Story Highlights:

- In the early 2000s, investors feared an oil shortage and drove prices up.

- Today, Wall Street underestimates recent events in the Middle East, and oil prices are too low.

- Here’s a safe way to navigate the turmoil in the oil sector … plus a bonus trade.

Here’s a safe way to navigate the turmoil in the oil sector … plus a bonus trade.

The biggest energy story of the 2020s will be oil.

It’s already the biggest overlooked story in 2019. Piracy and terrorism in the Strait of Hormuz. Drone attacks on Saudi Arabian oil infrastructure.

And yet, the way the market is behaving … it’s as if everyone thinks that’s just going to go away.

It isn’t.

And oil prices are going to keep going up as this escalates.

In fact, oil may be the best-performing asset over the next five years.

The reason is simple: Nobody is looking at it. And right now, everyone from Main Street to Wall Street underestimates the oil sector.

But we can use this to our advantage and get ahead of Wall Street. Plus, I’ll show you two ways you can capitalize on oil prices.

Fear of a Lack of Supply Drove Prices up in Early 2000s

Last Monday, I sat down with Banyan Hill expert and colleague John Ross. We discussed the drone attack in Saudi Arabia and what that means for you. You can watch our video below.

Let’s face it — the struggle of the last five years was one of oversupply.

The oil sector was a terrible place to invest. It was a brutal bear market for oil companies. Bankruptcies and lost investments plagued the sector.

What you may not remember is that it came on suddenly and unexpectedly.

But prior to that, the world loved oil. In the early 2000s, Main Street and Wall Street thought we were running out of oil.

Matt Simmons’ book Twilight in the Desert was a bestseller. In it, he proposed that Saudi Arabia had far less oil than it stated. That idea resonated with both world leaders and investors.

And the idea of peak oil was as popular then as climate change is today. Based on M. King Hubbert’s 1956 paper on the subject, peak oil showed a finite amount of oil in the world.

Based on his math, the world was well past halfway done.

According to Hubbert’s work, the world was running out of oil. Fear of supply disruptions pushed oil prices up over $100 per barrel for years.

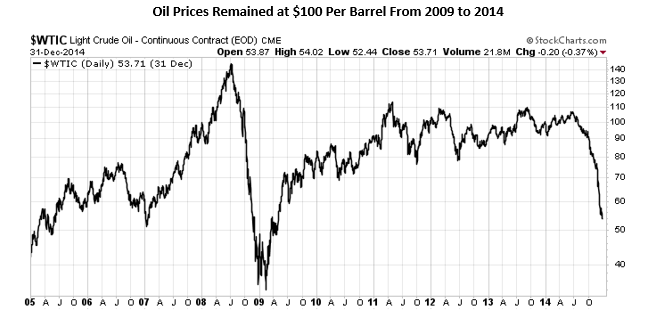

You can see what I mean in the chart below:

As you can see, oil prices skyrocketed as we entered the 2008 economic crisis.

We spent most of the period from 2008 to 2015 with oil prices bouncing around $100 or more.

It wasn’t until mid-2014 that the impact of the U.S. shale plays began to hit home. The explosion of U.S. production from 1.8 million barrels per day in 2008, to 3.2 million barrels per day in 2014, to over 4 million barrels per day today, sent shock waves through the market.

What was fantasy in 2008 was reality just a few years later: The world had too much oil — so prices began to slide lower.

Back in 2015, Saudi Arabia decided to let the price fall rather than cut its own production. And by early 2016, oil prices collapsed from over $100 per barrel to under $28 per barrel.

That was a 72% fall in under two years. It was the lowest price in 13 years. And it marked the bottom of the oil bear market.

Oil Supply Is Fragile: Hedge Your Portfolio

Fast forward to today, when nearly 6 million barrels of oil per day went offline because of drone strikes. Saudi Arabia can cover that for about two months.

After that, the world will be short about 4 million barrels per day.

The headline on the opinion page of The Wall Street Journal said: “Don’t Panic Over the Saudi Attack and the Oil Supply.” The takeaway was that OPEC needed to cut anyway.

But there’s a 4 million barrel per day difference between a big OPEC cut and the damage done. In other words, the shortage we’re facing now doesn’t equate to OPEC’s cut.

The world’s oil supply is frighteningly fragile. And it could easily be disrupted further.

As promised, here are two ways you can protect your investments:

- Join the Real Wealth Strategist Our readers get firsthand insight on the latest oil news, the most profitable companies to invest in and more.

- And for a more general exposure to the oil market, you can buy the Energy Select Sector SPDR Fund (NYSE: XLE).

The XLE fund will give you exposure to major companies in the oil industry. Exxon Mobil Corp., Chevron Corp. and ConocoPhillips are some of its top holdings.

Click here to learn more about how you can join us on oil trades and make the most of this rising asset.

It’s not time to panic … but don’t take this lightly, either. Make sure to hedge your bets.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist