If you’re following the news, you know things are pretty rough out there…

Record-high inflation. Soaring mortgage rates. The worst stock sell-off in 50 years.

Well, according to my research, that’s just a preview of even more madness in store for the markets over the next few years. But, the good news is, with technology accelerating, there’ll be more opportunities to make money than ever. You just have to know how to navigate the markets.

How do you do that?

I recently went searching for the answer to that very question.

I wanted to find the best way to make order from chaos in any market. A way for my readers to protect themselves from the losses we’ve seen recently, while still giving themselves the opportunity to make huge gains.

Not long ago, I found what I was looking for.

I came across a man named Keith Kaplan. Keith’s one of America’s top data scientists. He’s also the head of TradeSmith, one of the largest financial data analytics companies in the world.

He and his team have spent over $18 million and 50,000 man-hours developing a system that tracks virtually every asset on the market — stocks, bonds, funds, you name it — and pinpoints the optimal time to get in and out for a chance at maximum gains.

It’s the type of technology I saw the top firms on Wall Street use when I worked there … but Keith’s system is specifically not for Wall Street. It’s for the everyday person.

And it’s an absolute retirement game-changer…

That’s why I asked him to sit down with me today for an interview on his exclusive system. Read on below, and learn why right now is the best time to start using it.

TradeSmith Helps You Beat the Billionaires With 1 Click:

An Interview With TradeSmith CEO Keith Kaplan on the “TradeStops” System

Ian: Thanks for taking some time out of your busy schedule today to answer a few questions for my Banyan Edge readers and me, Keith.

I wanted to interview you because, frankly, you and your team are doing great work over at TradeSmith.

You’ve spent the last 15 years building financial technology tools for the Main Street investor. They’re the same types of tools that I used at hedge funds, but much easier to operate.

I find your work fascinating. Can you tell me a little bit more about your TradeStops system?

Keith: Thank you for having me, Ian … and absolutely!

It all starts with understanding the risk and health of any individual stock or fund. That’s key.

We built several algorithms that tell you just that. They look at each of the thousands and thousands of securities in our system.

(To make this simpler, I’ll just say “stocks” from now on. But I want your readers to know that our systems covers everything from stocks and mutual funds to exchange-traded funds and commodities. Even cryptocurrencies!)

We assign a number to each stock, and the lower the number, the lower the risk. And we assign a color: green is healthy, yellow is caution and red is unhealthy.

But there’s another point we look at: the buying and selling activity of billionaires. Do you know how we get the data on what stocks they’re buying and selling, Ian?

Ian: Sure, Keith. Every quarter, billionaires have to file a report with the SEC called a 13F. This report covers tells the SEC everything these individuals bought and sold over the last quarter.

Keith: Yes, exactly! In our TradeStops system, we grab every quarterly 13F filing from the SEC and load the stocks that nearly 30 billionaires are buying and selling into our product.

This means that anytime you want, you can log into our system to see what these billionaires are buying and selling each quarter. It’s really cool.

From there, you can see which stocks are healthy and which are not. And you can also find the level of risk each stock has currently.

Ian: I agree, that’s really cool. And it’s unique.

I’ve certainly seen some systems out there that do similar work. But what you do on a stock-by-stock level with health and risk is unlike anything I’ve seen in the past for Main Street.

So, can you show our readers how people can act on these billionaires’ stock picks?

Keith: Here’s where things get really fun.

People don’t typically know how much money to put into a stock, or multiple stocks, that they’re buying.

At the click of a button, our system can tell you not only how risky or healthy a stock is … but how much of that stock to buy. Especially when comparing it to your existing portfolio or other stocks that you’re buying at the same time.

And we have a whole set of super user-friendly tools that help you determine what to buy, when to buy it, how much to buy and when to sell it.

Ian: And you pull that all together in your Pure Quant Portfolio Builder tool (which I love, by the way).

Keith: Yes, we do. The Pure Quant Portfolio Builder tool pulls together everything we do in our system into a simple and graceful three-step process.

It’s built on literally 15 years of research, back testing, algorithms and data in our system…

First, you tell the tool what source of stocks you like. That can be anything from a broad index, like the S&P 500 Index … to your Strategic Fortunes newsletter, Ian … to anything you want.

You then tell it how much money you have to invest, such as $10,000 or whatever you’d like. And finally, you tell it how many stocks you’d like to buy.

The tool then does all the work to build you a perfectly risk-balanced and diversified portfolio of stocks.

The results read like a recipe for investing, and it’s so simple to use.

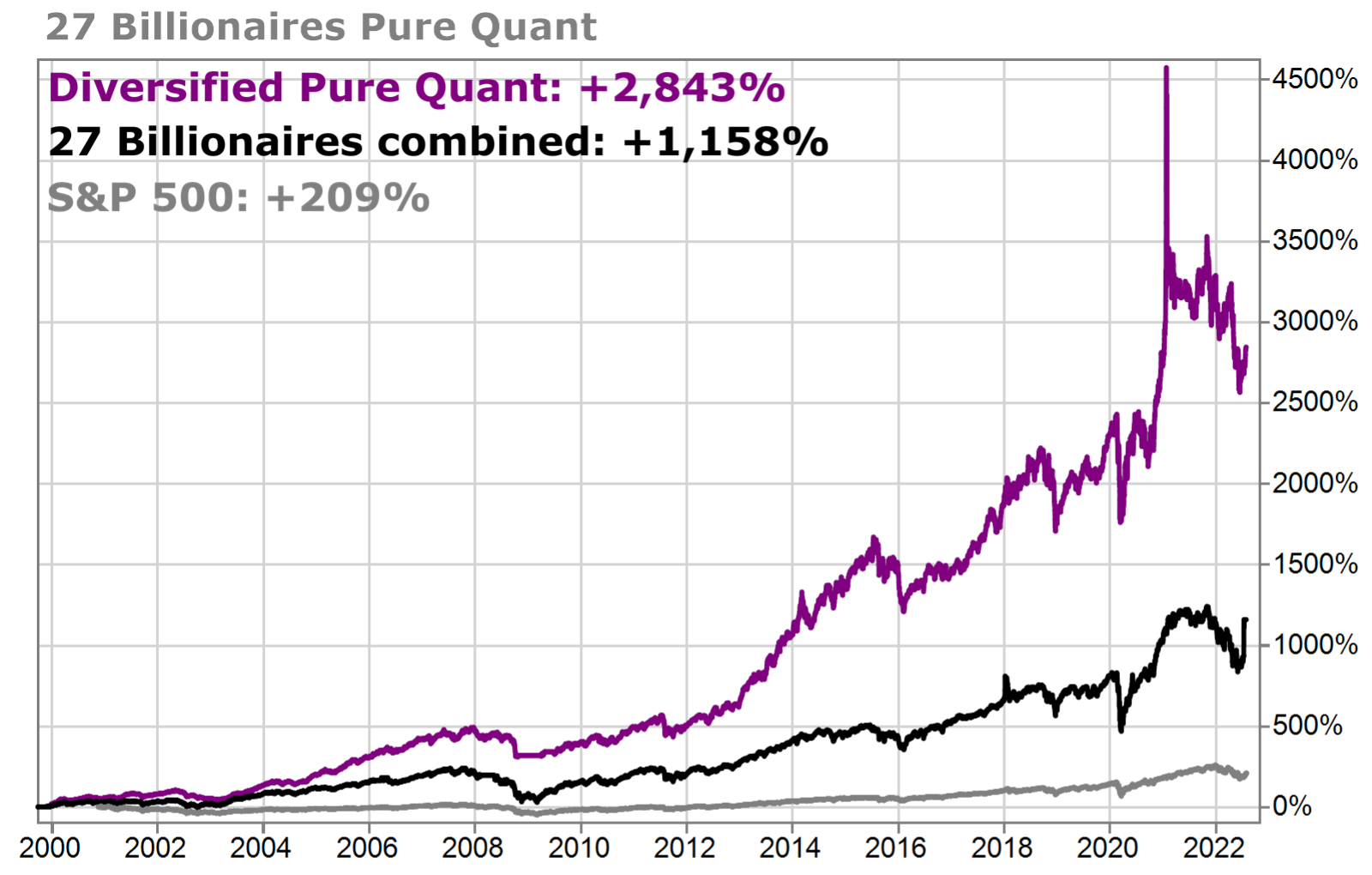

Here’s a great example of just using those billionaires’ stocks in our system over nearly 20 years. You’ll see two things:

- The stocks the billionaires bought over this period of time greatly outperformed the S&P 500. That’s incredible by itself.

- We more than doubled the billionaires’ performance by using their same stocks and leveraging the Pure Quant Portfolio Builder along the way.

Ian: Keith, you put together great tools that are not only easy to use, but that also do some really sophisticated stuff behind the scenes.

Having tools that help Main Street investors know what to buy, when to buy it, how much to buy and when to sell is an absolute game-changer for folks without access to hedge funds and Wall Street. You’re doing incredible stuff here!

Thank you very much for joining me today.

Keith: You’re welcome! Always a pleasure. And I look even more forward to our live webinar next Tuesday.

Build & Protect Your Portfolio: Join Us for the “1000% Project”

To date, over 68,000 investors have used TradeSmith’s tools to grow — and most importantly, protect — over $30 billion in wealth.

Jon L. said: “I literally avoided catastrophe by using this.”

Patti S. noted: “This has saved me a lot of money in this volatile market.”

Theresa H. commented: “I feel much safer with you on my team. Keep up the great work. You guys are mathematical geniuses.”

These are just a few examples out of an entire community of people who have been using Keith’s products to get ahead of the market’s biggest moves.

But seeing is believing … and you can’t fully understand how big of a game-changer these tools can be to your wealth-building efforts and your peace of mind without trying them for yourself.

That’s why I’m hosting a special event with Keith next week to lay all our cards on the table.

We’re calling it the “1000% Project.”

You’ll discover not just how to build your portfolio — but how to protect it during volatile times.

All you need to do is click this link to sign up for our webinar on Tuesday, January 24.

I look forward to seeing you there!

Regards, Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Market Edge: It All Comes Back to Risk Management

A few months back, I wanted a new bike. Or at least I thought I did.

I love playing basketball, but my creaky knees aren’t getting any less creaky with age. I needed a new outlet.

My apartment in Lima is just a quick hop, skip and jump away from the Miraflores Malecón, or sea wall, which has a fantastic bike trail that runs along the sea. Cycling seemed like a no-brainer.

But then I went to the bike store and was utterly overwhelmed.

There were road bikes … gravel bikes … hard-tail mountain bikes, full-suspension mountain bikes… and each broad grouping had seemingly infinite subcategories and variants.

I had too many options, making the experience overwhelming and burdensome and almost turning me off to the idea completely.

I eventually just asked a friend who was an experienced cyclist to choose one for me. His choice may or may not have been better than what I would’ve ultimately came up with on my own. But it made my life a lot easier.

Risk management can be the same way. Every smart investor knows they need risk management in place. But there are infinite risk management techniques to choose from, and even something as simple as a stop-loss has nearly infinite variants.

Reading today’s interview, I nodded knowingly when Ian mentioned TradeStops. Because I’ve used the service for years. Here’s why…

Setting a proper stop-loss is something I always struggled with. I experimented with using a blanket 20% for all positions … but that didn’t really make sense because some stocks are naturally far more volatile than others.

I tried setting stops based on each stock’s recent support levels. But that was a little too subjective for my tastes, and it didn’t work particularly well for stocks that were in solid uptrends.

That’s when I discovered TradeStops’ volatility-based stop-losses. The model sets a recommended stop-loss for each individual stock based on its historical volatility. This helps to separate the signal from the noise.

Now, I don’t put a stop-loss on every position. I own a few “forever” stocks that I am comfortable holding even through a nasty bear market. Most of these are dividend-focused stocks that I’m confident will continue throwing off their dividends regardless of what happens. But for the vast majority of the stocks I buy, setting stop-losses helps bring structure to my investments.

I only have so much mental bandwidth. And by using volatility-based stop-losses, I take one very mentally taxing question off the table. I don’t have to agonize over when to sell a position. I sell it when it hits its stop. End of story.

That’s why you’d be doing your future self a big favor to join Ian King and Keith Kaplan next Tuesday, and learn what the TradeStops crew has been working on for 2023. I guarantee it’ll give you the peace of mind we all deserve after the volatility of last year.

Speaking of mental bandwidth … I hope you got a chance to listen to Mike Carr and myself push our nerd cred to the limit on yesterday’s podcast. I haven’t had so much fun with a data set in what feels like years.

If you missed it, catch the replay here. See where the numbers take us!

Charles SizemoreChief Editor, The Banyan Edge Charles SizemoreChief Editor, The Banyan Edge |