A few weeks ago, Thomas Peterffy, CEO of Interactive Brokers, said its clients were sitting on $50 billion of idle cash. That’s the highest it’s ever been.

And stories about “cash-like” assets such as certificates of deposit and short-term debt instruments are everywhere this week.

All this cash tells me investors are worried.

You can’t blame them for acting skittish.

Peak earnings. Tariffs. Emerging markets slowdown. Interest-rate hikes. Those are just a few explanations for why investors are gun-shy.

But if you’re dialed into market sentiment, you know this is an opportunity to make big, fast gains.

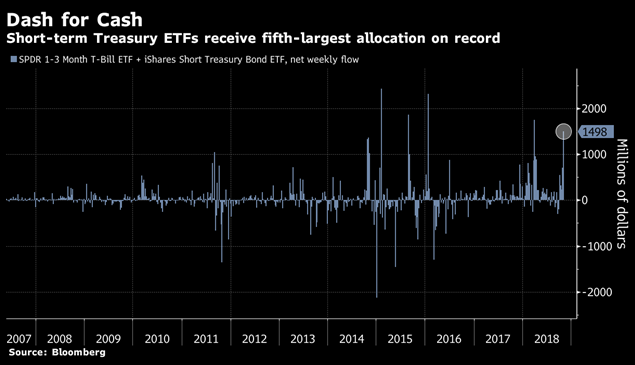

This chart shows weekly flows into the SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (NYSE: BIL).

Inflows spiked last week to the fifth-highest level on record.

But compare the above chart to a weekly chart of the S&P 500 Index. It doesn’t take long to notice that spikes of idle cash helped fuel subsequent stock market rallies.

Most recently, the cash spikes in 2015 and early 2016 preceded a two-year, 56% bull market.

This looks like a buying opportunity.

Maybe the S&P 500 breaks through 3,000 or 3,200 in the next four to six months. Maybe it goes a whole lot higher if the U.S. can ward off recession next year.

Regular readers might already know how I’m going to play this.

Since we are late in the business cycle, natural resources and materials should outperform in this phase of the bull market.

Look for bargains in steel and solar industries, for example, where the trade war pressured share prices lower.

Good investing,

John Ross

Senior Analyst, Banyan Hill Publishing