I’m getting tired of seeing scary articles about inflation.

I know: Last week’s 7.5% inflation print was the highest in 40 years.

The media needs to grab your attention, so it’s using this data to invoke fear.

But as a result of the fear mongering, many aren’t getting the whole story about inflation’s effect on stocks.

In general, high inflation isn’t great for stocks in the short run.

But holding stocks offers good protection against inflation over the long run.

In fact, the last time inflation was this high, the stock market gained over 400%.

How Algorithms Cause Sharp Moves Lower

When inflation is higher, investors expect their earnings to have less value. Because of this, they price stocks lower.

Today, this repricing process is extremely fast.

Algorithms sift through news articles and update stock valuations in real time. If conditions are met, trades to buy or sell are automatically placed.

Most of the algorithms are programmed to do the same thing, so they all trade at the same time. With all of them trading in unison, prices move extremely fast.

When negative news headlines hit the web, the algorithms cause sharp moves downward.

I get that these rapid drawdowns can be hard to stomach for some investors.

The thing is, these price drops have offered some of the best buying opportunities.

Stocks Have Shrugged Off Inflation Before

Remember, the media amplified fear about the COVID crisis in the first quarter of 2020.

This caused the S&P 500 Index to fall 35% in four weeks.

After that, the index surged 45% in less than three months.

I’m confident we’ll soon see stocks shoot higher again.

If you look at the data, you’ll see that in the past, stocks have shrugged off inflation.

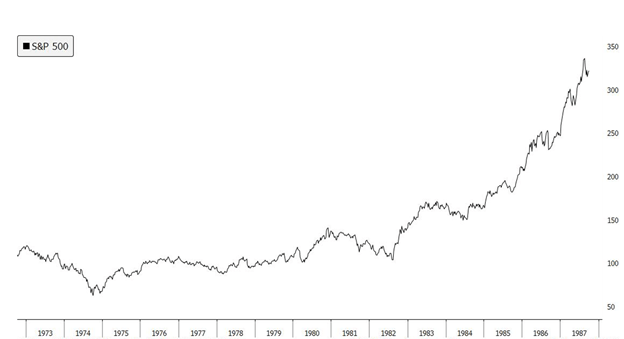

In the 1970s and early 1980s, inflation was running hot. It hovered in the high single-digits to low double-digits for nearly 10 years.

During that time, stocks pulled back initially. But the S&P 500 came roaring back.

By 1987, the index had increased over 400% from the lows.

(Source: Bloomberg.)

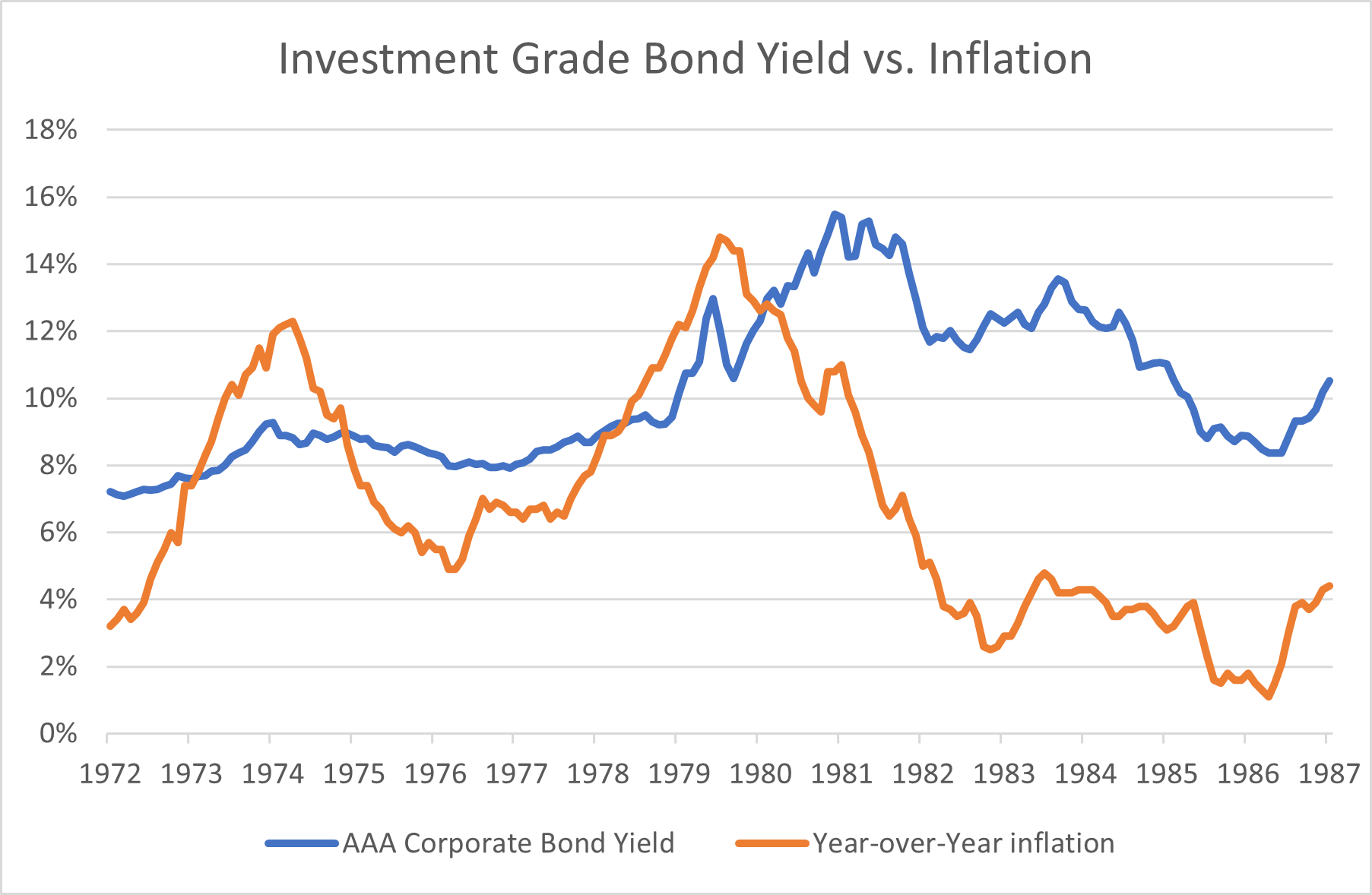

Keep in mind, investors had other alternatives to stocks during that time.

Bond yields generally remained higher than inflation. This meant investors could still grow their wealth by investing in bonds.

(Source: Bloomberg and FRED.)

Today, things are much different. Bond yields are lower than inflation.

According to Moody’s, the average long-term AAA corporate bond yield is less than 3%.

That’s much lower than the 7.5% inflation reading we saw last week.

This means investors lose wealth by investing in bonds right now.

By sitting on cash, investors are even worse off.

To grow wealth, money must be invested in something.

And with low interest rates, stocks are the only game in town.

Institutions Need to Invest in Stocks

Keep in mind that institutions like pensions and endowment funds need to get a specific rate of return to meet their liabilities.

Right now, funds are sitting on trillions in deficits. In other words, they need to generate trillions in assets to meet their expenses.

The shortfall for U.S. state pensions alone stands at around $1 trillion.

Globally, the deficit is likely much greater and will continue growing if inflation remains high.

Institutions need to invest in stocks to fix this problem. Bond yields are too low.

This is good news for the stocks of innovative, high-quality businesses.

They should see a lot of demand from managers that need to grow their assets.

If you want to learn about the companies Ian King and I are most excited about, check out Strategic Fortunes.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

BioDelivery Sciences International Inc. (Nasdaq: BDSI) develops and commercializes pharmaceutical products for chronic pain and neurological conditions. The stock jumped 53% this morning on the news that it is being acquired by Collegium Pharmaceutical in a deal worth $604 million.

Cornerstone Building Brands Inc. (NYSE: CNR) designs, manufactures and installs external building products for commercial, residential and repair markets. It is up 22% after the company revealed that it received a buyout offer from private equity firm Clayton, Dubilier & Rice, LLC.

Kelly Services Inc. (Nasdaq: KELYA) provides office staffing and other workforce solutions to various industries. The stock is up 17% after the company reported better-than-expected earnings for the fourth quarter, driven by the economic recovery.

Astrea Acquisition Corp. (Nasdaq: ASAX) is a special purpose acquisition company that is up 16% this morning. The stock rose after the SPAC terminated a deal to take HotelPlanner and Reservations.com public, in a move that was considered beneficial to all parties.

Rolls-Royce Holdings plc (OTC: RLLCF), the British multinational aerospace and defense company, is up 14% this morning. The move came after the company announced that it expects to develop a fully-electric small aircraft in three to five years.

Collegium Pharmaceutical Inc. (Nasdaq: COLL) develops and commercializes medicines for pain management. It is up 13% on the news that it is acquiring BioDelivery Sciences International to expand its portfolio of pain management therapeutics.

Cepton Inc. (Nasdaq: CPTN) develops LiDAR sensors, smart LiDAR systems, LiDAR perception evaluation kits and other related products. The stock is up 13% with no specific news to report. The stock has seen some volatile trading since it went public last week via a SPAC deal.

SQL Technologies Corp. (Nasdaq: SKYX) develops technologies for the installation of smart electrical fixtures such as lights and ceiling fans. The stock is up 11% after the company closed its upsized initial public offering of 1.65 million common shares.

Freshworks Inc. (Nasdaq: FRSH) develops software solutions for businesses worldwide. It is up 11% on a rebound after falling on Friday when it reported fourth-quarter earnings that missed analyst estimates.

Rivian Automotive Inc. (Nasdaq: RIVN), the electric vehicle company, is up 11% this morning. The stock jumped after a filing by Soros Fund Management, run by billionaire-investor George Soros, disclosed a 20-million share stake in the company.