A $4.5 Trillion Powder Keg

Great Ones, I know that I’m not the most bullish talking head when it comes to the stock market. But every now and then, I get a little bit tired of listening to the sound of my bearish tears. Don’t you?

Yeah … you’re such a bearish crybaby, Mr. Great Stuff, especially on hydrogen stocks…

Nice try, but I’m not going on another hydrogen rant today. No, today, I have 4.5 trillion reasons to believe that this bull market has room to run … assuming everything continues to go well with the pandemic rebound.

According to Fundstrat Global Advisors Founder Thomas Lee, there’s a $4.5 trillion powder keg just sitting on the sidelines right now, and the U.S. economy is giving off sparks.

But wait, where is this massive load of cash? In a combination of institutional and retail money market funds.

Wait … what?

Oh, come on. Don’t tell me you don’t know what a money market fund is?! These are like the most basic funds available. They specialize in cash and cash equivalents, are highly liquid (i.e., easy to trade) and are very low risk.

If someone says they’re holding cash in their portfolio, they likely mean they are invested in a money market fund. Nobody actually holds cash anymore … get with the times!

Anywho, Mr. Lee says that some $3 trillion in institutional cash is currently sitting in money market funds — the highest such reading since June 2020. Additionally, retail investors are hoarding roughly $1.5 trillion in money market cash.

“Total cash on the sidelines is $4.5 trillion = tons and tons of firepower on the sidelines. This bodes well for April equity gains,” said Lee. With the U.S. economy continuing to strengthen and the vaccine rollout gaining momentum, Lee believes that the “face ripper” rally on Wall Street will continue throughout April.

All investors need now is a little more confidence in the economic rebound and the pandemic vaccination rollout … and Bob’s your uncle.

At this point, you’re probably wondering what investments are best-positioned to take advantage of this explosive stockpile of sideline cash. Well, Lee believes that small caps, energy and cyclical stocks are the places to be. I tend to agree, but with a few caveats.

Cyclical stocks like finance and banking stocks, energy producers and industrials are a solid choice. Not only are they a solid defensive bet against inflationary pressures, but they also gain during a period of economic rebuilding.

The Great Stuff Picks portfolio currently holds a smattering of cyclical plays, including Boeing (NYSE: BA), CarMax (NYSE: KMX), Cummins (NYSE: CMI) and Applied Materials (Nasdaq: AMAT).

Energy is a perennial favorite for periods of economic growth. But here, I’d argue for alternative energy companies … or at least companies with heavy green portfolios. NextEra Energy (NYSE: NEE) and Plug Power (Nasdaq: PLUG) are a couple of the Great Stuff Picks on that front.

Finally, small caps always lead during a bull market, making them a no-brainer pick to benefit from the $4.5 trillion in sideline cash.

Here, I’ve chosen to combine energy and small caps for some real powerhouse potential … if you have the risk tolerance and patience to ride it out. Decarbonization Plus (Nasdaq: DCRB) — aka Hyzon Motors — is the Great Stuff Picks trade on this front. Be patient; it will come around.

Editor’s Note: I Ran Out Of Patience … What Else Ya Got?

Elon Musk is famous for his billion-dollar early investments in PayPal, SpaceX and of course Tesla, all of which made him the world’s richest man. So, it might sound hard to believe, but his next billion-dollar bet could be the biggest payout of all … and almost nobody is talking about it.

It’s not in 5G, space or solar. Elon’s making his next big innovations in America using this emerging technology, and he’s not the only billionaire in this race. Yet, I believe they will all get beat by one North Carolina company that holds the key to making this tech a global manufacturing power.

Click here for the full story.

The Good: Building Blox

I have to be honest with you, Great Ones. I don’t understand the appeal of Roblox (NYSE: RBLX). Considering that I’ve been a gamer my entire life, that says something.

I mean, I’ve played Pong and Combat, for heaven’s sake.

What I do understand, however, is that Roblox added more than 80 million users in 2020 alone. The game now has roughly 199 million monthly active users.

I told my eldest daughter this information, and her response was: “Eeew.” So, I guess I’m not alone.

Even so, let’s put Roblox’s numbers in perspective: Netflix ended 2020 with about 203 million subscribers. And Netflix’s market cap is about $200 billion more than Roblox.

If that seems like an opportunity … you’re not alone. This morning, a veritable flood of analysts initiated coverage on RBLX:

- Goldman Sachs: Buy rating and an $81 price target.

- Bank of America: Buy rating and a $70 price target.

- Morgan Stanley: Overweight rating and an $80 price target.

- Truist: Buy rating and a $78 price target.

Now, I may not be hip to the current generation’s taste in video games, but I’m certainly hip to investing lingo. And RBLX has considerable potential if it can hold on to its pandemic subscriber gains.

The Bad: Papers Please

Buffets might be back on the menu … if you make it past the passport check.

Like any salty sea dog stuck on the beach, Norwegian Cruise Line (NYSE: NCLH) is itching to head back out to sea ASAP. Joining Royal Caribbean’s (NYSE: RCL) lead two weeks ago, Norwegian got with the CDC about plans to start sailing as soon as July 4.

And just like Royal Caribbean, you’ll have to have proof of vaccinations before getting on the gangway.

No matter how you personally feel about vaccination passports and what have you … after a year of idling and cash-burning, any sign of future sailing is mega optimistic for Norwegian. Honestly, the public reaction to vaccination passports (VaxPasses?) is the only reason why Norwegian is today’s “bad.”

Sure, I’d expect limited passenger counts (and limited passenger revenue) once these sailings start. But for Norwegian, any cash coming on board is better than losing more millions by the day. NCLH investors cheered the news, sending the stock up 6% today.

The Ugly: Play The Game

It finally happened: GameStop (NYSE: GME) finally announced that it might sell up to $1 billion in stock.

After a roughly 900% run-up due to Reddit “diamond hands,” it’s about time.

If anyone should take advantage of GME’s situation, it’s GameStop itself… I’m just surprised it took this long.

This is a bit of bad news for all those GME hodlers over on WallStreetBets — share dilution doesn’t help their plan of bidding up the share price to force short sellers to capitulate.

However, based on Thursday’s closing price, analysts believe that GameStop could pull in about $670 million to help speed up its plan to go full-on e-commerce. While I applaud billionaire Ryan Cohen — GME’s No. 1 shareholder and GameStop board member — for his aggressive tactics, I’ll believe that GameStop is an e-commerce contender when I see it.

Buried amid the stock sale news was a report that GameStop saw global sales rise 11% in the prior nine weeks.

Not bad, GameStop. Not bad. However, it still doesn’t justify the company’s ridiculous valuation. Unless you’re into rampant speculation, avoid GME shares.

We’ve talked at length of Roku’s (Nasdaq: ROKU) role as one platform to access nearly every streaming service, even long-term holdouts like ahem HBO Max. For Great Stuff Picks readers, ROKU’s also a simple way in on the frothy, finicky streaming market — and quite a profitable one, might I add.How many markets can one streamer rule? All of them, as it turns out.

But what about free video? What about all y’all out there streamin’ in the free world?

I may be out of the loop in the realm of Roblox, but where streaming’s concerned, AVoD’s about to be all the rage. That’s “ad-supported video on demand” for anyone unversed in analyst lingo.

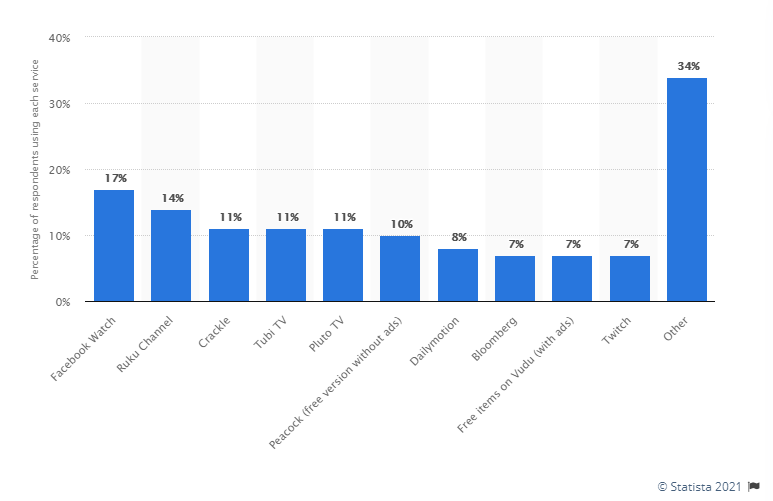

Other than YouTube, here are the most popular AVoD services in the U.S. and Canada, courtesy of Statista:

Check it: The king of streaming has risen once again. Roku’s already king of the stacked streaming race, and with free ad-supported video, it’s making its way up to the top in short order.

The only other services sharing the same rarefied ad-supported air as ROKU … are mostly mobile. On that front, YouTube’s a shoo-in for the AVoD market it helped create, and don’t get me started on the default app Stockholm Syndrome that’s propelling Facebook Watch…

Well, the streaming market is about to reach an inflection point — if it hasn’t already. How many new streaming services have you seen launch recently? Too many. We might as well jump on the bandwagon with Great Stuff Plus…

Unless you’re a daily streamer, people will stop wanting to pay for additional premium services, and we’re about at that point now.

A couple things happen from here: People will want to either dummy down their stable of paid streaming services or have one easy way to reach all of them. Roku covers both.

Then there’s the free market … where I think ad-supported services will see a resurgence. It’s easy to sample a service’s selection without adding it to a packed monthly streaming budget. And anyone who knows their way around an adblocker is A-OK with the freemium services, but I never said such a thing.

Roku already leads the connected-TV market right now, and since it has the biggest install base for connected TVs, it should continue to lead. The AVoD market you see in the chart above is just sweet icing on the paid cake.

Remember, Roku just bought out Nielsen’s advertisement tools tech — the Death Star of ad-targeting. You want AVoD market domination? There you go — it’s Roku. Not to mention that it already has its own free channel, shown in today’s chart.

What’s on the Roku channel? Everything Roku currently has content deals for. I mean, it just added This Old House to the lineup … and if that doesn’t get your DIY blood pumping, nothing will. Plus, Roku’s been on a content acquisition spree in the past year with whatever it salvaged from the Quibi wreck.

Bottom line: Roku has both the free and premium streaming service markets on lockdown, and it’s only going to get better from here.

Great Stuff: Gather ‘Round The Roku

Great Ones, I know my streaming habits (read: addiction) are not indicative of all y’all out there. So … throw me a bone, won’t you?

We here want to know how you stream, where you stream and what you stream. Are you a Roku-till-I-croak-u diehard? Are you sticking with the old-world cable cabal? Or are you checking out some of the AVoD market’s free goodness?

Drop all your teeming streaming thoughts to GreatStuffToday@BanyanHill.com.

And for all those numerous readers writing in saying “Add me!” or “Sign me up!” … first off, how’d you receive this? Second, all you have to do to sign up for Great Stuff is click here!

Once again: Just click here if you want to sign up for Great Stuff!

Finally, remember what Mr. Great Stuff always says: Like Stuff? Share Stuff! So be sure to share ‘Stuff with everyone right down your email list. Send it all!

And don’t forget! If you want to be in this week’s edition of Reader Feedback, drop us a line at GreatStuffToday@BanyanHill.com! But, if that’s still too many virtual hoops to jump through, why not follow along on social media? We’re on Facebook, Instagram and Twitter.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff