Alright, I’m going to solve one of the biggest problems when it comes to investing. Let’s say there’s a stock that you like, but shares are just going the wrong way for you.

You were willing to stick with the decline in the beginning, but at some point, you begin to second-guess yourself, wondering whether you made the right decision. And now, you are ready to bail. You simply can’t afford to take further losses.

The day after you sell your shares, the stock pops higher and continues from there … while you sit on the sidelines frustrated.

We’ve all been there. It’s one of the most frustrating problems investors face.

But there’s a way to use options so this kind of frustration doesn’t happen to you again.

And today, I’ll show you how to use these options through the worst of trades — and still be around when the stock climbs.

Let me explain…

Protective Put Options: Your Insurance Policy

Regular readers know options are a great tool to leverage a portfolio by minimizing risk and maximizing profits on a stock following the move we expect.

Today, I want to show you how to protect individual positions, or even an entire portfolio, by using put options.

You may be familiar with puts. In one of my options services, we use them as a way to profit from a decline in the underlying stock. In another service, we use them to collect income.

But they can also be used to hedge your portfolio and help you stay in stocks well past the time you would have normally exited.

Used this way, they’re called protective put options.

Let’s say you own Tesla (Nasdaq: TSLA), the high-flying electric vehicle manufacturer.

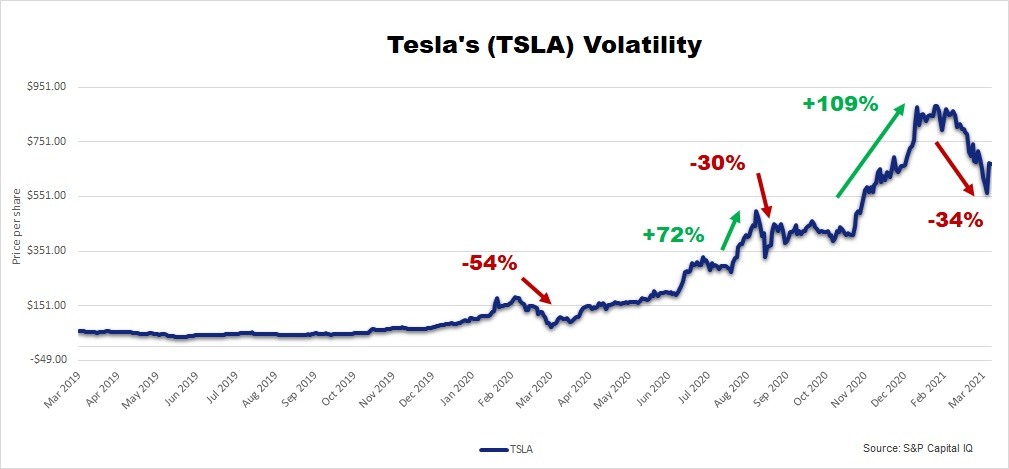

It’s a popular but extremely volatile stock. Plenty of shareholders are willing to stomach any kind of swing the stock sees. But others who are faint at heart might lose their shirts in a stock like Tesla.

Shares have fallen as much as 40% just in the past several weeks.

At some point in all this, you may not be sure if you should ride out the volatility or preserve capital and move on to a brand-new trade.

As long as you believe in the stock, there’s nothing wrong with riding out the ups and downs.

But we can use protective put options to hedge our position and sleep well at night while we’re in a trade.

How to Protect Your Gains

Here’s how it works…

With Tesla trading around $680 a share on Wednesday this week, instead of exiting after the brief rally or setting a stop-loss, you have a third option: Buy a put option on the stock.

Remember, a put option gives the buyer the right, not the obligation, to sell the stock at the strike price on or before the expiration date.

This acts as insurance to any further declines in a stock you want to own for the long term.

For Tesla, you could hedge your positions against another plunge lower.

That would mean purchasing one put option contract for every 100 shares of the stock you own — remember, one options contract covers 100 shares of stock.

Tesla is trading around $680 as I write this.

The June 18, 2021 $680 put option is trading for roughly $105 per share. This would cost you $10,500 per contract. But again, you are hedging 100 shares of the stock — a value of $68,000. So, it would set you back 15%. And it would only be profitable if Tesla falls below $575 ($680 strike price minus the $105 premium equals $575 a share).

When you have a stock like Tesla, which can shoot up 20% in a day, paying a double-digit premium to protect you from panicking during the down times is worth the insurance.

Protective puts cost more during volatile times, like we are seeing now. But the benefits still hold up.

For example, if Tesla falls to $500 a share before June 18, you’d have two options:

- Exercise the option to sell your stock at $680 per share. You would give up the premium you paid, a 15% loss, but you also wouldn’t have to suffer through the drop down to $500, which would be a 26% loss.

- Close out the protective put options for a profit. This is what I recommend.

Selling the put option back into the market is essentially selling your insurance policy. You’re making money on the sale and that helps to lower your losses.

On the trade we mentioned above, if TSLA fell to $500, the option’s price would rise and you’d be able to sell it for a profit.

It wouldn’t offset your entire loss, but you would be feeling a lot less pain than other TSLA shareholders.

Then, when the stock rebounds you can build up your gains even quicker.

Nothing is perfect when it comes to hedging a portfolio, but protective put options are as close as it gets.

We hope that by now, in reading the Weekly Options Corner, you’ve seen that options can do all kinds of things to enhance your portfolio.

Have you made any trades from the Weekly Options Corner? Tell us how you’re doing at WeeklyOptionsCorner@BanyanHill.com.

That’s all for today.

Regards,

Editor, Quick Hit Profits