Someone made a huge mistake last week.

It isn’t the first time it has happened … and it won’t be the last. Avoiding this common mistake could save you thousands of dollars during your investment career.

So, what happened?

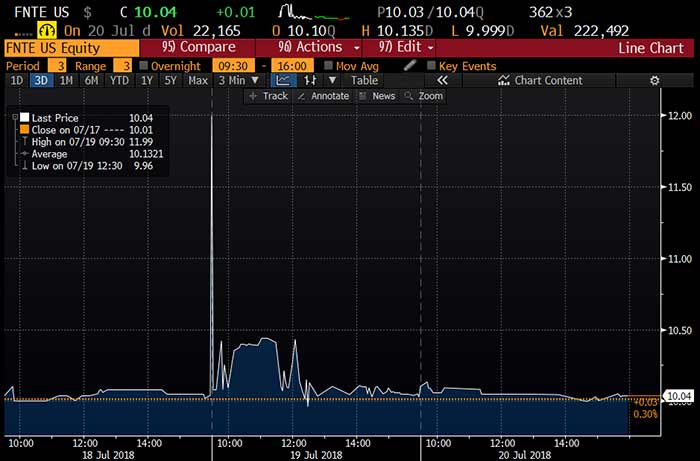

Shares of FinTech Acquisition Corp. II (Nasdaq: FNTE) shot up when trading opened on July 19.

(Source: Bloomberg)

You can see the dramatic price move when trading opened on July 19. The box toward the upper left of the image shows an investor bought shares for $11.99 at 9:30 a.m.

Shares immediately returned to near $10, where they had been trading.

That’s an instant loss of more than 15%.

I am confident the culprit of this occurrence was a market order.

I want to tell you why you should avoid market orders when buying (or selling) a stock … especially one that doesn’t trade many shares each day.

2 Types of Trades

You see, when you buy (or sell) a stock, you can do it one of two ways. You can use a market order or a limit order.

A market order executes “at the market.” That means you pay the current price … no matter how high or low that may be.

A limit order occurs at a price you choose, and not one penny more.

When you are entering stock trades with your broker, I strongly encourage you to use limit orders. The trading activity in FNTE on July 19 in the above chart is a good example why.

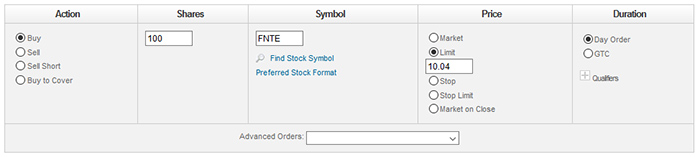

To place a limit order, simply select it as an option on your brokerage’s website, and enter the price you want to buy or sell shares at. The image below shows a limit order to buy 100 shares of FTNE at $10.04 per share.

Trading Like This Will Save You a Lot of Money

Since it started trading in March 2017, the median daily volume of the FNTE stock above is only 4,600 shares.

It is essential that you use a limit order if you are buying a stock that trades only a few thousand shares per day. If you only take away one thing from this essay, please make sure it is this.

If a stock only trades a small number of shares a day, there may be just a few people willing to sell shares at a given time. And those people may only sell at a price greater than the market price.

I suspect that happened in the FNTE example above. It didn’t have to, though.

Shares traded between $9.96 and $11.99 on July 19. That tells us it is likely a limit order for a price just above $10 would have been filled.

And it would have saved the buyer a chunk of change.

There Are Trade-Offs

No strategy is foolproof.

There are disadvantages to using limit orders. There is a risk you won’t get into the stock because it may not trade down to your limit price.

There’s also a chance that even if it does trade to your price, you won’t get to buy all the shares you ordered. That’s because sellers may only be willing to sell a certain number of shares at your price.

I hope these issues won’t dissuade you, though. There’s no rule that you must enter a position immediately.

And stocks are volatile. It’s likely that if the order doesn’t fill the first day you enter it, it will later.

Remember, you can enter a limit order slightly above the current price. That way, you increase the likelihood of your order filling while you ensure it doesn’t fill at a too-high price.

Wrapping Up

Investing isn’t a sprint. If there’s a stock you really want to own, it won’t hurt you if you have to wait a couple days to buy it.

To me, it is more important to get the right price than to enter a position as soon as possible.

Good investing,

Brian Christopher

Senior Analyst, Banyan Hill Publishing