s time to buy, you won’t want to.”

At heart, I’ve always been a contrarian. And I can tell you, it’s not easy. Especially after last year, it seems easier to go with the herd and sit on the sidelines, bracing for more losses.

However, some of the biggest opportunities are found going against the grain.

Let me give you an example from my hedge fund days, back during the financial crisis.

Back in early 2009, stocks were plummeting, home values were tanking and banks like Bear Stearns, Washington Mutual and Lehman Brothers all went bankrupt.

It was a scary time to be an investor. Especially after the weaker banks fell like dominoes.

But as a student of economic history, I knew that it was not the time to be fearful.

So while everyone was selling, I saw the opportunity of a lifetime staring me in the face.

And I went ALL-IN.

I doubled down on the best opportunities just like Jesse Livermore, Franklin Templeton and Tudor Jones did to make their fortunes.

Ultimately, I ended up capturing a game-changing profit for my hedge fund at the time. Enough to put us on the map.

And right now, I’m spotting the same kind of opportunity in small-cap stocks.

If you read my last article, you know I’m bullish on small caps for a lot of reasons. But since then, market activity has confirmed my expectations.

After Fed Chair Jerome Powell announced another interest rate hike last week and stocks rallied, small caps rallied even harder.

Just look at the data. The S&P 500 is up 2.2% in the last five days. The Russell 2000, a small-cap benchmark, is up 3.5%.

This is no surprise to me. Because my research shows that, historically, small caps are the biggest winners as the market recovers.

The National Bureau of Economic Research confirms: “Small caps have significantly outperformed large-company stocks in the first year following a recession.”

By historical measures, with two quarters of negative growth to start 2022 — we’ve already gone through a recession. And there’s a good chance we could avoid another one this year.

That’s why the iShares Russell 2000 ETF, which tracks small-cap stocks, is up over 10% to start the year.

iShares Russell 2000 ETF Year to Date

But finding these small-cap winners is easier said than done.

It’s one thing to pinpoint the section of stocks you expect to race up. And it’s something else entirely to home in on that one promising stock that winds up delivering a year- or decade-defining return.

To find those, you have to be able to cut through the clutter…

My 4-Part Strategy to Target Winning Stocks

For much of my investing career, I’ve been following a four-part strategy for pinpointing winning stocks in any kind of market.

Here’s what I do:

- I narrow the universe of stocks down to a particular market capitalization. In this case, I’m looking at market caps between $100 million and $2 billion.

- I determine if the company is an industry disruptor. (Is it revolutionizing its sector like Netflix did streaming?)

- I crunch the numbers, particularly revenue growth. I want to make sure the company is headed in the right direction.

- And then I look at S-3 filings from wealthy investment firms to see whether the smart money is buying in. That tells me it’s go time.

But, if you’re like me, it’s easier to see this system in action. So let’s look at OpenTable, the restaurant reservation site, as an example.

The company went public just after the financial crisis back in 2008. The markets were brutal back then.

With a market cap of $619 million, OpenTable immediately passed my first step. So let’s move into step two, where I analyze its disruptive potential.

On the surface, OpenTable looked like a bad play — the restaurant industry was getting hammered at the time.

But to make a bear market fortune, you have to be willing to go against the grain.

Now keep in mind, this was back in 2008 — right after the iPhone first released. Everyone was missing the bigger picture.

The restaurant industry wasn’t dying — it was on the verge of disruption.

The way people found places to eat, ordered food, set up reservations … it was all about to change. Soon, everything was going to be done from a smartphone.

OpenTable was at the forefront of it all, as a single platform that people could use to make a reservation at ANY restaurant.

That’s what you see when you analyze disruptive potential.

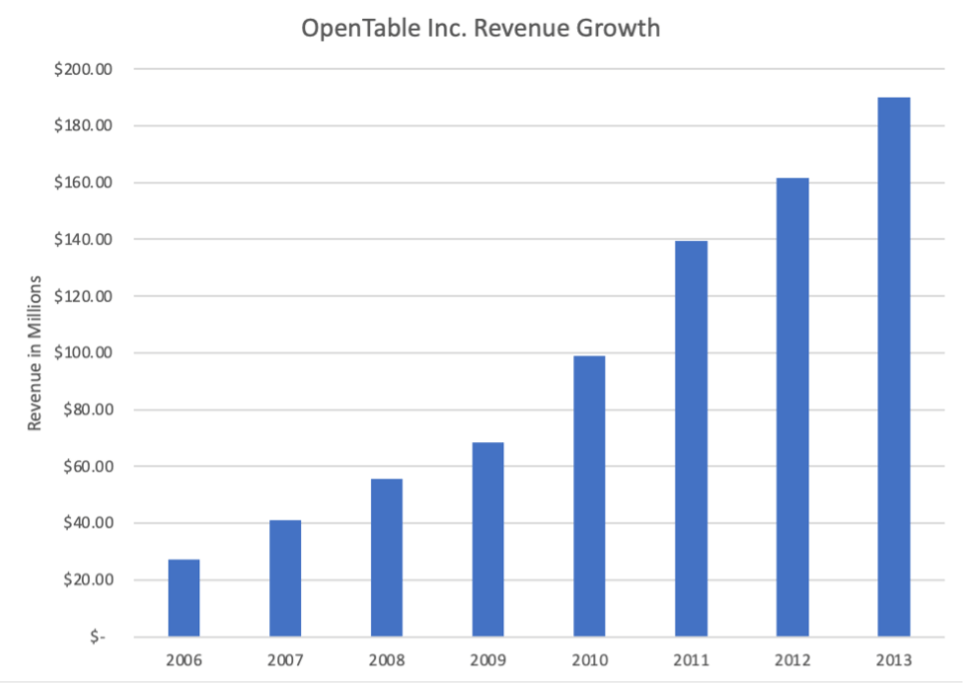

But that’s only one step of my analysis. Which leads to my third step: crunching the numbers.

Revenue growth — my most important metric — was off the charts for OpenTable. Even before it went public, it was steadily growing.

In just three years, the company had doubled revenues, and it kept climbing from there.

So nothing indicated the company was struggling financially. Even during the Great Recession, the company was still growing.

But I still had one final check to do. I needed to see if the smart money was buying in.

And sure enough, it was.

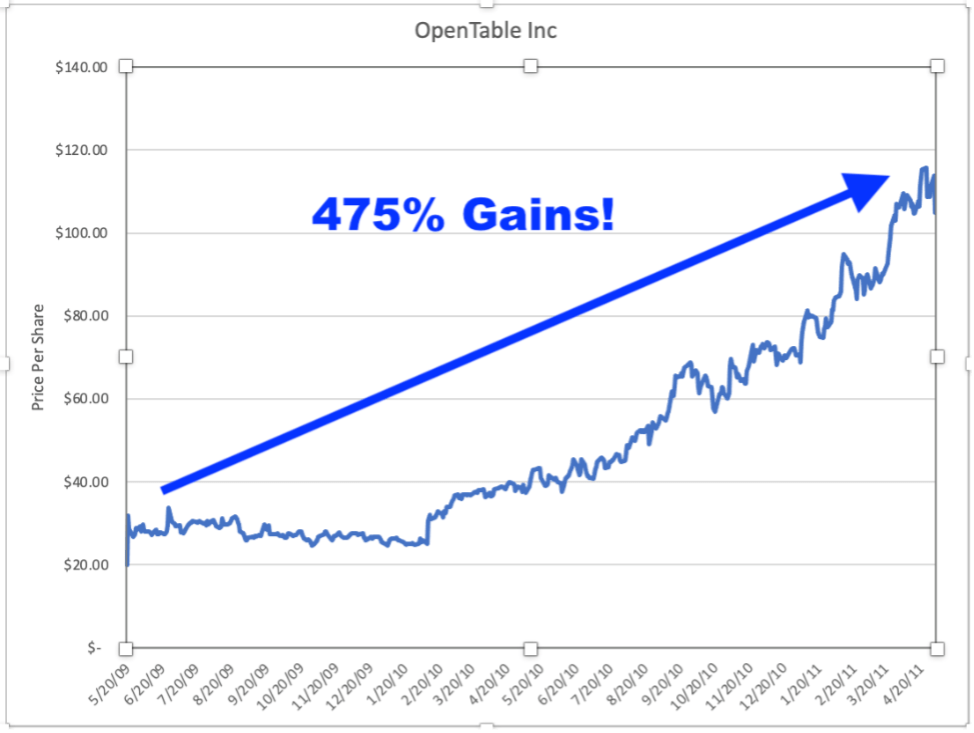

On January 30, 2009, shortly after OpenTable went public, Bank of America Securities quietly invested almost $70 million. Right in the middle of the recession.

That’s a pretty clear indicator that the smart money was confident about OpenTable’s future.

My strategy would’ve flashed a buy signal at $20 a share.

Within 15 months, it was trading at $115 a share.

A 475% gain, at a time when the market plummeted nearly 50%.

Talk about a bear market fortune!

These opportunities are all around us when things get tough. It just takes some digging.

Here’s Your Ticket to a Bear Market Fortune

If you’d like to see this strategy in real time, I suggest you check out my Extreme Fortunes research service. Over the past 90 days, several of the small-cap stocks I recommended to my readers using this exact strategy are already up by as much as 45%.

But you need to do so today — we’re closing down this limited-time offer tonight at midnight ET.

Click on the link right here for all the details.

In the meantime, I’d love to hear from you. Write to the team and me at BanyanEdge@BanyanHill.com.

Here’s what we want to know: What are you buying?

Are you going all-in on value, growth, small caps, cryptos? Or are you stashing your cash under your mattress?

I’m looking forward to reading your responses.

Regards, Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Read Strategic Fortunes reviews from real subscribers here!

Market Edge: A Tax Hike I Can Get Behind

I have trouble getting my children to read. Once they sit down and start, they generally like it. But getting them to start is the issue.

So … I bribe them! I offer my sons candy if they sit down and read … proportionate to the number of pages they read.

I’m probably not winning any “father of the year” awards … and getting them to brush their teeth is another challenge I haven’t quite figured out.

But lo and behold, my sons are reading more than they did before.

I was thinking about this as I read that President Biden will propose quadrupling the tax on corporate stock buybacks in his State of the Union address tonight. (The Inflation Reduction Act set the tax rate on buybacks at 1%.)

Now, the president can propose it all day long… In a divided Congress, it’s not likely to pass.

But let’s just say it does. Believe it or not, this would have major benefits to mom-and-pop investors: namely a surge in dividends paid.

Hear me out…

Like my children, people do what they’re incentivized to do. And this is one of the major reasons companies prefer stock buybacks over dividends.

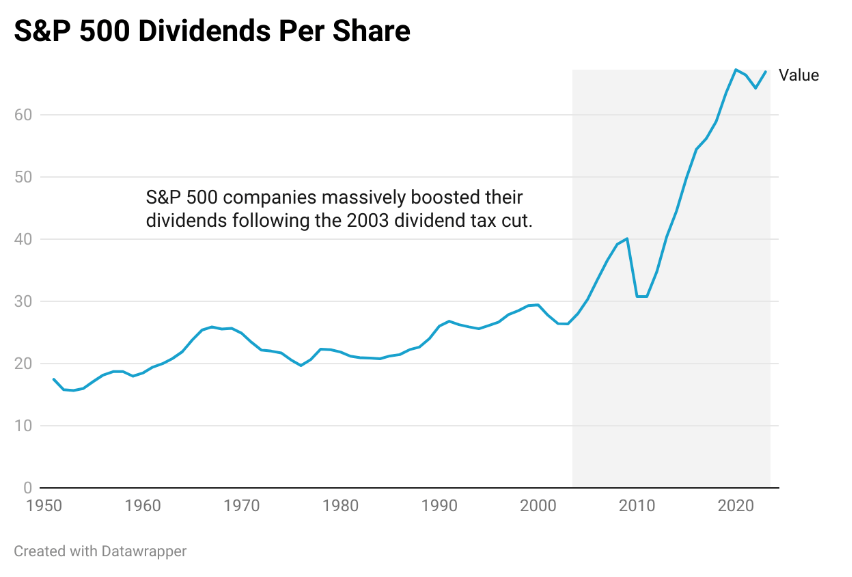

Dividends are taxed twice. Companies pay taxes on the earnings used to pay the dividends … and then the investors have to pay taxes again on the dividends they receive.

Before 2003, dividends, like bond interest, were taxed at the investor’s marginal tax rate, meaning investors were losing as much as 50% of their taxes on dividends.

Big shock … dividends weren’t popular, and the dollar amount of dividends barely moved between 1960 and 2002.

But following the Bush tax cut, qualified dividends were taxed at only 15%. And then like clockwork, dividend payments suddenly went through the roof.

Now, I’m no fan of tax hikes. But if the government is going to get its money from somewhere — and I can choose what it taxes — I’d rather it tax buybacks than my earned income … or even my dividends!

If I had my way, I’d tax dividends at a lower rate than buybacks because, frankly, I’m more confident that dividend-paying companies’ interests are better aligned with shareholders.

I don’t see major movement here anytime soon. But the sooner Biden formally proposes it, the sooner it becomes part of the discussion … and the sooner it comes to becoming reality.

And if that happens, it will create a wealth of new opportunities for income investors!

To a better kind of investing,

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge